Stabilizing the Health Insurance Market: What the Experts Say

BPC’s Future of Health Care leaders, together with experts and stakeholders from across the health care spectrum, are exploring the federal and state roles in health insurance and how to ensure a stable and affordable individual health insurance markets across the country.

Today, we bring you Five Takeaways from our research and a recent event, Future of Health Care: Stabilizing the Individual Insurance Market, including two Deep Dives on the issue of health insurance cost-sharing reduction (CSR) subsidies which were established under the Affordable Care Act (ACA) which remain in legal limbo.

#1: Shifting Federal and State Roles in Health Insurance is Not New

The history, in a nutshell:

- 1940s: McCarran-Ferguson Act exempts insurance from most federal regulation

- 1950s: Major federal tax break for employer-sponsored insurance (ESI) added to the Tax Code

- 1960s: Creation of Medicare (federal) and Medicaid (state-federal partnership) programs

- 1970s: ERISA, legislation to fix the pension system, shifts ESI regulation for self-funded ESI plans to the feds, while states retain regulatory role for fully-insured large group and small group employer-based plans

- 1990s: HIPPA legislation aims to protect coverage when workers move between jobs; feds and states enact “guarantee issue” laws to ensure small businesses can offer coverage; Children’s Health Insurance Program (another state-federal partnership) created

- 2010s: ACA increases federal rules for individual market and small group market health insurance (e.g., minimum benefits, rate variation based on age 3:1, single vs. family, smoker vs. non-smoker and NOT on health status); with state roles maintained for insurance licensure and oversight, rate review; also increases federal share in Medicaid for states that expand to 138% of the federal poverty level (FPL)

#2: The Individual Market is One [Challenging] Piece of a Broader Coverage Landscape

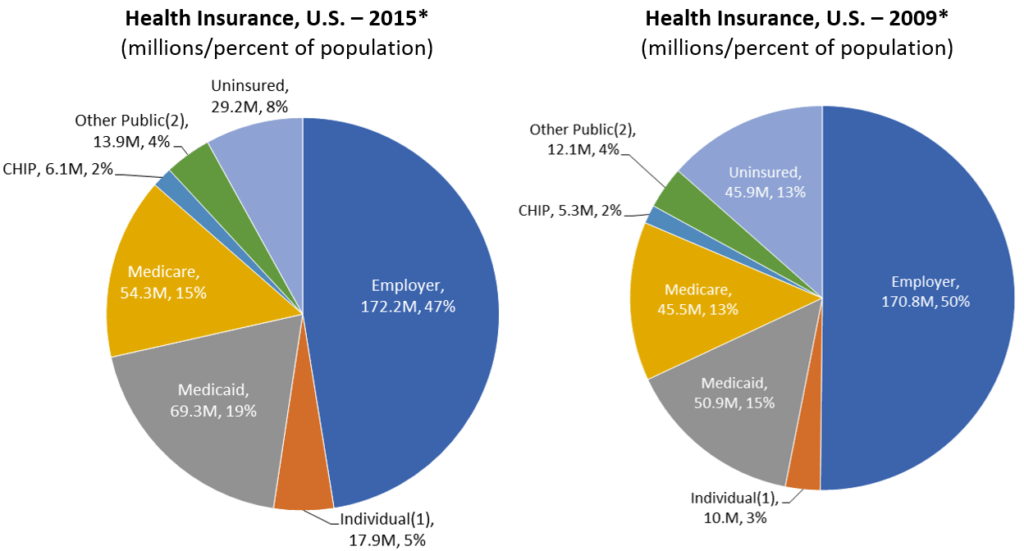

Employer-sponsored health insurance (ESI) is still the predominant source for health insurance among Americans, 172.2 million in 2015, or 47% of the total population. Here is a snapshot of where Americans received their health insurance coverage in 2015 versus 2009:

*Source: Centers for Medicare & Medicaid Services, Office of the Actuary, National Health Expenditures Group. Available: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html.

*Source for individual market (non-group) coverage data: Donahue, DA. Mark Farrah Associates (MFA). Growing Individual Market Options. Healthcare Business Strategy. June 24, 2010. Available: http://www.markfarrah.com/healthcare-business-strategy-print/Growing-Individual-Market-Options.aspx.

(1) “Individual” includes directly purchased non-group major medical health insurance and excludes Medicare supplemental plans and plans purchased through Multiple Employer or other Association arrangements.

(2) “Other Public” includes health insurance coverage provided by the Department of Veterans Affairs and the Department of Defense.

#3: There is Considerable Variation in Health Insurance Coverage Across States

Since enactment of the ACA, state decisions have played a big role in the coverage outcomes and health of each state’s individual insurance market. Examples include:

- Whether or not to expand Medicaid

- How to handle health insurance premium rate review, 47 of 50 states have an Effective Rate Review Program, though they are implemented differently

- Whether to allow transition, or “grandmothered,” plans to continue

- Selecting an Essential Health Benefit “benchmark plan” for the state

- Outreach and enrollment efforts in the states

- Tying ACA marketplace participation to individual or small-group market participation

- Ability of carriers to get contracts with providers

- Health care provider costs and medical practice in the state

It is worth bearing in mind that states started out from different places to begin with – some used rate bands that allowed wide variation in insurance rates across age groups or other categories; others required some form of community rating or required robust benefit packages. Lastly, state demographics make a difference, age, income, health status of the population, mix of urban vs. rural residents, size of the individual market.

#4: ACA Marketplace Risk Pools are Less Young and Healthy than Predicted

Experts cite various reasons that fewer-than-anticipated younger people signed up for ACA plans. The most often cited reason is cost: younger, healthier individuals may make the rational economic decision to pay the lower-cost federal penalty for not having insurance, rather than the higher-cost premium, while betting on not getting sick and needing health insurance that year. At BPC’s event, experts also cited federal and state actions as contributing factors ? for example, weak enforcement of the individual mandate penalty, outreach and enrollment efforts targeting younger people, and the ease of signing up through Healthcare.gov or other mechanisms (it is believed the more steps one must go through, the less likely a healthier person who does not urgently need insurance will complete the process).

#5: Funding Health Insurance Cost-Sharing Reduction (CSR) Payments and Reinsurance Programs Could Deliver Near-Term Insurance Market Stability

BPC leaders and other experts agree that at least two policy actions could bring near term stability to health insurance markets. One policy is to continue paying health insurance cost-sharing reduction (CSR) subsidies through at least plan year 2018, but ideally also through 2019 or longer.

- Want to learn more? Read our Deep Dives:

Another policy is to invest in reinsurance programs that can reduce risk for insurers and help them cover those with costly health needs without unsustainable premium increases for the rest of those ensured under that plan. Medicare Parts C and D have benefitted from reinsurance mechanisms, albeit on a smaller scale, which could prove instructive for the individual insurance market. The ACA included a temporary reinsurance program, and the House-passed American Health Care Act would establish an “Invisible Risk-Sharing Program,” which seeks to address the goal of reinsurance for managing risk and bringing down health insurance costs.

Stay tuned for more on BPC’s Future of Health Care here.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give NowRelated Articles

Join Our Mailing List

BPC drives principled and politically viable policy solutions through the power of rigorous analysis, painstaking negotiation, and aggressive advocacy.