Congressional Progressive Caucus Fiscal Year 2013 Budget: The Details

Today, the Congressional Progressive Caucus (CPC) released its vision for fiscal policy over the next ten years. This plan is the latest in a string of budget proposals for fiscal year (FY) 2013, and on this blog, we will continue to produce objective analyses as additional plans are put forward.

The CPC budget is entitled the Budget for All, and represents the ideas of a progressive Democratic coalition in the House of Representatives.

The release follows President Obama’s budget submission and House Budget Committee Chairman Paul Ryan’s The Path to Prosperity, which has passed through his committee.

All three plans would stabilize the debt over the ten-year budget window (albeit at different levels), but they offer starkly different visions for federal taxing and spending policy. There are substantial ideological divides among the plans over the proper role for the federal government in society.

Although the CPC budget includes some spending cuts ? primarily in the area of defense ? they would be more than offset by additional deficit spending (i.e., tax cuts and spending increases that are intended to strengthen the sluggish economic recovery and repair the national infrastructure). Thus, nearly all of the deficit reduction in the CPC plan can be considered to stem from a heavy dose of additional revenues, the vast majority of which would be collected from high-income taxpayers and corporations.

As detailed in our explanation of Ryan’s budget, that plan takes the opposite approach. There is no deficit spending proposed for the near term. Additionally, since the budget specifies that revenues should remain at or near historic averages, the Ryan plan achieves all of its deficit reduction over the decade through aggressive spending cuts and reforms, with particular focus on Medicaid, low-income support programs, and annually appropriated domestic spending.

President Obama, House Republicans and the CPC should be commended for releasing proposals that seriously attempt to address the nation’s debt problem over the coming decade. Elements of each will be necessary to reach a grand bargain that places the country back on a sustainable fiscal track.

More from BPC’s FY 2013 Budget Analysis Series

Below is an objective analysis of the CPC’s proposed budget. As with our analysis of Chairman Ryan’s budget, this post will focus heavily on the ten-year budget window. Although it is critical to understand the long-term effects of major policies included in any debt reduction plan, significant uncertainty in projections and lack of specificity in policies make concrete scoring beyond the first decade extremely difficult for these packages.

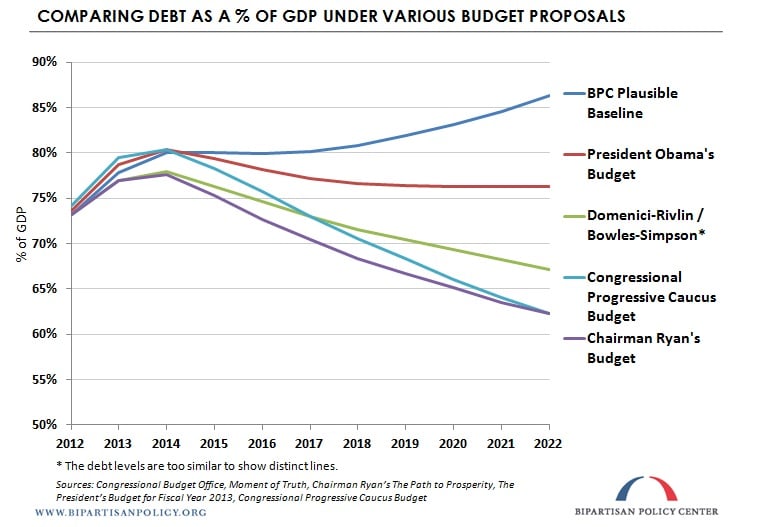

Debt, Spending, and Revenues

The CPC’s budget, in a similar manner to Ryan’s, would reduce the size of the debt as a percentage of our economy, or gross domestic product (GDP), to 62 percent by 2022. Notably, this is lower than the debt levels achieved by either the Bipartisan Policy Center’s (BPC) Domenici-Rivlin or the Bowles-Simpson commissions (both of which reduce the debt to 67 percent of GDP by 2022), and significantly lower than the debt level in 2022 under the president’s budget proposal for FY 2013 (76 percent) or the BPC Plausible Baseline* (86 percent).

