Barriers to Savings: Asset Tests

In 2014, the Bipartisan Policy Center (BPC) launched the Commission on Retirement Security and Personal Savings, led by former Senator Kent Conrad and WL Ross & Co. Vice Chairman Jim Lockhart. The commission will consider and make recommendations regarding Social Security, pensions, defined contribution (DC) savings vehicles, strategies to generate lifetime income and other factors that affect retirement security.

This BPC-staff authored post is the 10th in a series that will outline the state of retirement in America and provide a sense of the challenges that the commission seeks to address in its 2015 report.

For more information on the topics below and in the rest of this series, see our recently released staff paper, A Diversity of Risks: The Challenge of Retirement Preparedness in America.

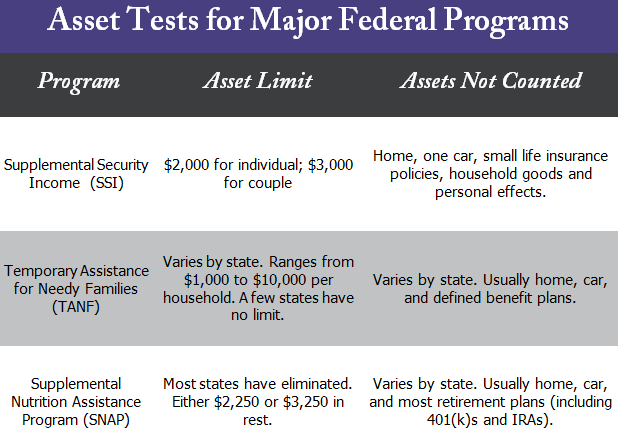

Many Americans face challenges in saving adequately to absorb financial hiccups and reach a secure retirement. But recipients of federal aid programs are actively discouraged from saving more by the government because of asset tests. Many federal programs that provide cash and in-kind benefits to eligible, usually lower-income, Americans have asset tests, including Medicaid (for many categories of eligibility), Temporary Assistance for Needy Families (TANF; cash welfare), Supplemental Security Income (SSI), the Supplemental Nutrition Assistance Program (SNAP; food stamps) and the Low Income Home Energy Assistance Program (LIHEAP).

No Savings Allowed

Eligibility criteria for many programs, such as asset tests, are set at the state level. In some of those programs, like LIHEAP and SNAP, most states have eliminated stringent asset tests in favor of income tests alone. Medicaid asset tests vary by state and whether the beneficiary qualifies because of age, disability, very high health care and long-term care expenses, or another category of eligibility.

The federally administered program that retains the strictest asset test is the Supplemental Security Income (SSI) program. SSI provides a safety net by guaranteeing a minimum level of cash income to all people aged 65 and over and to people with disabilities who are under age 65. Payments to beneficiaries ensure a minimum income of 74 percent of the federal poverty guidelines for individuals and 82 percent for couples. Although small, SSI plays an important role in retirement income for the poorest Americans, who may not be eligible for Social Security or who may receive very modest Social Security benefits. As of April 2014, SSI provided benefits to over two million Americans over age 65 and to over six million Americans with disabilities.

The asset limit in SSI counts almost all of a beneficiary’s non-housing assets (with the exception of cars up to a certain value), including retirement accounts, and the limits have not been updated for inflation in over 40 years. Applicants to SSI are ineligible if they have more than just a few thousand dollars in liquid assets.

Asset tests also incentivize (and in many cases, necessitate) people who need long-term services and supports (LTSS) to spend down their savings. Our fifth blog in this series, “Needing Help: Long Term Care Risk,” explained that individuals with LTSS needs who do not have sufficient insurance often end up spending down almost all of their non-housing assets until they qualify for Medicaid.

The Bottom Line

Asset tests are clearly a strong savings disincentive for Americans who benefit from means-tested programs. Those individuals are effectively penalized for saving — even what little they may be able to — for retirement or other purposes. The small amount of assets permitted does not allow program recipients to build up even a modest rainy-day fund, making participants unlikely to save at all. BPC’s Commission on Retirement Security and Personal Savings is examining asset tests and other challenges that low-income Americans face in their attempts to save.

Alex Gold contributed to this post.

Up Next in Retirement in America:

#11: The $1.2 Trillion Problem Hurting Americans’ Savings

#12: One Big Asset: Homeownership

#13: Social Security and You

View all posts in BPC’s Retirement in America series under Related Stories below.

Register for “Starting to Save: Innovations for Working America”

This coming Thursday, March 19, BPC will hold an event on Prize-Linked Savings and other ways to help low- and moderate-income Americans build assets. Prize-Linked Savings are lotteries with no losers: participants are entered into a lottery with every deposit that they make to their bank account ? and they always keep their principal. On Thursday, we will be joined by Representative Derek Kilmer (D-WA) and Senator Jerry Moran (R-KS), who recently cosponsored and passed a bill that will allow Prize-Linked Savings at banks nationwide. Following their remarks, we will have a panel discussion with experts on Prize-Linked Savings and incentivizing savings for all Americans.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give NowRelated Articles

Join Our Mailing List

BPC drives principled and politically viable policy solutions through the power of rigorous analysis, painstaking negotiation, and aggressive advocacy.