Why Are Natural Gas Prices So Low?

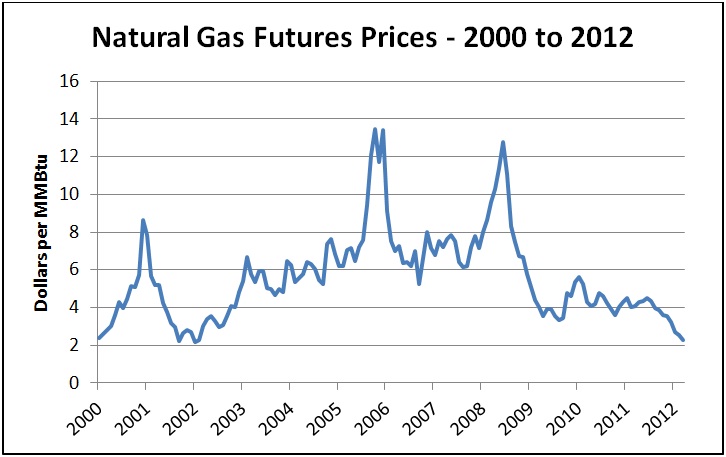

As American consumers worry about the rising price of gasoline, natural gas producers are worried about a different kind of pain at the pump. This month natural gas prices passed below the $2 mark for the first time in a decade. This post explores the drivers of current low natural gas prices and the effect low prices have had on natural gas producers and consumers.

Today’s low natural gas prices are caused by a number of discrete factors affecting both the supply and demand side of the natural gas market: Factors Contributing to High Supply

- New technologies have unlocked previously inaccessible resources in shale formations. The domestic natural gas supply picture has shifted dramatically in the last decade due to the widespread application of hydraulic fracturing in shale formations. This technological breakthrough has enabled economic production of natural gas from geologic formations that were previously inaccessible. Just a few short years ago it was widely forecasted that imports of natural gas would be needed in order to replace rapidly declining domestic production. Recent Energy Information Administration (EIA) estimates of recoverable domestic shale gas resources range from 482 to 827 trillion cubic feet compared to 38 trillion cubic feet in 2003. This year the EIA projects that production of natural gas from shale formations is expected to meet 32 percent of demand.

- Natural gas production is growing in association with drilling for crude oil and natural gas liquids. As oil prices rise and natural gas prices fall, producers are shifting focus to shale basins that contain crude oil and natural gas liquids (which are typically linked to crude oil prices and used to manufacture petrochemicals). Natural gas is produced along with crude oil and liquids and, where gathering and pipeline infrastructure exists, the co-produced natural gas is sold. Associated natural gas production has grown to roughly 10 percent of total natural gas production.

- Lease provisions and contracting terms are driving additional natural gas production. The prospect of a lucrative corporate buy out or contracting provisions such as “held-by-production” (HBP) leaseholds also support an oversupply in the market and has been driving down prices. Under HBP leaseholds, natural gas must be produced in order to maintain, or “hold,” a lease, so gas is produced uneconomically in order to retain control of the acreage. In addition, smaller, independent companies may be incentivized to increase their reserves and ensure production in order to attract bids from potential acquirers.

Factors Contributing to Low Demand

- The recession has decreased the demand for natural gas. Natural gas demand from all sectors (residential, commercial, industrial) has been suppressed in the last few years due to lower economic activity. This trend is reversing as low prices spur new demand, particularly from the industrial sector.

- Mild winter weather in 2011-2012. Winter weather is an important driver of residential and commercial demand, and thus natural gas prices. However, winter temperatures in January and February of 2012 were significantly above average which in turn reduced natural gas demand.

- Natural gas storage is at historically high levels. “Working gas” is natural gas that can be delivered to the market at a particular time. Higher working gas storage levels indicate increased available gas supply and suppress prices. According to EIA estimates, working gas in storage was 2,487 billion cubic feet (Bcf) as of Friday, April 6, 2012, 920 Bcf above the 5-year average of 1,567 Bcf.

Interested in learning more about price volatility in natural gas markets? Click here to read a report from the BPC Task Force on Ensuring Stable Natural Gas Markets.

Interested in learning more about shale gas production? Click here to read a report from the BPC Energy Board, Shale Gas: New Opportunities, New Challenges.

Related Posts

- EPA Finalizes New Standards for Oil and Gas Production, April 19, 2012

- The Strategic Petroleum Reserve: Political Oil and the Path Forward, April 19, 2012

- EPA’s New Regulation: Bold, Modest, or Both?, March 30, 2012

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now