Budget Battles Defining Washington: A Timeline

The Brief

Note: This page is no longer updated. Edits to this page were last made in February 2020.

Congress and the president have fought over the budget since the beginning of the Republic. But over the course of the last decade, fights over the federal government’s spending, revenues, and deficits have severely intensified. The timeline below chronicles major episodes in the ongoing federal budget drama — including budget showdowns, agreements, and legislation with major fiscal effects — from the start of the Obama administration to the present.

Scroll down to see when events occurred and select “Read More” for a detailed description of what happened at each juncture. Fiscal Year = FY; Gross Domestic Product = GDP; “X Date” = The theoretical date when the Treasury department is unable to pay all of the government’s bills in full and on time.

Share

Read Next

-

American Recovery and Reinvestment Act Is Enacted

February 2009

Shortly after President Obama takes office, the American Recovery and Reinvestment Act is enacted in response to the 2008 financial crisis. At the time, the Congressional Budget Office estimates the law will increase spending and reduce taxes by a combined $787 billion over ten years. Together with the effects of the recession, the federal deficit for FY 2009 reaches a record $1.4 trillion, or 9.8 percent of GDP, the highest since World War II.

-

Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Ac

March 2010

President Obama signs the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act into law. These laws represent a wide-reaching, comprehensive overhaul of the U.S. health care system. Notably, the legislation passed using reconciliation instructions from the 2009 budget resolution, allowing it to pass with only Democratic support. At the time, the Congressional Budget Office estimates the law to reduce deficits on net by $143 billion over ten years.

-

BPC's Debt Reduction Task Force Recommendations

November 2010

The Bipartisan Policy Center’s Debt Reduction Task Force, co-chaired by former Senate Budget Committee Chairman Pete Domenici and former Congressional Budget Office and Office of Management and Budget director Alice Rivlin, releases its final recommendations. Their plan would have reduced and stabilized the federal debt below 60 percent of GDP by 2020, and achieved $5.9 trillion in debt reduction over the first ten years. (In 2013, the task force’s recommendations on health care are subsequently updated by BPC’s Health Care Cost Containment Initiative.)

-

The National Commission on Fiscal Responsibility and Reform Releases Recommendations

December 2010

The National Commission on Fiscal Responsibility and Reform, co-chaired by former White House Chief of Staff Erskine Bowles and former Senator Alan Simpson, releases recommendations designed to address the growth of entitlement spending and the gap between projected revenues and expenditures. The commission votes 11-7 in favor of sending its plan to Congress, short of the 14 vote supermajority required to do so. From 2012 to 2020, the commission’s plan would have achieved roughly $4 trillion in deficit reduction, and then would have balanced the budget by 2035.

-

President Obama signs the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

December 2010

President Obama signs the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, which reduces payroll taxes for one year and extends certain tax cuts passed during the George W. Bush administration as well as select provisions of the stimulus. At the time, the Congressional Budget Office projects the law will increase the federal deficit by $858 billion over a ten year period.

