Road to the Grand Bargain

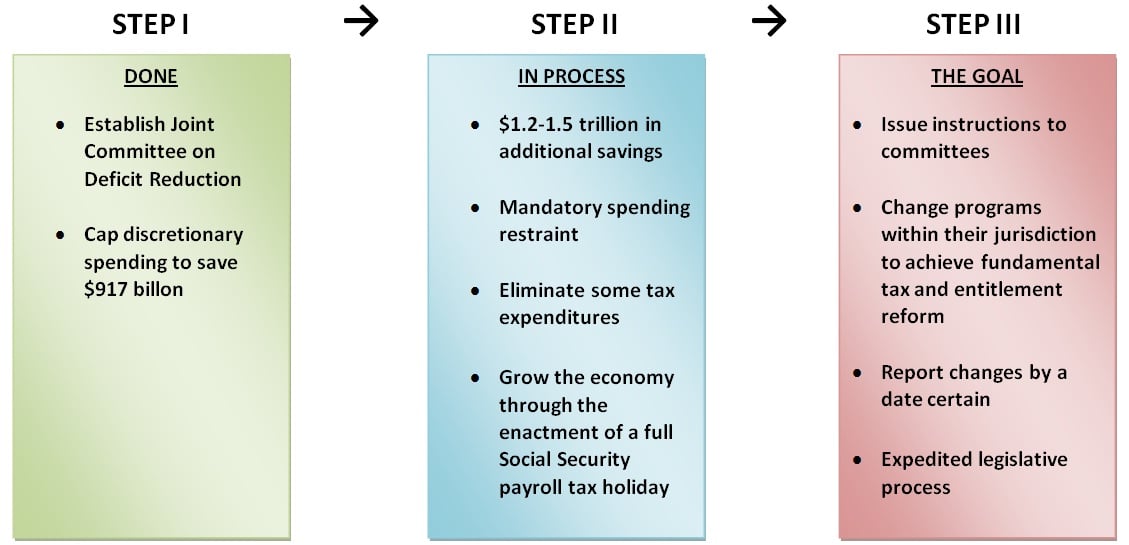

? Recent focus on the mandate of the Joint Select Committee (JSC) on Deficit Reduction to find $1.2 trillion to 1.5 trillion in additional deficit reduction over the next decade has not taken sufficient account of the JSC’s important powers under the Budget Control Act (BCA) that created it. Specifically, the BCA provides the JSC with extraordinarily broad power to develop legislation that would alter federal spending and tax policies.

If a majority of the members of the JSC agreed to change Medicare law not only to save money during the next ten years, but also to reform the underlying structure of the program, they could mandate such specific changes in policy. If, in the same package, the JSC wished to change tax policy through fundamental true tax reform, it could do that as well. But the BCA requires that all the JSC’s changes to law be reported in legislative language by November 23, 2011. Wholesale reform of tax and spending policy is virtually impossible to draft within that time frame ? a constraint on which the current public discussion has focused. Still, the JSC could achieve these objectives.

The JSC has the power under Section 404 of the BCA to draft legislation that must be voted on by the House and the Senate and, if approved, presented to the president for his signature. Significantly, such legislation could:

- Order the committees with jurisdiction over entitlements and revenues to report legislative language by a specific date next year (for example, April 15, 2012), after the expiration of the JSC itself, to change their programs to reduce projected federal deficits by an amount certain.

- In that order, the JSC could specify explicitly not only the deficit reduction targets to be met, but also the nature of the structural program changes to be made ? and by so doing, enforce what would be a true and binding agreement between the two political parties that had been negotiated within the JSC.

- The legislation developed by the instructed committees would be reported back to the House and Senate Rules Committees (or the Budget Committees) and combined into one bill, which would be scored by the Congressional Budget Office.

- The JSC could, further, order that the legislation reported back by the instructed committees receive “fast-track” treatment in the House and Senate, which could be similar to the fast-track treatment afforded to some other types of legislation, and would be determined by the recommendations of the JSC itself.

- Lastly, the JSC could draft the legislative language so that failure to produce the substantive legislation would trigger a sequestration, either conforming to the instructions given to the committees and in the amount of the deficit reduction targets required by the JSC, or in some new manner that could be specified by the JSC.

In sum, Section 404 of the BCA gives the JSC the power to do much more than just find savings of $1.2 trillion to 1.5 trillion; it also has the power to establish and enforce a process that uses existing congressional committees to change entitlement and tax policies.

Related Posts

- CBO Issues Analysis of the Joint Select Committee Sequester, September 13, 2011

- An Important Test for the Country, September 2, 2011

- The Super Committee’s Opportunity, September 2, 2011

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now