Federal Reserve Dividends Should Not Be a Piggy Bank for Congress

The Senate is considering new legislation that seeks to change an obscure interest rate paid by the Federal Reserve to its member banks as part of broader legislation to pay for transportation investment. The interest rate determines dividends private banks receive, risk-free, on funds they are required to invest as a condition of becoming a member of the Federal Reserve System. This rate was originally set at 6 percent when the Federal Reserve was created and has never been changed. The proposal would cut this rate to 1.5 percent and has now advanced to the Senate floor with no debate or discussion before the Senate Banking Committee. Tinkering with the Federal Reserve’s system to fund current congressional spending initiatives, without public debate or thought on its ramifications, sets a dangerous precedent and is bad policy.

Congress should strongly resist changing the rate the Federal Reserve pays to member banks as dividends for the capital they hold in the Federal Reserve System without a vigorous and public debate. The Fed is a hybrid central bank?both public and private?and is a complicated, delicate operation. Proposals to thoughtfully examine its structure, such as the idea put forth by Senate Banking Chairman Richard Shelby (R-AL) to create a special commission to study and produce recommendations to change the Federal Reserve System, deserve public debate and potential congressional action. Ideas to further incentivize the Federal Reserve System to more wisely use its resources, which come fundamentally at taxpayer expense, also deserve consideration. There may well be avenues that Congress can and should take to more effectively manage the Federal Reserve System that will provide savings to taxpayers.

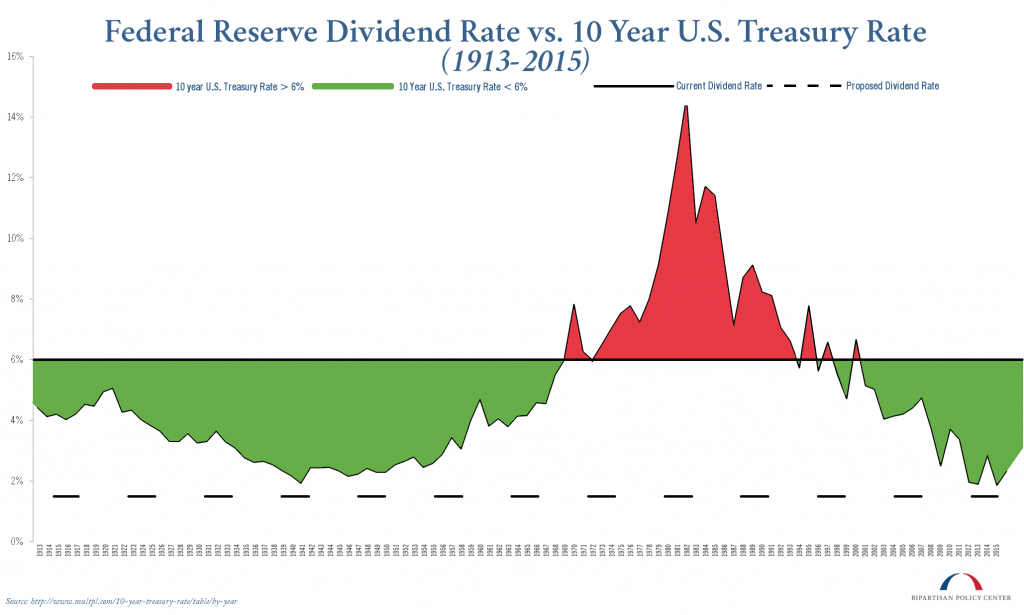

Over the 102 years this interest rate has been in place, the amount banks received from it has varied widely from what banks would have received had they invested in an alternative risk-free asset, such as U.S. Treasuries. BPC analysis in the chart below shows the difference in what banks received in return for holding Federal Reserve shares versus the interest rate on U.S. Treasury 10-year notes. From the introduction of the dividend in 1913 to present, the average return on 10-year U.S. Treasuries was approximately 5 percent, just slightly under the 6 percent rate paid by the Federal Reserve. Thus, over history, the original framers of the Federal Reserve System picked an interest rate for Federal Reserve Bank capital that would turn out to be remarkably close to actual experience over the next century.