-

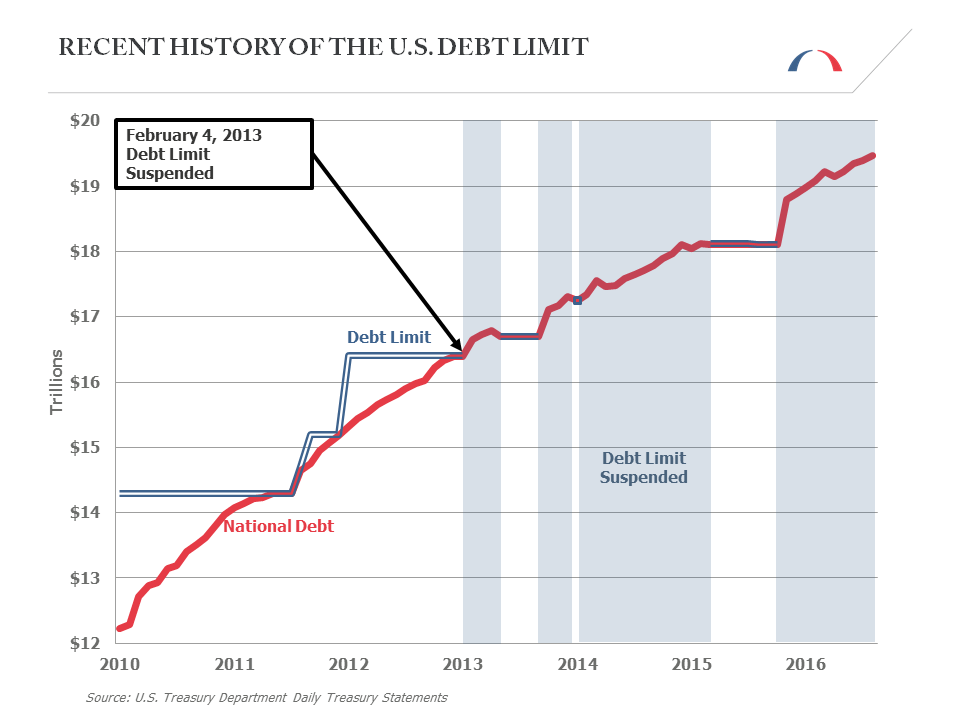

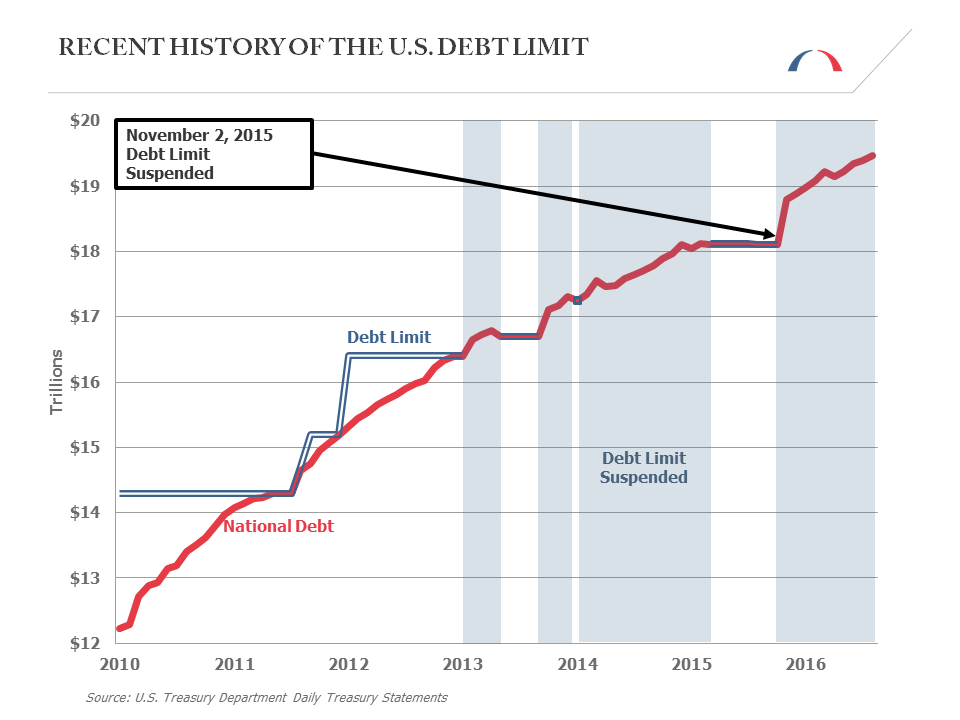

The United States Reaches Its Statutory Debt Limit of $14.3 trillion

May 2011

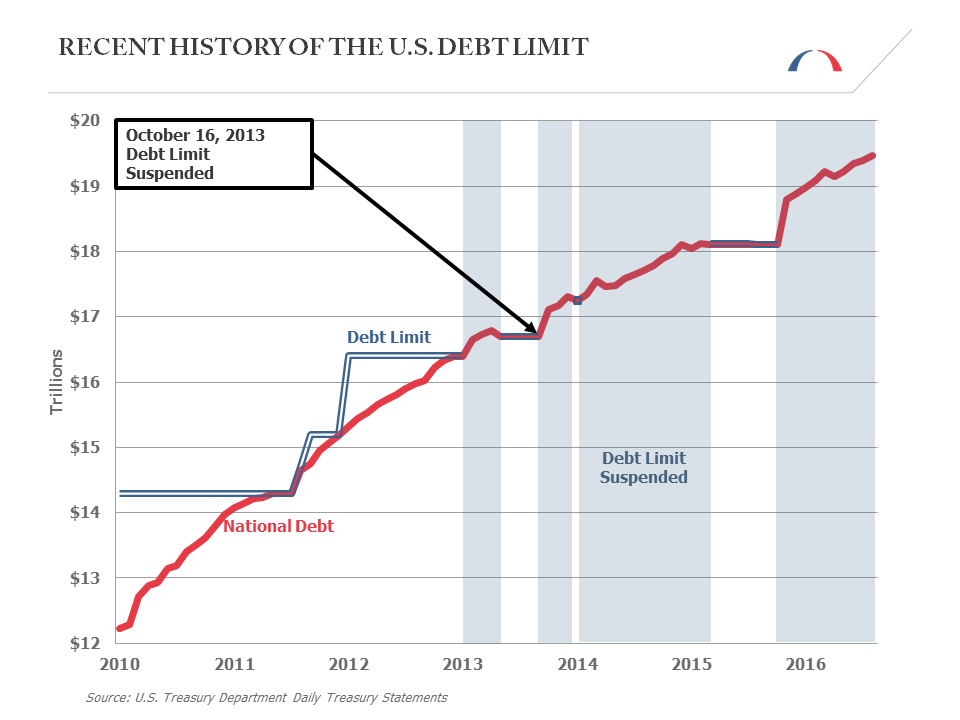

The United States reaches its statutory debt limit of $14.3 trillion and the Treasury Department begins deploying “extraordinary measures,” technical procedures to temporarily stave off defaulting on the government’s obligations. The “X Date,” when those measures are projected to be exhausted and Treasury runs out of cash to pay its bills in full and on time, is expected in early August 2011.

