House Democrats' Fiscal Year 2013 Budget: The Details

Budget season for fiscal year (FY) 2013 began last month, when President Obama released his plan for tax and spending policy over the next decade. In recent days, House Republicans under the leadership of Budget Committee Chairman Paul Ryan and the Congressional Progressive Caucus (CPC) both submitted budgets of their own. House Democrats added their voice to the mix yesterday.

We provided objective summaries and analyses of the earlier plans (Ryan and CPC), and we will continue that series in the coming days with posts on the bipartisan Cooper-LaTourette proposal, and submissions from the Republican Study Committee and the Congressional Black Caucus. Below we focus on the Democratic House budget.

The House Democrats’ plan looks very similar to the budget offered by President Obama. The Democratic House budget follows the president’s conceptual approach in many areas, including near-term growth initiatives, a higher income tax burden on upper-income individuals, corporate tax reform, replacement of the sequester cuts, and reforms to agriculture subsidies. The overall level of debt reduction achieved by the two proposals is comparable.

On the other hand, the Democratic House budget is easily contrasted with Chairman Ryan’s plan that passed through his committee. House Democrats would enact immediate deficit spending intended to facilitate economic growth, while the Ryan budget would not. The Democrats propose to raise the top tax rate for individuals, while the GOP budget would lower it. House Democrats would collect additional revenues for deficit reduction, while the Republican budget would not. The Democratic budget for health care solely focuses on implementation of the Affordable Care Act (ACA), whereas Ryan’s budget repeals the ACA, implements premium support for Medicare, and block grants Medicaid. The policy summaries of these two budgets epitomize the substantial ideological divide that exists between the parties today.

Notably, the Democratic House budget lacks specific policy proposals for any of three largest entitlements in the budget: Social Security, Medicare, and Medicaid. There is no way to stabilize our debt over the long run without reforms to some or all of those programs.

More from BPC’s FY 2013 Budget Analysis Series

- Congressional Progressive Caucus

- Republican Study Committee

- House GOP/Chairman Ryan

- Cooper-LaTourette

What follows is an objective analysis of the House Democrats’ proposed budget. As with our analysis of previous budgets, this post will focus heavily on the 10-year budget window. Although it is critical to understand the long-term effects of major policies included in any debt reduction plan, significant uncertainty in projections and lack of specificity in policies make concrete scoring beyond the first decade extremely difficult for these packages.

The budget appears to contain a moderate gap between the quantitative spending reductions detailed according to budget function, and the qualitative policies that would support those figures. For purposes of this analysis, we accept the budget’s bottom-line spending targets, but note that the plan is not always entirely clear about how the policies match up with the figures provided.

