Treasury Insurance Regulation Report Includes Positive Steps, More to Do

The U.S. Treasury Department made a series of recommendations in its recent report, A Financial System That Creates Economic Opportunities – Asset Management and Insurance, including highlighting opportunities for insurance regulatory reform. Several of Treasury’s recommendations match closely with those previously made by the Bipartisan Policy Center in its report Improving U.S. Insurance Regulation including a focus on activities-based regulation, better regulatory coordination, and other improvements to the insurance regulatory system.

Activities-Based Framework

Treasury has argued in both its asset management and insurance report, and in its November report on Financial Stability Oversight Council (FSOC) Designations, that shifting to an activities-based framework would focus attention on business activities that have higher systemic risk characteristics. We agree.

Currently, FSOC may designate a nonbank financial company as a systemically important financial institution (SIFI), subjecting it to regulation by the Federal Reserve Board if the Council determines that the company’s financial distress would threaten U.S. financial stability, or if the activities a company engages in make it particularly vulnerable to threatening that stability. Designation, however, is an either-or decision and creates a separate class of institutions that are subject to substantially more regulation and oversight. If a firm restructures itself to attempt to escape its SIFI designation, it is not clear that the overall market will become less risky.

To improve systemic risk oversight, FSOC should be required to assess a firm’s vulnerability to material financial distress before it designates, or de-designates, a nonbank SIFI. Further, Congress should require that FSOC seek a formal opinion from the Federal Insurance Office (FIO) in each case in which an insurer is considered for designation or de-designation as a SIFI.

Congress should also monitor the progress of state regulators in addressing systemic risk in the insurance sector. If states are not able to make needed improvements within a reasonable period, Congress and the administration should consider additional federal involvement. One way to do this would be to give FSOC the authority to set minimum federal standards on systemically risky activities and products. Under this approach, the federal government would design a mechanism to set minimum standards that each state would be required to meet. An approach that focuses on risky activities and products would be a better way to address systemic risk than designating large insurers as SIFIs. Although we do not advocate such an approach at this time, another option for Congress to consider if needed improvements are not made would be an optional federal insurance charter.

Increased Coordination

Treasury recommends increasing compliance program coordination among regulatory agencies, and BPC has long championed streamlining the U.S. financial regulatory structure across a number of dimensions. While insurance is primarily regulated at the state level, numerous federal agencies or authorities are involved in insurance and the role of federal agencies will only increase as financial sector products converge with insurance.

Treasury recommends asking FIO to establish a more structured and rationalized approach to its engagement with federal agencies and entities on insurance-related issues. BPC has recommended improving state-federal coordination and agrees that FIO and states should further improve their cooperation. Specifically, FIO should establish an advisory committee of state regulators chosen by the National Association of Insurance Commissioners (NAIC) who would then work with FIO to promote better coordination and address current conflicts in insurance regulation.

In addition, BPC recommends that FIO take an ongoing role in monitoring state insurance regulation, including an annual report on the activities and governance of NAIC and state insurance regulation. FIO still would not have regulatory authority, but would be able to keep federal policymakers well-informed about state insurance regulation and provide greater incentive for state regulators to continually improve their oversight to avoid future federal regulation.

International Insurance Regulation

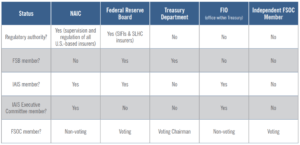

In a global setting, it has been even more challenging to represent a U.S. position on insurance regulatory matters because of lack of coordination. Congress attempted to address this issue in Dodd-Frank but the addition of several federal roles concerned with insurance oversight has not solved the difficulties the United States faces. Table A summarizes the key activities and limitations of each participant.

Table A

Treasury believes that the U.S. members of the International Association of Insurance Supervisors (IAIS) will be best-positioned to advance American interests if Team U.S.A. coordinates its interagency efforts and strengthens collaboration. BPC has recommended reforming the structure of Team U.S.A. as well, including making FSOC’s independent member with insurance expertise a member of the team.

Treasury should consider additional BPC recommendations that respond to international insurance issues, specifically:

- Continue to Prioritize Policyholder Protection: The United States should resist any effort to shift to an approach that could allow insurance subsidiaries to be used as a “source of strength.”

- Do Not Adopt Mark-to-Market Accounting Standards: U.S. policymakers should continue to avoid the adoption of mark-to-market accounting rules for insurance assets in any way that could reasonably be expected to trigger or fuel fire-sale dynamics among insurers.

- Study the Impact of G-SII Designations: The FSB and the IAIS should study the impact of global systemically important insurer (G-SII) designations on domestic insurance markets and policyholders

Cybersecurity

BPC has also recommended that policymakers should focus their resources and actions on how to overcome obstacles to a fully functional market for cyber insurance. Treasury is right to say that officials and regulators should work with insurers to improve cybersecurity and data security in the insurance industry and develop more uniform data security and data breach notification laws and regulations.

More to Do

Treasury’s report also mentions that it will take steps to expeditiously recommend National Association of Registered Agents and Brokers (NARAB) nominees to President Trump. In 2016, representatives for 10 of the 13 positions on the NARAB board were nominated but not confirmed by the Senate, so the Association is unable to establish a one-stop licensing compliance mechanism for insurance producers operating outside their home states. The Treasury’s direction on this issue is a positive step but BPC recommends going one step further, and allowing members of the NARAB board be appointed by the president without requiring Senate confirmation. The president would instead choose from a list provided by the NAIC and consult with the NAIC.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now