-

The Budget Control Act of 2011 and the Super Committee

August 2011

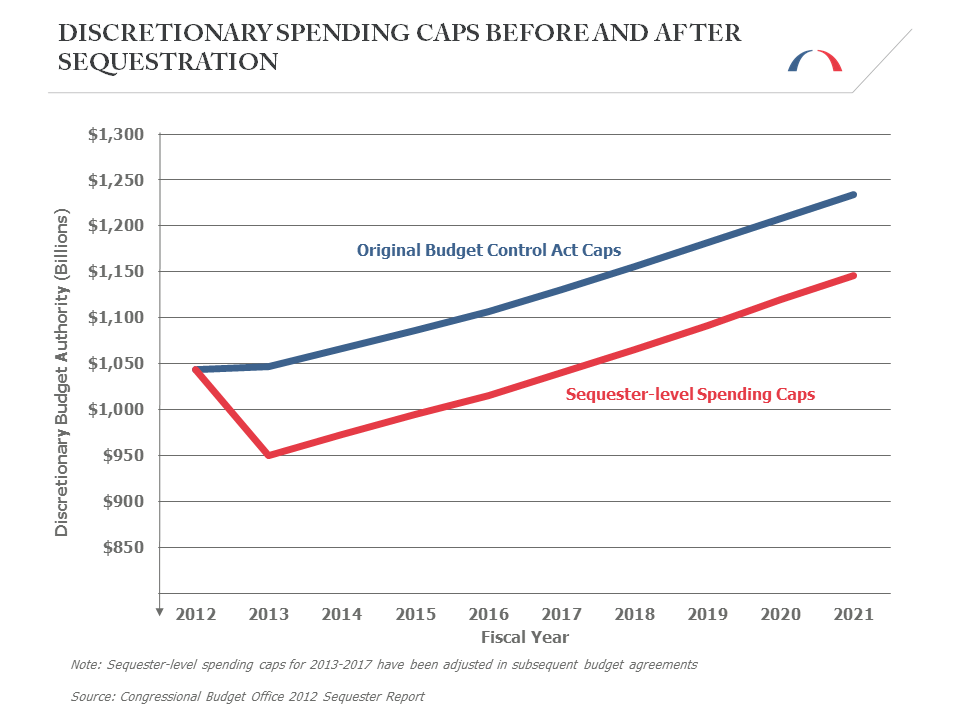

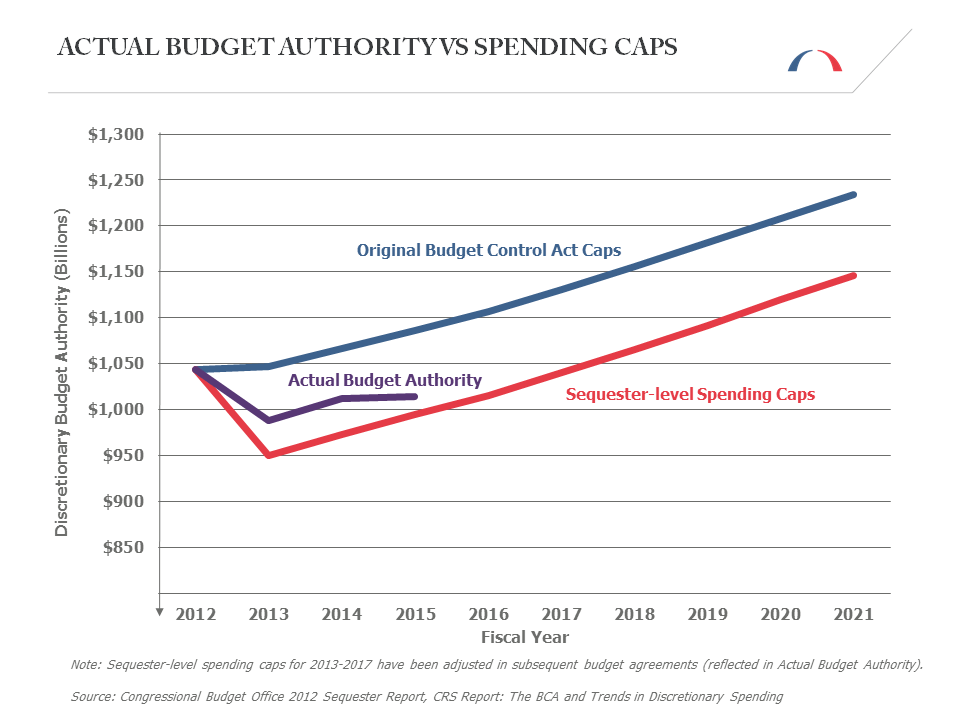

Congress and the president enact the Budget Control Act of 2011, which creates the Joint Select Committee on Deficit Reduction (the so-called “Super Committee”) and establishes caps on discretionary spending through 2021, while also ending the immediate debt-limit impasse. The law authorizes increases of the debt limit in stages before ultimately reaching $16.4 trillion on January 27, 2012.

CBO estimates at the time that the spending caps would reduce deficits by $917 billion from 2012-2021, on top of at least $1.2 trillion in savings from automatic reductions in lieu of Joint Select Committee reductions, for total savings of at least $2.1 trillion over the following decade.

-

The Middle Class Tax Relief and Job Creation Act of 2012

February 2012

President Obama signs the Middle Class Tax Relief and Job Creation Act of 2012, which extends the payroll-tax reduction and employment incentives from the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 for an additional year. CBO projects the law will increase the deficit by $89 billion over a ten year period.

-

