Streamlining the U.S. Financial Regulatory System

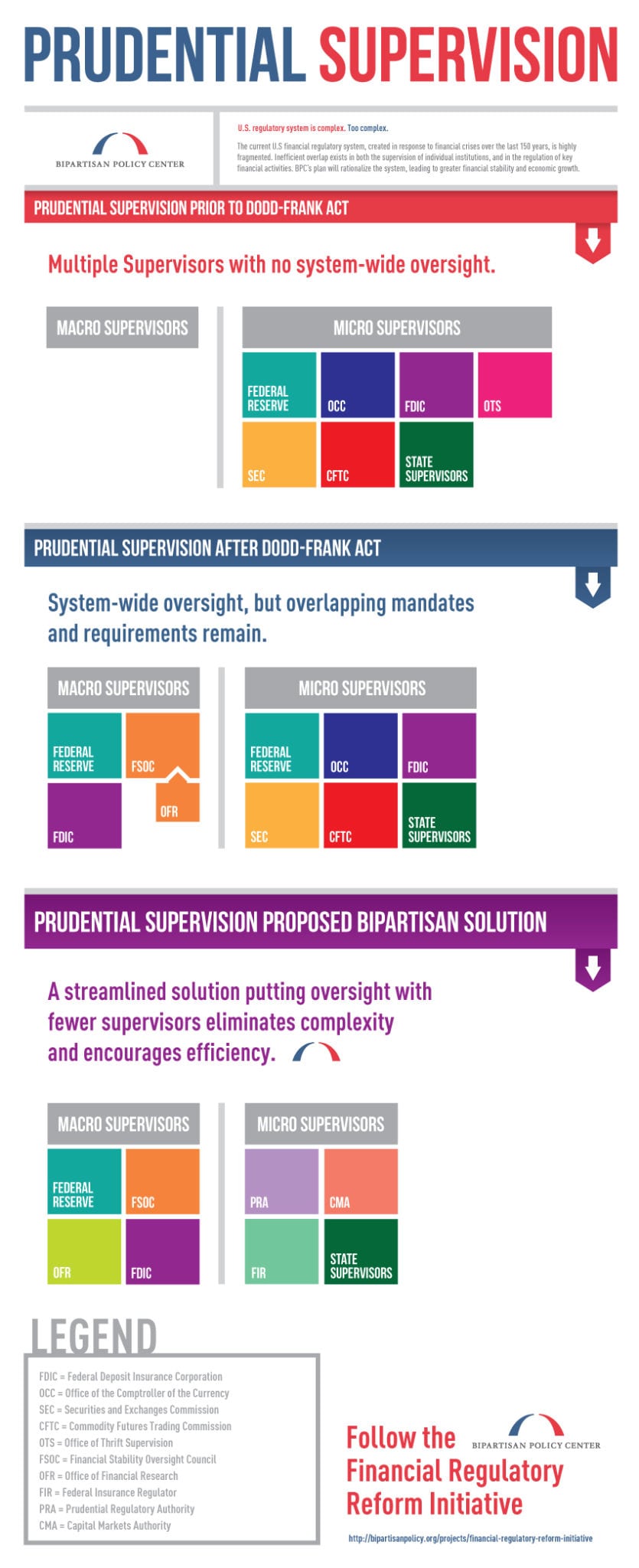

Banks and thrifts, and their holding companies, are subject to examination by multiple federal and state financial regulators. Prudential supervision ensures that financial institutions are sufficiently capitalized, are not engaging in activities that are too risky, are liquid enough to meet their obligations, and are otherwise safe and sound.

The current examination system, however, is often fragmented, with overlapping and duplicative responsibilities. There is an opportunity for greater coordination and cooperation among the federal prudential banking agencies since they share a common safety-and-soundness goal and have limited resources. A structure where a single banking agency is responsible for prudential regulation will be more accountable to all stakeholders, including the public, regulators, and industry.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now