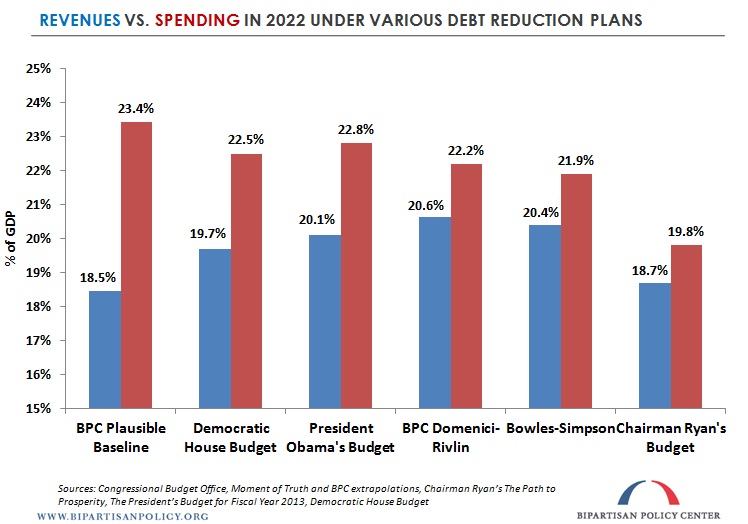

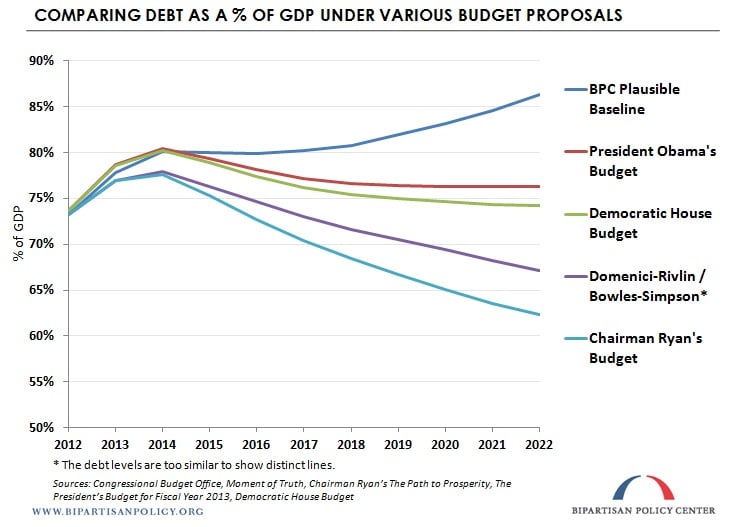

Debt, Spending, and Revenues

As expected, the House Democrats propose similar levels to President Obama for debt, spending, and revenue. Debt as a percentage of our economy, or gross domestic product (GDP), would reach 74 percent by 2022, slightly lower than the 76 percent achieved by the president’s budget, with marginally lower levels of both spending and revenues. Although the Democratic House budget reduces the ratio of debt to GDP from the BPC Plausible Baseline*, debt would remain significantly higher than the levels achieved by the Bipartisan Policy Center’s (BPC) Domenici-Rivlin Task Force and the Bowles-Simpson Commission (both of which reduce the debt to 67 percent of GDP by 2022), as well as the House Republican budget (62 percent of GDP).

The charts below illustrate the revenue and spending levels achieved in 2022 by each major budget plan, and what each would do to the debt over the next 10 years:

To view and share a larger version of the graph above, click here.

To view and share a larger version of the graph above, click here.

Debt Ceiling

The Democratic House budget would require an increase in the debt ceiling of roughly $8 trillion through 2022, an amount roughly equivalent to that necessitated by President Obama’s FY 2013 proposal. Both the Ryan and CPC budgets would require a smaller increase over the coming decade of approximately $5.5 trillion.

Growth Initiatives through Deficit Spending

House Democrats propose to allocate substantial funds to initiatives intended to grow the economy and increase domestic investment. Some of these proposals have been circulating for the past few years, and President Obama included many of them in his American Jobs Act (and subsequently, in his FY 2013 budget). They include both targeted tax cuts and spending increases, appearing to total roughly $200 billion over the decade. Below is a sample of the proposals:

- Create an infrastructure bank to attract private investment and facilitate private-public partnerships, carrying a cost of $10 billion over the next decade. (A description appears on p. 56 of President Obama’s budget.)

- Address immediate surface transportation priorities with a $50 billion investment.

- Allocate $80 billion over the decade towards initiatives to support education jobs and infrastructure, as proposed by President Obama. This would include $30 billion for rebuilding public schools, $25 billion to prevent educator layoffs, and $8 billion for colleges to train workers in high-growth industries.

- Enact a temporary 10-percent tax credit for new jobs and wage increases. This would cost approximately $32 billion over the decade.

- Enact tax credits for investment in advanced energy manufacturing, for the production of advanced technology vehicles and alternative-fuel commercial vehicles, and for investment in American manufacturing communities. These proposals would total roughly $12 billion in foregone revenue.

- Send $5 billion to states and localities to hire police officers and firefighters.

- Per President Obama’s proposal, establish a Veterans Job Corps to employ approximately 20,000 veterans at a cost of $1 billion.

- Prevent the interest rate on subsidized student loans from doubling in the middle of this year. This plug is projected to cost $6 billion.

- Fund science and engineering workforce development (details unspecified).

- Allocate additional resources to the Small Business Administration to maintain current volume of lending for loan programs.