The Joint Select Committee on Deficit Reduction Fails to Come to an Agreement

November 2012

The Joint Select Committee on Deficit Reduction fails to come to an agreement on a deficit-reduction plan. Their failure triggers provisions of the Budget Control Act of 2011 that initially cut and then automatically reduce caps on defense and domestic discretionary spending, enforced by a sequester that kicks in with the start of 2013.

-

Debt Limit Reached, Treasury Begins Taking Extraordinary Measures

December 2012

The United States reaches the statutory debt limit of $16.4 trillion, established by the Budget Control Act of 2011, and the Treasury begins taking extraordinary measures to postpone default. The “X Date” — when those measures are projected to be exhausted and Treasury runs out of cash to pay its bills in full and on time — is expected in February 2013.

-

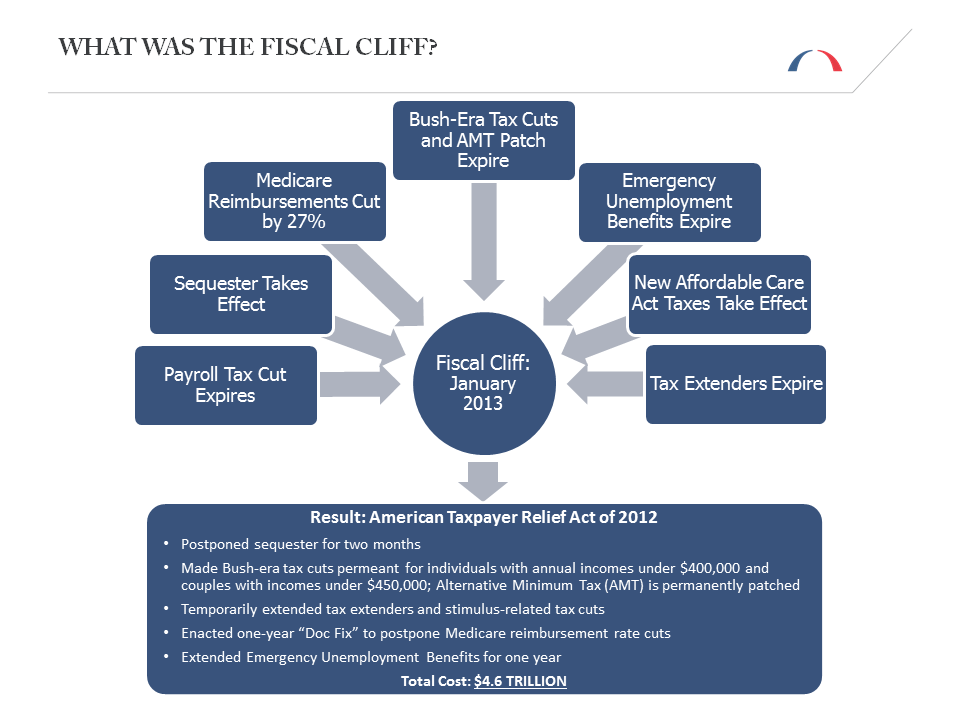

Fiscal Cliff Created

January 2013

The combination of multiple fiscal events creates a so-called “fiscal cliff.” In response, Congress enacts the American Taxpayer Relief Act of 2012, which CBO estimates at the time will increase deficits from 2013-2022 by roughly $4.6 trillion (mainly from extending the majority of the “Bush tax cuts”) and postpones the sequester for two months.

