Earnings Report: Federal Government

“’The debt is yesterday’s problem.’” That’s the new cry in Washington, D.C., and, apparently, on Wall Street. Lulled by new forecasts that show deficits declining for the next three years, policy- and market-makers have moved on to the next challenges?guessing what the Federal Reserve will do (or perhaps who the Federal Reserve Chair will be) and how Congress will fund the government next year.

One should expect nothing less in the ten-second attention span of Wall Street and the two-year election-cycle attention span of political Washington.

Thus, CNBC conducted a poll of Wall Street participants that revealed that concern about debt and deficits had declined among those polled from 80 percent in January to less than 50 percent now.

This dramatic change of view mirrors the new call for “growth” above all else in Washington.

Here are the facts:

- the Congressional Budget Office (CBO) in May lowered its baseline deficit projections for each of the next ten fiscal years;

- CBO’s estimates show that total accumulated additional deficits over the next decade will result in additional national debt of only $6.340 trillion instead of the CBO February projection of $6.958 trillion.

- deficits during the next two years will be substantially lower than deficits of the last two years.

These three facts were trumpeted by both the Legislative and Executive Branches as evidence of real progress.

As we have noted before, the rest of CBO’s analysis seems to have been lost in the rush to declare victory over deficits.

Below the fold, CBO repeated its warning that “with such deficits, federal debt held by the public is projected to remain above 70 percent of GDP?far higher than the 39 percent average seen over the past four decades. (As recently as the end of 2007, federal debt equaled 36 percent of GDP.)”

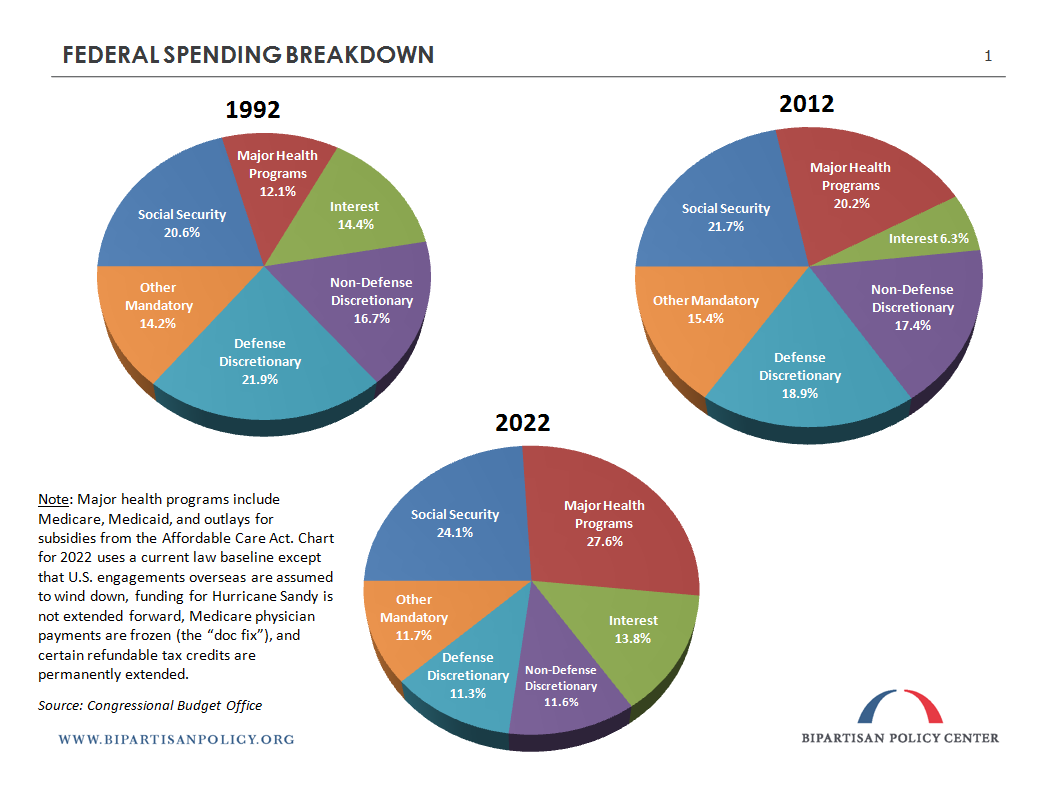

A picture is worth a thousand words, so here is the future in three pie charts:

Click here for a larger version of this image.

Comparing the three charts shows the stark realities of the federal budget. Under current law, interest spending will exceed defense spending by 2022. Interest costs will also exceed all non-defense discretionary spending in that year.

Here’s one way to look at the national situation as if it were a business and you were considering buying part of that business.

- Its costs will rise faster than its forecast income during the next 20 years.

- Its primary sectors for future growth are facing serious headwinds that will lead to less and less investment.

- It will spend more on retiree benefits within the decade than on any other single item and these costs are rising more rapidly than any other part of this company’s business.

- Its indebtedness has doubled as a proportion of its costs in just the past six years and interest payments will exceed all investments in its products within the decade.

- Most of this company’s debt is owned by dangerous competitors who may at any time demand higher interest rates.

- It has substantial assets, but getting rid of those real assets and trimming non-core spending has proved virtually impossible because the CEO and his Board of Directors fear that shareholders will fire them if they engage in these necessary reforms.

That is an incomplete, crude, business-like analysis of the United States budget and fiscal situation.

It is not all that dissimilar to real businesses that during the past ten years have shown similar characteristics?and which the American taxpayer had to bail out to avoid an economic meltdown.

A simple question emerges: Would you invest in a business whose balance sheet looks like that?

Well, you might if you were assured that the CEO and directors of the firm would begin to quickly reduce costs by selling non-essential assets and closing redundant production lines.

Yet, the CEO and Board have made similar promises for the past 30 years and, except for one four-year span about 20 years ago, have failed to undertake those reforms.

The United States has the “exorbitant privilege” of having the world’s reserve currency?and its own printing press with which to print more of that currency.

So, the CEO and the Board keep their collective heads in the sand and hope that future CEOs and Board members will somehow avoid the obvious catastrophe ahead. Let the shareholder beware.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give NowRelated Articles

Join Our Mailing List

BPC drives principled and politically viable policy solutions through the power of rigorous analysis, painstaking negotiation, and aggressive advocacy.