Medicaid

House Democrats do not make any particular proposals for Medicaid. The budget solely states an opposition to block granting the program, a policy recommended by Chairman Ryan.

Medicare

The plan does not make any specific recommendations for Medicare, only stating an opposition to premium support.

Social Security

The Democratic House budget does not propose specifics on Social Security reform. It simply states that “privatization” of the program should be off the table. Chairman Ryan’s House GOP budget and President Obama’s submission similarly avoided detailed policies.

Revenue Policies

House Democrats propose changes to the tax code that are very similar in nature to those proposed in President Obama’s FY 2013 submission. All of the increase in revenues is collected from upper-income Americans, with no increase in the tax liability of individuals with adjusted gross income below $200,000.

There are a number of major policies included in the revenue package, but most analysts would agree that it falls short of comprehensive reform, because many of the tax code’s complexities and inefficiencies remain in place. Below are some of the specific proposals for the individual income tax:

- Allow the upper-income “Bush” tax cuts to expire at the end of the year, returning the top individual income tax rate to 39.6 percent. This would raise nearly $1 trillion over the decade.

- Enact the Buffett Rule, a provision that would guarantee a minimum effective tax rate for upper-income individuals. (Details of one version of the proposal can be found on p. 39 of President Obama’s FY 2013 budget.)

- Keep the Alternative Minimum Tax (AMT), but “patch” it for inflation. The patch is fully paid for over the decade at a cost of roughly $1 trillion.

- Allow the increased exemption level and reduced rates on the estate tax to expire. For context, the estate tax currently has a $5 million exemption, with a top rate for taxing assets above that set at 35 percent. Under current law for 2013, the exemption will revert back to $1 million with a top rate of 55 percent, producing a significant increase in revenues from that tax.

The budget also encourages limitations on individual income tax expenditures for those taxpayers earning over $1 million annually, but provides no specifics in that area. As for corporate taxes, House Democrats endorse the framework outlined by President Obama earlier this year. The reform would be revenue neutral. It would lower the top marginal corporate tax rate in exchange for broadening the base by closing a variety of corporate tax expenditures, including preferences for oil and gas exploration, and for corporations that move American jobs overseas. Many of the remaining details remain unspecified.

Under this reform, the research and development tax credit would be extended. The plan also advocates the extension and enhancement of clean energy incentives in the tax code.