-

The No Budget, No Pay Act of 2013

February 2013

President Obama signs the No Budget, No Pay Act of 2013, which suspends the debt limit from the act’s passage through May 18, 2013.

-

The Sequester Goes into Effect

March 2013

The sequester, which had been postponed by the American Taxpayer Relief Act of 2012, goes into effect. As specified in the Budget Control Act of 2011, the sequester entails automatic, across-the-board spending cuts through 2021.

-

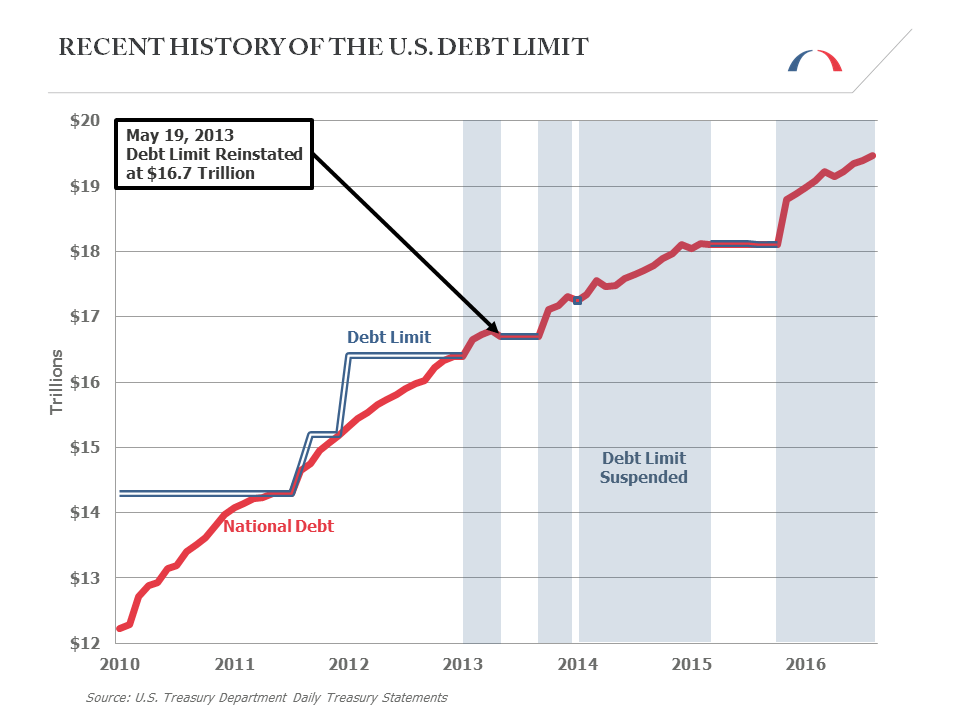

Debt Limit Reinstated at $16.7 Trillion

May 2013

The statutory debt limit, suspended by the No Budget, No Pay Act of 2013, is reinstated at $16.7 trillion. The Treasury resumes its extraordinary measures to avoid defaulting on federal obligations. The “X Date” is expected in the fall of 2013.

-

A Government Shutdown

October 2013

The federal government begins a 16-day shutdown after Congress fails to enact either appropriations bills or a continuing resolution by October 1, the result of disagreements surrounding funding for the Affordable Care Act. The shutdown ends when Congress passes, and President Obama signs, the Continuing Appropriations Act of 2014 on October 16. The law contains a continuing resolution to fund federal spending at FY2013 levels until January 15, 2014, and also suspends the debt limit until February 7, 2014.

-

The Bipartisan Budget Act of 2013

December 2013

Congress enacts, and President Obama signs, the Bipartisan Budget Act of 2013. The law raises the discretionary sequestration caps for FY 2014 and FY 2015, cancelling about $65 billion in sequester cuts on defense and domestic discretionary spending, but extends the duration of sequestration caps on mandatory spending for an additional two years, through 2023.