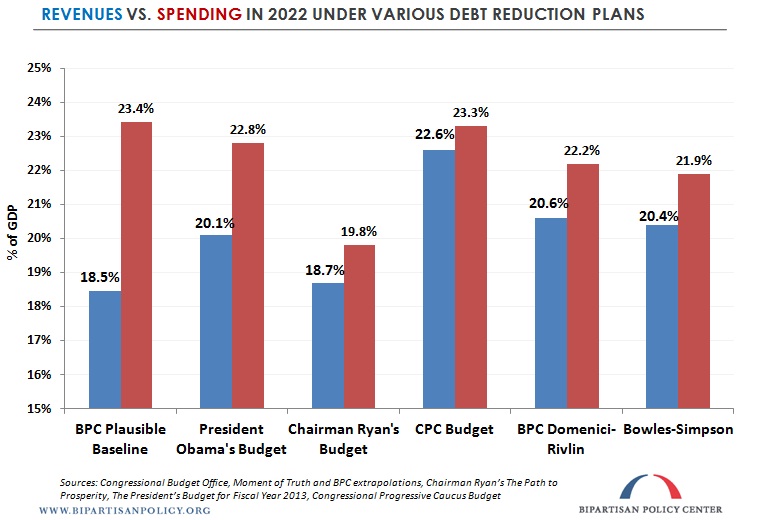

The chart below illustrates the revenue and spending levels achieved in 2022 by each major budget plan.

To view and share a larger version of the graph above, click here.

To view and share a larger version of the graph above, click here.

Debt Ceiling

The CPC budget would necessitate an increase of the debt ceiling by roughly $5.5 trillion through 2022 ? an identical amount to that required by the Ryan budget. The president’s plan includes a somewhat higher level of overall debt in the year 2022, and so the requisite increase would be roughly $3 trillion greater for his proposal over the same horizon.

Growth Initiatives through Deficit Spending

The CPC proposes to allocate substantial funds to initiatives intended to grow the economy and increase domestic investment. Some of these proposals have been circulating for the past few years, and President Obama included many of them in his American Jobs Act (and subsequently, in his FY 2013 budget). They include both targeted tax cuts and spending increases, totaling roughly $450 billion over the decade, according to the CPC. Below is a sample of the proposals:

- Create an infrastructure bank to attract private investment and facilitate private-public partnerships (details unspecified).

- Extend the Making Work Pay tax credit through 2015.

- Implement the Emergency Jobs to Restore the American Dream Act, which includes (among other proposals) the School and Park Improvement Corps for rehabilitation projects, the Student Jobs Corps for college students seeking part-time work-study positions, and the Neighborhood Heroes Corps to employ teachers, firefighters, and police officers.

- Enact a temporary 10-percent tax credit for new jobs and wage increases.

- Enact tax credits for investment in advanced energy manufacturing, for the production of advanced technology vehicles and alternative-fuel commercial vehicles, and for investment in American manufacturing communities.

- Double the allowed amount of expensed start-up expenditures.

- Expand capital access for entrepreneurs and small businesses.

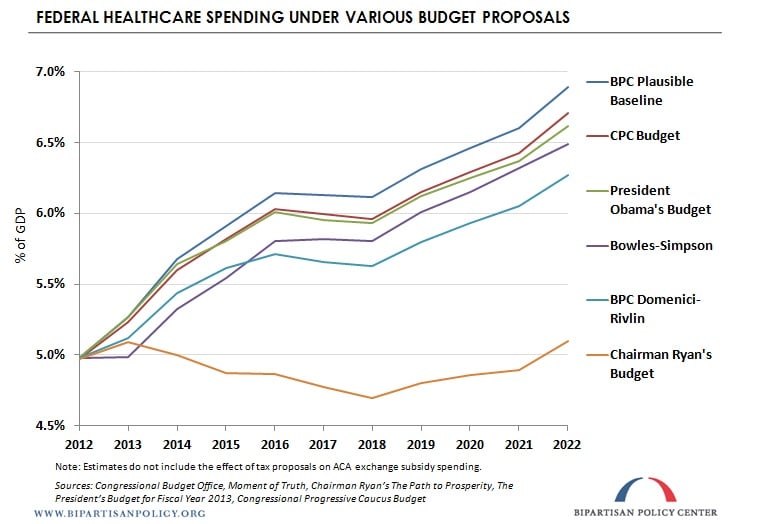

Health Care

One significant health care proposal from the CPC is to add a public option for the under-65 insurance market. Many progressives had been pushing to include this in the Affordable Care Act (ACA), but it was not in the final version of the bill. The public option is projected by the Congressional Budget Office to save $104 billion over the decade. In addition, a number of other health policies are recommended in the budget:

- Give the federal government the ability to negotiate drug prices for Medicare Part D with pharmaceutical manufacturers, as is already done in the Department of Veterans Affairs. This is projected to save the federal government $157 billion in the 10-year window, and also may have the effect of lowering drug costs for seniors.

- Grant states waivers to set up single payer health programs.

- Adopt policies from President Obama’s budget to increase the accessibility and affordability of generic prescription drugs.

- Reduce Medicaid waste, fraud, and abuse, and close a provision in the tax code that allows some self-employed individuals to avoid paying full Medicare payroll taxes by routing their income through an S corporation.

- End the tax deductability of marketing junk food and fast food to children.

Finally, the CPC budget would prevent the 27-percent cut to physicians’ payments under Medicare that is scheduled to be imposed in calendar year 2013. This automatic cut resulting from the sustainable growth rate (SGR) mechanism installed in the 1990s has been avoided in recent years by providing offsetting deficit reduction ? referred to as the “doc fix.” CPC includes and fully pays for this “doc fix” over 10 years, preventing the physician payment cut.

To view and share a larger version of the graph above, click here.

Social Security

Over five years, the CPC budget would phase out the cap (or taxable maximum) for employees and employers on Social Security payroll taxes. This means that instead of current law, under which each party pays 6.2 percent only on income up to $110,100, both employees and employers would pay the 6.2 percent on all taxable income. Due to the Social Security benefit calculation formula, those who pay additional taxes under this proposal would receive higher benefits upon retirement. This policy is projected to raise $1.4 trillion for the Trust Fund over 10 years, and would extend the solvency of the program.

Revenue Policies

The CPC budget proposes significant changes to the individual income tax code that would markedly increase progressivity. The wealthy would be asked to pay significantly more than they do today. The Caucus also would make adjustments to the corporate tax and institute additional revenue-raising measures, detailed below. One unquestionably positive aspect to the proposal is the specific and detailed listing of the particular policies that CPC supports. In addition to provisions that would cost money, such as rate cuts and increases in credits or subsides, the budget enumerates the (potentially less popular) changes that would raise revenues. On the other hand ? regardless of one’s views on the total revenue take for the federal government and how the tax burden should be distributed ? because much of the complexity in the individual income tax code would remain in place and the corporate rate would remain uncompetitively high, many observers would not consider it to be a comprehensive tax reform plan. The following are some of the revenue proposals in the budget. For a complete list, please refer to the document itself (pp. 5-8): Individual

- Allow the upper-income (often referred to as the “Bush”) tax cuts to expire at the end of this year, raising the top two individual rates from 33 and 35 percent to 36 and 39.6 percent, respectively. The current reduced rates are extended for all other taxpayers until 2017, when the 28-percent rate is returned to 31 percent. Lastly, in 2019, the 25-percent bracket would sunset, and those income levels would be subject to the 28-percent rate.

- Maintain a number of the smaller provisions (mostly credits) from the 2001, 2003, and 2010 tax cut laws, as well as the boosted refundable credits currently in place from the American Recovery and Reinvestment Act (ARRA, or the “stimulus”), including the American Opportunity Tax Credit for college expenses.

- Keep the Alternative Minimum Tax (AMT), but “patch” it for inflation. The patch is fully paid for over the decade at a cost of roughly $1 trillion.

- Tax individual income over $1 million at significantly increased rates, ranging from 45 percent for income up to $10 million to 49 percent for income over $1 billion.

- Adopt a 0.5-percent surcharge on income over $10 million, phased in over the next five years.

