What We're Reading: December 16

Throughout the week, the BPC Housing Commission will highlight news articles that address critical developments in housing policy. Any views expressed in the content posted on this forum do not necessarily represent the views of the Commission, its co-chairs or the Bipartisan Policy Center.

Residential Housing Ready to Awaken?

By Albert Bozzo CNBC “After half a decade of withering sales and slumping prices, there are strong and diverse signs that the single-family housing market is poised for a rebound. In some metropolitan areas, the market has bottomed, with both sales and prices on the rise and foreclosures on the decline. This contrarian ? and largely overlooked ? thesis flies in the face of the persistent gloom that has nagged the industry since 2007, when the subprime crisis flared.” Read more here.

Home values dip in October as market reaches for the bottom

By Kerry Curry

HousingWire

“Regionally, 95 of the 156 of the metropolitan statistical areas covered by Zillow experienced monthly home value depreciation and 39 metros showed monthly home value increases. Twenty-two metros remained flat. Some of the nation’s hardest hit areas showed some stabilization. In Miami, home values were flat on a monthly basis while Phoenix and Detroit saw monthly gains of 0.2% and 1%, respectively. But the housing market is far from healthy with only 10 metros seeing home value appreciation on a yearly basis with seven of those metros also having monthly appreciation, including Fort Collins, Colo., Madison, Wis., and Oklahoma City.” Read more here.

Federal agency sues Chicago over vacant-property rules

By Mary Ellen Podmolik

Chicago Tribune

“The agency’s lawsuit, filed in the U.S. District Court in Chicago, charges that the city’s ordinance encroaches on the FHFA’s role as the sole regulator and supervisor of Fannie Mae and Freddie Mac. It says Chicago cannot mandate how the agencies handle vacant buildings for which they are the designated mortgagee. The lawsuit’s filing follows failed discussions with Chicago officials to find an alternative means of dealing with vacant, abandoned properties within the city.” Read more here.

Surging student loan debt threatens homeownership

By Jacob Gaffney

HousingWire

“College graduates may not be able get onto the property ladder as soon as they’d like due to the costs associated with funding higher education. According to Rick Palacios, a senior research analyst at John Burns Real Estate Consulting, student loan debt now totals $865 billion, which is an average of $25,000 per student. ‘Student loans are going to be yet another hurdle for the housing market to overcome,’ Palacios said. ‘Faced with mounting student loan debt, poor job prospects and stagnant wages, an increasing number of people aged 25 to 34 have moved back in with their parents.’” Read more here.

Secondary market still favors large mortgage servicers

By Jon Prior

HousingWire

“The too-big-to-fail mortgage servicing model may be beset with difficulties, yet despite fewer mortgage modifications and slower foreclosure timelines, some securities analysts prefer the big guys because they can still move the cash. The reason for the preference is rooted in the structure of housing finance, where in the secondary markets, the buck stops at the mortgage servicer level. Literally.” Read more here.

Fed Takes No Action, Citing Signs of Moderate Growth

By Binyamin Appelbaum

The New York Times

“The Fed’s policy-making committee said its optimism about the economy was tempered by the persistence of unemployment, the blighted housing market, the deceleration of global growth and the risk of a European crash. ‘The committee continues to expect a moderate pace of economic growth over coming quarters and consequently anticipates that the unemployment rate will decline only gradually,’ it said in a statement. ‘Strains in global financial markets continue to pose significant downside risks to the economic outlook.’” Read more here.

Homeless Families in Illinois Walking a Hard Road

By Meribah Knight

The New York Times

“The number of homeless families is rising in Illinois, according to the National Alliance to End Homelessness. Between 2008 and 2010 their ranks swelled by more than 7 percent, to 6,827. ‘Anecdotally, we have seen a significant number of single mothers entering the Chicago system of care,’ said John Pfeiffer, the deputy commissioner of Chicago’s Department of Family and Support Services. A nearly three-year evaluation of Mr. Daley’s program by researchers at the University of Chicago and Loyola University tracked more than 500 homeless people for a year and found a fragmented system that inhibited progress.”

Read more here.

NAR Lowers Its Sales Estimates for Past Five Years

By John Caulfield

Builder

“On December 21, the National Association of Realtors (NAR) will release revisions that will lower its estimates for existing home sales dating back to 2007. For nearly a year, NAR has been in consultation with several government and housing-market entities?including the NAHB, HUD, Fannie Mae, Freddie Mac, the Mortgage Bankers Association, and American CoreLogic?to determine how best to collect and estimate home sales.” Read more here.