-

The Debt Limit Is Reinstated at $17.2 Trillion

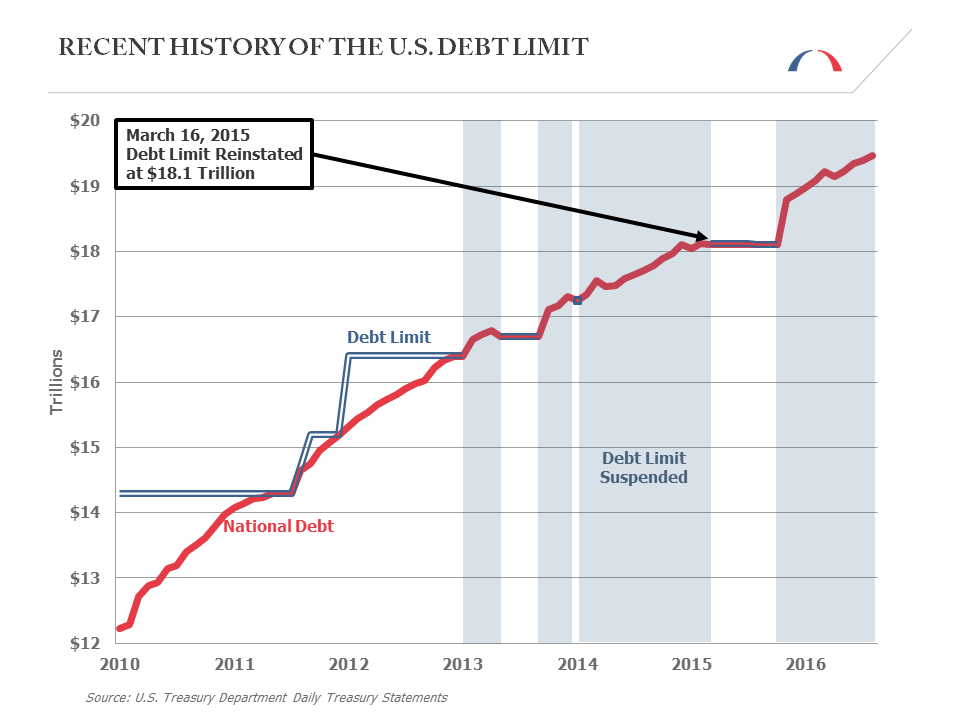

February 2015

The suspension of the statutory debt limit expires and the debt limit is reinstated at $17.2 trillion. Treasury begins implementing extraordinary measures in order to finance the federal government on a temporary basis. Shortly thereafter, President Obama signs the Temporary Debt Limit Extension Act, which suspends the debt limit through March 15, 2015.

-

Debt limit is Reinstated at $18.1 trillion

March 2015

The February suspension of the statutory debt limit expires and the debt limit is reinstated at $18.1 trillion. Treasury begins implementing extraordinary measures in order to finance the federal government on a temporary basis. The “X Date” is expected in the fall of 2015.

-

The Medicare and CHIP Reauthorization Act of 2015

April 2015

President Obama signs the Medicare and CHIP Reauthorization Act of 2015. The law replaces Medicare’s Sustainable Growth Rate (SGR) formula (which had been continually suspended by policymakers for over a decade and would have resulted in steep cuts to Medicare reimbursement rates) with payment reforms designed to reward health care providers based on the quality of their outcomes over the quantity of services provided. On net, CBO estimates that the law will add $141 billion to the deficit over ten years relative to a scenario where the SGR was allowed to take effect (though the reform was effectively deficit-neutral when compared to the more-realistic alternative scenario in which reimbursement rates were frozen rather than cut). The law also includes several changes recommended by BPC’s Health Care Cost Containment Initiative in 2013.