- Tax capital gains and qualified dividends as ordinary income. With top tax rates being raised to nearly 50 percent, this represents a substantial change from current preferential tax treatment (both are taxed uniformly at 15 percent). Under President Reagan’s 1986 tax reform, however, investment income was similarly taxed as ordinary income, albeit at a top rate of 28 percent. The step-up basis of capital gains at death would be eliminated, as well.

- Set exemption level for the estate tax at $2.5 million (or $5 million for couples) and tax assets above that at progressive rates up to 65 percent. For context, the estate tax has a $5 million exemption in 2012 with a top rate for taxing assets above that set at 35 percent, and under current law for 2013, the exemption will revert back to $1 million with a top rate of 55 percent ? a significant increase in the estate tax. The CPC proposal would exempt more taxpayers than under 2013 current law (i.e., those with assets between $1 million and $2.5 million), but impose higher rates on estates above the exemption level.

- Cap the benefit of itemized deductions at 28 percent, as President Obama has proposed previously. This would be accompanied by eliminating the mortgage interest deduction for second homes and yachts. Combined, these policies are projected to save nearly $500 billion over 10 years.

- Replace the tax exclusion for interest on state and local bonds with a direct subsidy to the issuer of 15 percent for the interest paid on those bonds. This would remove the advantage from the taxpayer/investor, but save money for all levels of government (including close to $200 billion projected for the federal government over the decade). At the same time, behavioral impacts from this change could reduce the demand for municipal bonds, making it more difficult for state and local governments to finance operations.

Corporate

- Eliminate preferences in the code for oil, gas, and coal companies. This is projected to save $25 billion over the decade.

- Levy a “Financial Crisis Responsibility Fee” ? a small tax ? on large banks with more than $50 billion in assets to collect $90 billion over the 10-year budget window.

- Enact a “Wall Street Gaming Tax” on derivatives, credit default swaps, and other types of transactions. (See the CPC budget for rates and additional details.) The tax is projected to raise $850 billion over the decade.

- Institute a carbon tax on polluters at $20 per ton, and increasing by 5.6 percent annually. One quarter of the revenues would be rebated to hold low- and middle-income families harmless. Post rebate, the tax is projected to raise nearly $900 billion over the decade.

- Close additional corporate tax loopholes and preferences.

- Enhance and make permanent the research and experimentation tax credit.

- Adopt the international tax reforms in President Obama’s FY 2013 budget. (For specific proposals, see pp. 203-204 of Analytical Perspectives from the Office of Management and Budget.)

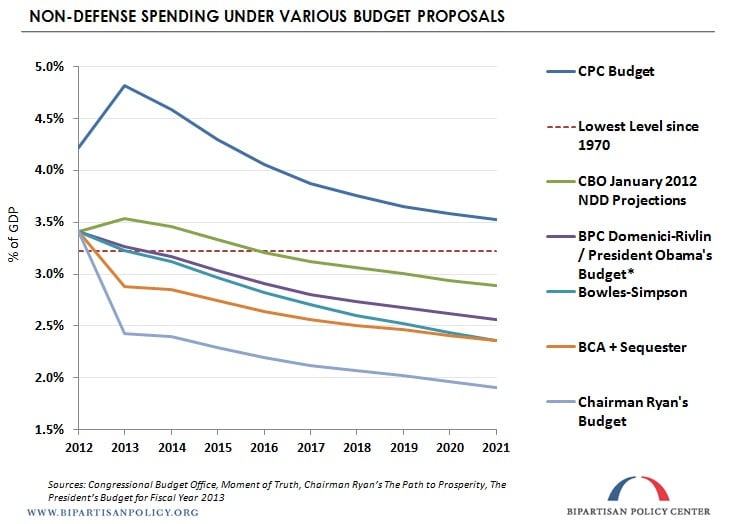

Discretionary Spending

First, the CPC budget reverses all of the cuts enacted in the Budget Control Act (BCA) for both defense and non-defense spending. Both the automatic sequester cuts and the original caps on discretionary spending are waived.