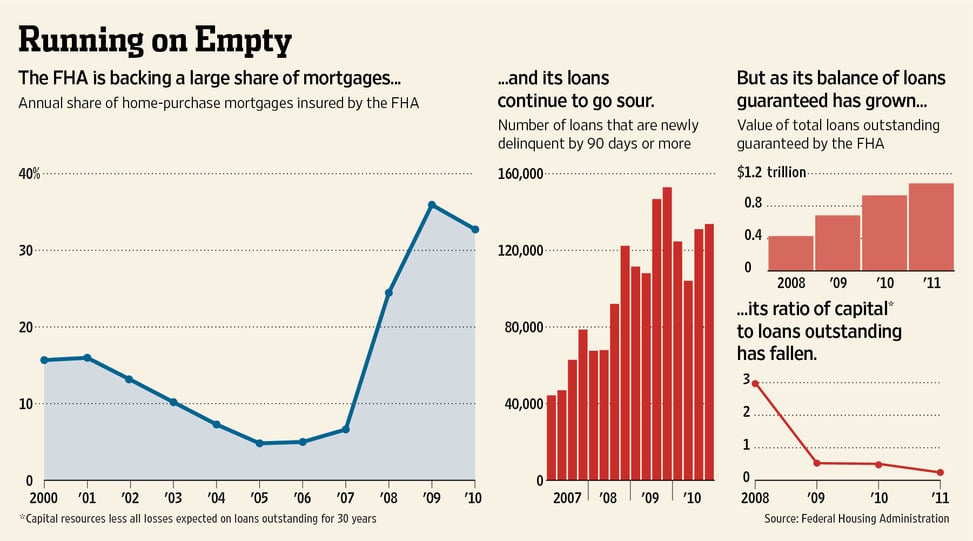

Does Congress Want to Supersize the FHA?

By Nick Timiraos

The Wall Street Journal

“Two recent obscure but important moves could end up sending more business to the Federal Housing Administration at a time when that agency is straining to avoid insolvency. The first was restoring higher mortgage caps last month. The other was the proposal last week by Democrats and Republicans to raise the fees that Fannie Mae and Freddie Mac charge lenders, which are passed on to borrowers in the form of higher rates, in order to pay for an extension of the payroll-tax cut. The provision would send those fees straight to the Treasury and explicitly forbids them being used to offset the cost of the firms’ $151 billion taxpayer tab.” Read more here.

Reverse mortgage bond investors feel sting of foreclosure delay

By Jon Prior

HousingWire

? “A nuance in Federal Housing Administration rules is costing investors in bonds backed by reverse mortgages. Home Equity Conversion Mortgages allow the borrower, who must be at least 62 years old, to convert a portion of the equity in the home for cash. Lenders do not require repayment until the borrower no longer uses the home as a principal residence, often in the event of death. If it cannot be repaid, even by the spouse if only one person is on the loan, then the lender will file a claim for the shortfall. The estate has six months to meet the payment requirement until a foreclosure proceeds, and often the estate sells the home. The lender can file a claim with the FHA on this shortfall as well.” Read more here.

Fed battling economic forces beyond its control

By John W. Schoen

MSNBC

“Fed policymakers have gotten a bit of breathing room lately from data showing a gradual pickup in the U.S. economy. But that growth remains threatened by the financial crisis in Europe, the ongoing budget gridlock in Washington and a housing market that shows no sign of emerging from a deep recession. After spending close to $2 trillion to put out the financial fires that swept through the U.S. banking system in 2008, Fed officials have watched their European counterparts fail to move decisively as fearful investors flee eurozone countries teetering on the brink of default. Despite calls to backstop Greece, Italy and Spain, the European Central Bank has responded tepidly to the crisis, arguing that those countries need to work harder to balance bloated budgets.” Read more here.

Living By Default

By James Surowiecki

The New Yorker

“When it comes to debt, then, the corporate attitude is do as I say, not as I do. And, while homeowners are cautioned to think of more than the bottom line, banks, naturally, have done business in coldly rational terms. They could have helped keep people in their homes by writing down mortgages (the equivalent of the restructuring that American Airlines’ debt holders will now be confronting). And there are plenty of useful ideas out there for how banks could do this without taxpayer subsidies and without rewarding the irresponsible. For instance, Eric Posner and Luigi Zingales, of the University of Chicago, suggest that, in exchange for writing down mortgages in hard-hit areas, lenders would take an ownership stake in a house, getting a percentage of the capital gain when it was eventually sold. Lenders, though, have avoided such schemes and haven’t done mortgage modifications on any meaningful scale. It’s their right to act in their own interest, but it makes it awfully hard to take seriously complaints about homeowners’ lack of social responsibility.” Read more here.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give NowRelated Articles

Join Our Mailing List

BPC drives principled and politically viable policy solutions through the power of rigorous analysis, painstaking negotiation, and aggressive advocacy.