-

Congress Passes a Concurrent Budget Resolution

May 2015

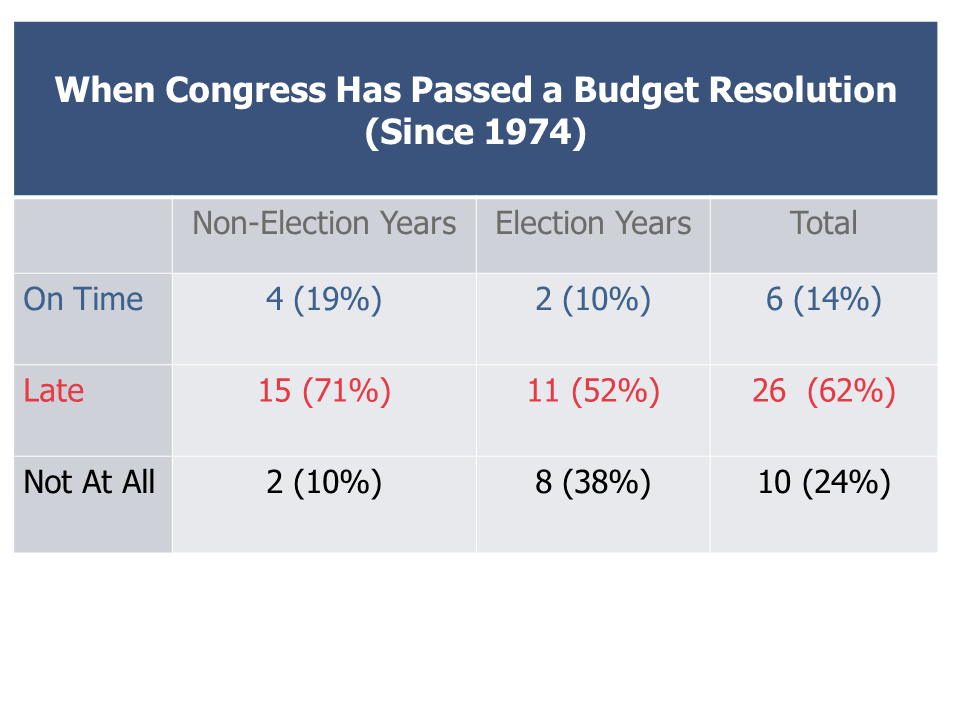

Both chambers of Congress pass a concurrent budget resolution for FY 2016 – the first time since 2009 – with only Republican support.

-

President Obama Signs a Temporary Spending Measure

September 2015

On the final day of FY 2015, President Obama signs a temporary spending measure continuing spending at FY 2015 levels through December 11, 2015.

-

The Bipartisan Budget Act of 2015

November 2015

President Obama signs the Bipartisan Budget Act of 2015, which suspends the statutory debt limit through March 15, 2017. The act also raises the sequestration caps for FYs 2016 and 2017.

-

The Consolidated Appropriations Act of 2016

December 2015

After Congress extends the December 11 appropriations deadline to December 22 through two temporary spending measures, President Obama signs the Consolidated Appropriations Act of 2016. The act funds federal government operations through the end of FY2016. It also makes permanent several expiring tax expenditures, adding over $800 billion to the deficit over the next ten years.

-

Treasury Deploys Its Extraordinary Measures

March 2017

On March 16, the suspension of the statutory debt limit expires, and the debt limit is reinstated at the level necessary to cover all borrowing since November 2015. Treasury deploys its “extraordinary measures” in order to temporarily continue meeting all of the federal government’s obligations. BPC estimates that these measures will only last until October or November of 2017, at which point the government would not be able to pay all of its bills in full and on time.

-

President Trump Signs an Omnibus Appropriations Bill

May 2017

On May 5, President Trump signs an omnibus appropriations bill passed by both chambers of Congress that continues funding through the end of the fiscal year. The bill increases discretionary spending for defense and homeland security by small amounts, among other minor spending increases.

-

Hurricane Harvey Strikes the Southern United States

August 2017

In late August, Hurricane Harvey strikes the southern United States. Harvey causes massive devastation, about $125 billion in damage to Houston and other affected areas, and garners significant federal attention as budget and debt limit deadlines approach.

-

President Trump and Congressional Leaders Strike a Short-Term Budget Agreement

September 2017

Shortly after Harvey makes landfall, and now less than a month before the end of the fiscal year and impending debt limit “X Date,” President Trump and congressional leaders strike a short-term budget agreement. The agreement suspends the debt limit and continues government funding at current levels through December 8, 2017. It also provides an initial “down payment” of aid for hurricane relief of about $15 billion.

Additionally, in the month of September, hurricanes Irma and Maria make landfall in southern states and Puerto Rico, adding both to an already destructive hurricane season in 2017 and to policymakers’ considerations for upcoming budget negotiations.

-

Congressional Republicans Narrowly Pass a Budget Resolution for FY2018

October 2017

After the passage of the short-term budget deal, attention shifts back toward the ongoing Republican tax reform effort. In late-October, Congressional Republicans narrowly pass a budget resolution for FY2018 with the intention of using the reconciliation process, which the budget resolution enables, to pass a tax reform package with only Republican support in both chambers (similar to passage of the Affordable Care Act on partisan lines in 2009).

-

The Debt Limit Is Reinstated at Over $20 trillion

December 2017

On December 7, the federal government narrowly avoids a shutdown by enacting a two-week continuing resolution. On the following day, the debt limit is reinstated at over $20 trillion, and the government once again begins operating using extraordinary measures. BPC estimates that the government will hit the debt limit “X Date” in March 2018 if no action is taken.

The Tax Cuts and Jobs Act of 2017 is signed into law by President Trump on December 22, after passing the House and Senate with Republican-only majorities. The law includes a myriad of changes to federal tax policy — some permanent, some temporary. At the time, the Joint Committee on Taxation estimates the law will reduce federal revenues by $1.5 trillion over the FY 2018-2027 period, not accounting for potential changes in the economy (e.g., increased growth) that could affect the projection.

On December 22, the same day the tax bill is signed into law, the federal government narrowly avoids a shutdown by enacting a continuing resolution to fund the government through January 19, 2018.