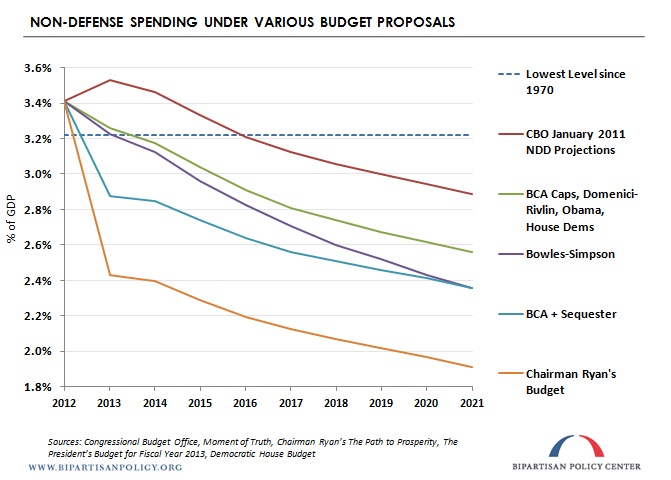

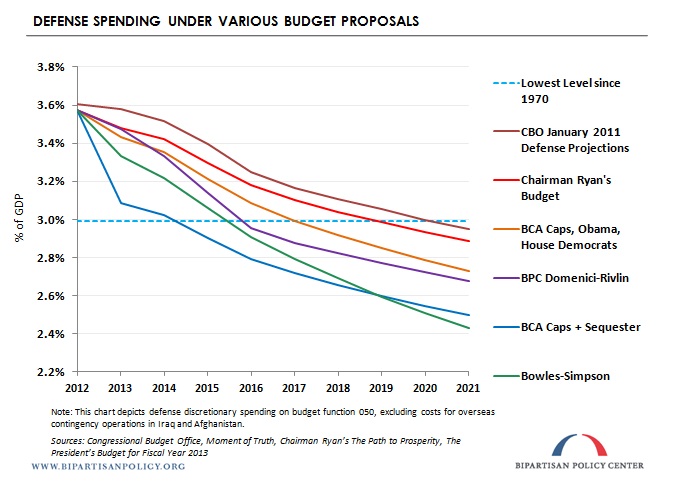

Discretionary Spending

House Democrats would replace all nine years of scheduled sequestration to annually appropriated (discretionary) spending with alternative deficit reduction (as outlined herein). The sequester would be turned off for both the defense and non-defense categories. Therefore, the budget abides by the discretionary spending caps established in last summer’s Budget Control Act (BCA).

The Democratic House budget also mandates that all spending for Overseas Contingency Operations (OCO) is zeroed out after FY 2014. This would end all explicit spending for overseas military engagements, and force any expenditures for those purposes to fit under the defense discretionary spending cap. For reference, President Obama, BPC’s Domenici-Rivlin, and Bowles-Simpson all budget for OCO spending of roughly $40 billion annually through the remainder of the decade.

One other particular policy mentioned in the budget for discretionary spending would give all active-duty combat troops an additional bonus.

To view and share a larger version of the graph above, click here.

?

To view and share a larger version of the graph above, click here.

Other Mandatory Spending

- House Democrats propose to replace all nine years of scheduled sequestration cuts to non-exempt mandatory (entitlement) spending with alternative deficit reduction policies.

- The Democratic House budget, similar to the president’s, proposes to move transportation funding from the discretionary (annually appropriated) pot to the mandatory side of the ledger. Additionally, the House Democrats would enact Obama’s FY 2012 $556 billion six-year surface transportation reauthorization proposal, which would increase transportation funding by $241 billion over ten years. This proposal includes $50 billion of “up-front” spending (as mentioned previously) aimed at boosting the sluggish economy, and $71 billion directed to the Federal Highway Administration to rebuild roads and bridges.

- The budget calls for a reduction in direct agriculture subsides.

- House Democrats propose to improve the solvency of the Pension Benefit Guarantee Corporation (details unspecified).

Budget Enforcement

Currently, the Republican-led House of Representatives follows a “CUTGO” rule, requiring that all mandatory spending increases be offset by other mandatory spending reductions, while allowing for tax cuts that are not offset. The House Democrats would replace this rule by reinstituting “PAYGO,” which mandates that any mandatory spending increase or tax cut be offset by mandatory spending reductions and/or revenue increases of equal or greater magnitude. Additional details can be found on pp. 60-62 of the budget submission.

Miscellaneous

- The Democratic House budget would reduce duplications that have been identified by the Government Accountability Office (details unspecified).

- House Democrats propose to modestly increase the amounts allocated to program integrity initiatives in the Internal Revenue Service and Unemployment Insurance. The BCA caps would be adjusted upwards to incorporate the entailed, up-front costs.

- The budget encourages the House of Representatives to locate additional savings from its own operations and maintenance budget.

* BPC’s Plausible Baseline assumes:

- The 2001, 2003, and 2010 tax cuts are extended permanently.

- The AMT is indexed to inflation.

- Medicare physician payment rates are frozen at 2012 levels (the “doc fix”).

- The Budget Control Act’s sequester does not take effect.

- The number of troops deployed for overseas contingency operations is reduced to 45,000 by 2015.

Related Posts

- Bipartisan Policy Center Debt Reduction Task Force Co-Chairs Domenici and Rivlin Praise Congressmen Cooper and LaTourette for their Bipartisan Budget Proposal, March 28, 2012

- Congressional Progressive Caucus Fiscal Year 2013 Budget: The Details, March 26, 2012

- Chairman Ryan’s Fiscal Year 2013 Budget: The Details, March 21, 2012

- The Debt Ceiling Slouches Toward 2012, February 24, 2012

- The Twelve Takeaways from CBO’s 2012 Budget and Economic Outlook, February 10, 2012

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now