It’s Time for a Holiday!

Jonathan Goldstein contributed to this post.

The United States is mired in the slowest recovery from the deepest recession since the Great Depression. Unemployment has hovered around 9 percent for over two years, and there is serious concern about a double dip recession. Any realistic plan to address these problems must garner bipartisan support, and now is the time for action. In order to spur economic growth and business activity, we will need agreement on an effective proposal to boost the flagging economy. The Domenici-Rivlin Task Force’s full Social Security payroll tax holiday for calendar year 2012 fits the bill.

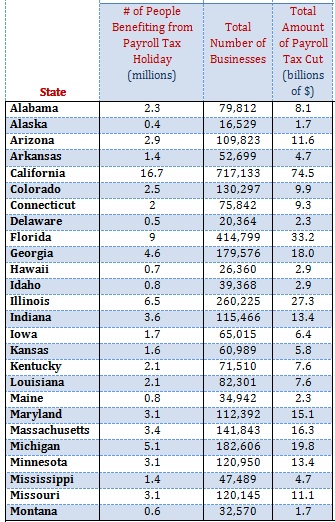

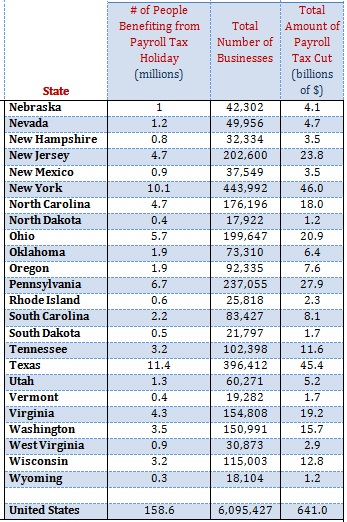

The holiday provides much better “bang-for-the-buck” than many other growth measures. It will immediately increase consumer spending and business hiring, thereby providing economic growth and jobs. The tax cut will provide financial relief for roughly 160 million American workers, many of whom are having difficulty making ends meet in the aftermath of the worst recession in nearly a century. A significant portion of the additional take-home pay will be spent quickly by consumers. Some of the money will undoubtedly go towards paying down debt, but household deleveraging is a necessary precondition for a return to low unemployment and sustained growth. A payroll tax holiday will help people get out of debt faster by adding roughly $3,000 to the average worker’s paycheck.

The Social Security payroll tax directly funds Social Security. Employees and employers each pay 6.2 percent of salaries ? up to a cap of $106,800 per employee ? in payroll taxes. Because of this cap, a payroll tax holiday proportionally will direct more money into the pockets of working- and middle-class Americans, those who are most likely to spend it in short order. On the business side, a holiday will reduce the cost of hiring additional workers for every one of America’s six million employers, the vast majority of them small business owners.

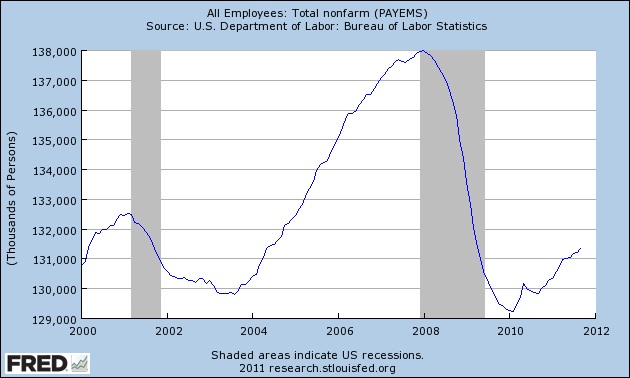

The Congressional Budget Office (CBO) projects that a full Social Security payroll tax holiday will create between 2.5 and 7 million jobs over two years. With almost 7 million fewer people employed now than before the recession, these jobs are sorely needed. The costs of continued long-term unemployment are steep and likely are already beginning to eat away at our future growth. Long-term unemployment leads to a permanent deterioration of the skills and productivity of our workforce. Therefore, returning unemployed Americans to work as quickly as possible must be a priority.

Temporarily suspending the payroll tax for employees and employers will not have any net effect on the Social Security Trust Fund. The General Fund of the government will transfer dollar for dollar back to the Trust Fund, such that it is made whole in real time with no impact on Social Security’s financing.

A payroll tax holiday must be coupled with a strong deficit reduction plan in order to both strengthen the economy and reduce the debt. Restoring the economy to steady growth will help stabilize and reduce the debt, but given the severity of our fiscal imbalance, growth alone is not a panacea. A bold deficit reduction package is necessary, as well.

By providing more money to consumers and businesses alike right away, however, the payroll tax holiday will help to quickly reignite the struggling economy. It provides more near-term benefits than almost any other proposal in circulation, and will be an effective growth- and job-creator for the United States. That is why the payroll tax holiday is needed now, and should be included in any comprehensive economic recovery plan.

?

Sources: U.S. Census Bureau, Tax Policy Center, and Center on Budget and Policy Priorities

Related Posts

- Unlocking Jobs and Growth, June 17, 2011

- Former Biden Economist Considers Domenici-Rivlin Payroll Tax Holiday, June 3, 2011

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now