-

The Federal Government Shuts Down

January 2018

At midnight on January 20, the federal government shuts down. Congressional leaders fail to agree on a continuing resolution to fund the government, as the parties feud over funding for the Deferred Action for Childhood Arrivals program.

A few days later, on January 23, President Trump signs a continuing resolution reopening the government following bipartisan negotiations. It funds the government through February 8.

-

The Bipartisan Budget Act of 2018

February 2018

On February 8, congressional leaders publicly announce a bipartisan, two-year spending and debt limit deal, referred to as the Bipartisan Budget Act of 2018. The deal suspends the debt limit until March 2019, and raises the discretionary spending caps on defense and nondefense programs by $296 billion over the next two fiscal years. The legislation does not finalize “line-by-line” appropriations for the remainder of FY 2018, only topline spending figures with an additional short-term continuing resolution lasting several weeks. Both chambers were on track to pass the legislation prior to midnight, but at the last minute, Sen. Rand Paul initiates a filibuster in the Senate. As a result, the government briefly shuts down at 12:01 a.m. on February 9 until the Senate passes the bill later that morning. President Trump signs the Bipartisan Budget Act of 2018 into law, reopening the federal government.

-

The Consolidated Appropriations Act of 2018

March 2018

The Consolidated Appropriations Act of 2018 becomes law on March 23, finalizing the “line-by-line” appropriations figures for the remainder of FY 2018. At this point, half of the fiscal year has already elapsed.

-

Congress Completes Its Work on FY2019 Appropriations Bills

September 2018

A few weeks before the end of the fiscal year, Congress completes its work on FY2019 appropriations bills for defense, labor, health, and education, and passes an $855 billion “mini-bus” appropriations package. The package also contains a continuing resolution for the remainder of the budget through December 7, 2018, about a month after the upcoming November elections. President Trump signs the package on September 28, 2018.

-

Partial Government Shutdown Avoided

December 2018

On December 7, Congress passes, and the president signs, a two-week continuing resolution for the discretionary parts of the government not included in the September agreement, avoiding a partial government shutdown. These areas include agriculture; commerce, justice and science; financial services; interior and environment; state and foreign operations; and transportation, housing and urban development. Funding for these programs lasts through December 21, 2018.

At midnight on December 22, the federal government partially shuts down, as Congress and the president remain at odds over funding for border security.

-

The Partial Government Shutdown Extends into the New Year

January 2019

The partial government shutdown extends into the new year and becomes the longest in U.S. history. Over one month into the shutdown, 800,000 federal workers — some furloughed and others temporarily working without pay — fail to receive their standard biweekly paychecks.

-

The Historic, 34-Day Long Partial Government Shutdown Ends

February 2019

A short-term continuing resolution enacted on January 25 ends the historic, 34-day long partial government shutdown. The Congressional Budget Office estimates that the government shutdown reduced economic activity by $3 billion.

By mid-February, Congress and the president agree to an omnibus spending package that finalizes line-by-line appropriations for the remainder of FY 2019. By this point, nearly half of the fiscal year has already elapsed.

-

The Debt Limit Is Reinstated at $22.0 Trillion

March 2019

On March 2, 2019, the suspension of the statutory debt limit expires, and the debt limit is reinstated at $22.0 trillion. As has become standard, Treasury deploys its “extraordinary measures” to continue government operations for a temporary period. BPC forecasts these measures will only last until October or early November 2019, at which point it would not be possible for the Treasury to pay all of government’s bills in full and on time.

-

The Bipartisan Budget Act of 2019

July 2019

After months of negotiations, a bipartisan spending and debt limit deal is struck. This deal, the Bipartisan Budget Act of 2019, raises discretionary spending caps by $320 billion over the next two fiscal years and suspends the debt limit through the end of July 2021. This legislation is signed into law by President Trump on August 2.

-

Spending Deal Averts Shutdown, But Adds to Federal Debt

December 2019

After two short-term continuing resolutions to start fiscal year (FY) 2020, Congress agrees to a $1.4 trillion appropriations deal that averts a government shutdown via two minibus packages, one primarily for defense and the other primarily for non-defense discretionary spending. President Donald Trump signs both packages into law on December 20. The Committee for a Responsible Federal Budget projects that the deal will add more than $500 billion to the federal debt over 10 years, primarily due to extension of the “tax extenders” and repeal of the Affordable Care Act’s “Cadillac tax,” medical device tax, and tax on health insurers. Of note, included in the spending deal is the bipartisan Setting Every Community up for Retirement Enhancement (SECURE) Act, which contains a number of provisions that are based on recommendations by BPC’s Commission on Retirement Security and Personal Savings.

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give NowRelated Articles

Join Our Mailing List

BPC drives principled and politically viable policy solutions through the power of rigorous analysis, painstaking negotiation, and aggressive advocacy.