That said, the overall average covers three distinct time periods. Between enactment and 1969 prevailing interest rates were lower than what was being paid out by the Federal Reserve. However, almost every year between 1970 and 1997 banks were worse-off holding capital in the Fed compared to buying Treasury notes. Since 2001, prevailing interest rates have once again been lower. Overall, banks received a lower return with Fed shares one-fourth of the time and a higher return three-fourths of the time than they otherwise would have with Treasury notes. It is worth noting that the reason the overall average difference between the fixed interest rate of 6 percent and the observed interest rates on Treasury notes of 5 percent is small, but the rate was lower for a longer duration is because when this was a ?good’ deal for banks it was a much smaller ?good deal’ than during the time period when it was a ?bad deal’ during which it was a much ?worse deal’.

The chart below illustrates this with the time period when Fed shares presented a higher return is shown in green and the time period when U.S. Treasuries yielded higher returns are in red. It is important to note that at no time in this period, would banks have earned at or less than the Senate’s proposed interest rate of 1.5 percent by investing in Treasury notes.

The Senate proposal would subject banks with more than $1 billion in assets to this new, lower interest rate. While $1 billion may sound like a high threshold, in fact more than 90 percent of all assets in the U.S. banking system are held by banks with more than $1 billion in assets. On the other hand, approximately 90 percent of the nation’s roughly 6,500 banks have assets less than $1 billion. This highlights how many small banks exist and also the concentration of assets in the U.S. banking system. That is supporters of the proposal can rightfully claim that most banks won’t be affected by the change. However, opponents of the proposal can rightfully claim that the vast majority of the banking system?as measured by the assets held by banks?will be affected.

Supporters claim that changing the interest rate to 1.5 percent would result in a savings for taxpayers of more than $16 billion over 10 years as a result of greater payments sent by the Federal Reserve to the Treasury. The Federal Reserve remits all excess income?revenue minus expenses?to the Treasury, so paying less in dividends to member banks arguably would increase remittances to the Treasury. This analysis, however, assumes that the Federal Reserve will simply increase its remittances by the amount of additional revenue it retains. In reality, the Federal Reserve determines its own expenses. There is nothing in the legislation that requires the Federal Reserve to return this windfall as opposed to using it for its own purposes.

Going forward, net profits of the Federal Reserve are projected to decrease rapidly once the Federal Reserve increases interest rates through the new mechanism of paying banks interest on excess reserves. In addition as the Federal Reserve unwinds its balance sheet it is likely to begin to book losses on some of its assets due to its unique accounting structure. Versions of the president’s budget have anticipated that the Fed’s profits may approach zero, or even go negative, for the first time in history as they change monetary policy and provide interest rates to banks on excess reserves.1

There is a reason that Congress has never before changed this rate to fund current spending.2 The famed Glass-Steagall Act, expressly reaffirmed the 6 percent interest rate. Any direct reinstatement of Glass-Steagall would mean a return to 6 percent, which would then score as costing the taxpayer money. On the other side of the political ledger, do those that are concerned about Federal Reserve accountability and want to ?Audit the Fed’, want to give the Federal Reserve billions of dollars of additional income with no additional oversight? Finally, for those in the middle, consider the political precedent that this sets as to Congress’s ability to change the rules that govern the Federal Reserve, including the conduct of monetary policy, as a way to create short-term ?savings’ to use as offsets to fund anything. Simply put, it is bad public policy to abruptly change a key interest rate with no public debate, especially as part of a mission to search the couch cushions for more money to fund the topic du jour.

1 The President’s FY 2014 Budget has Federal Reserve remittances going to zero or negative in 2018. More current budgets have the number shrinking but remaining positive. For a more in depth discussion of why this is, check out Carpenter (2013).

2 Congress has previously required specific Fed Remittances as part of annual spending and budget bills. See Pub. L. No. 106?113, § 302, 113 Stat. 1501 A-304 (1999) (The Federal reserve banks shall transfer from the surplus funds of such banks to the Board of Governors of the Federal Reserve System for transfer to the Secretary of the Treasury for deposit in the general fund of the Treasury, a total amount of $3,752,000,000 in fiscal year 2000.); Omnibus Budget Reconciliation Act of 1993, Pub. L. No. 103?66, 107 Stat 312 (1993) (“During fiscal years 1997 and 1998, any amount in the surplus fund of any Federal reserve bank in excess of the amount equal to 3 percent of the total paid-in capital and surplus of the member banks of such bank shall be transferred to the Board for transfer to the Secretary of the Treasury for deposit in the general fund of the Treasury.”)

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now