On top of reversing those cuts, the CPC’s budget proposes substantial increases to domestic and international affairs spending, totaling $1.75 trillion over the next 10 years. However, exactly how much of the increase is dedicated to annually appropriated budget programs versus mandatory spending is unclear. Some of this would come in the form of short-term stimulus spending, as described in the Growth Initiatives section above, but the large majority would serve to increase the government’s commitment to low-income support programs, education, international development, veterans’ benefits and services, community development and housing assistance, and research on energy, health care, science, and the environment.

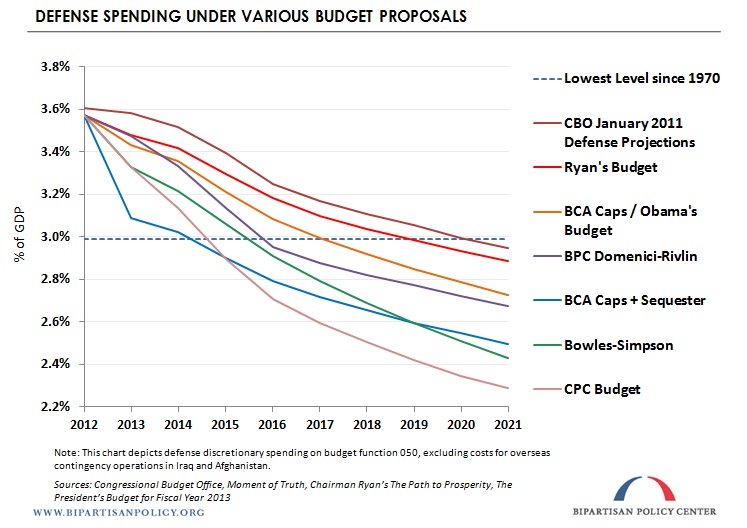

Alternatively, defense spending would be cut even deeper than it is scheduled to be under the BCA’s sequester, predominantly through a large reduction in force structure, private contractors, and the procurement and updating of weapons systems. Moreover, the CPC’s budget would eliminate all funding for any operation in Iraq or Afghanistan after FY 2013. For reference, the president’s budget, BPC’s Domenici-Rivlin, and Bowles-Simpson budget for spending of roughly $40 billion annually on these operations through the latter half of the decade.

To view and share a larger version of the graph above, click here.

To view and share a larger version of the graph above, click here.

Other Mandatory Spending

- The CPC’s budget, similar to the president’s, proposes to move transportation funding from the discretionary (annually appropriated) pot to the mandatory side of the ledger. Additionally, the CPC would enact Obama’s FY 2012 $556 billion six-year surface transportation reauthorization proposal, which would increase transportation funding by $241 billion over ten years. This proposal includes $50 billion of “up-front” spending aimed at boosting the sluggish economy, and $71 billion directed to the Federal Highway Administration to rebuild roads and bridges.

- The plan would increase funds for many mandatory spending programs, such as the Supplemental Nutrition Assistance Program (SNAP, or food stamps), Temporary Assistance for Needy Families (TANF), and the Food and Nutrition Service. The total amount (for mandatory programs, as opposed to annually appropriated ones) and the amounts of the individual increases are unspecified.

- The CPC budget calls for a reduction in agriculture subsides through adoption of the relevant proposals in President Obama’s FY 2013 budget.

- The CPC proposes to reform unemployment insurance to make the program solvent and more robust. (A detailed description and rationale for the proposal can be found here.)

Miscellaneous

- The plan lends support for comprehensive immigration reform (details unspecified).

- The CPC would establish public financing of elections (details unspecified).

- The CPC budget endorses write-downs on mortgage principal amounts for struggling homeowners (details unspecified).

* BPC’s Plausible Baseline assumes:

- The 2001, 2003, and 2010 tax cuts are extended permanently.

- The AMT is indexed to inflation.

- Medicare physician payment rates are frozen at 2012 levels (the “doc fix”).

- The Budget Control Act’s sequester does not take effect.

- The number of troops deployed for overseas contingency operations is reduced to 45,000 by 2015.

Related Posts

- Chairman Ryan’s Fiscal Year 2013 Budget: The Details, March 21, 2012

- The Debt Ceiling Slouches Toward 2012, February 24, 2012

- The Twelve Takeaways from CBO’s 2012 Budget and Economic Outlook, February 10, 2012

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now