One Social Security Reform that Democrats and Republicans Agree On

Everyone knows that Democrats and Republicans don’t exactly see eye-to-eye on Social Security and how to address its unsustainable finances. But despite broader disagreements, members of both parties on the House Ways and Means Committee are working this week on a modest but important change to improve the program’s benefit structure.

The proposal affects individuals who work for state and local governments that do not participate in Social Security because they have another public pension plan.1 These government employers and their employees do not contribute to Social Security through payroll taxes on earnings, nor are the employees eligible for benefits based on this work. However, many of these same workers may have other jobs at some point during their careers that are covered by Social Security, making those individuals eligible for benefits.

Without any adjustment, the standard benefit formula would provide these workers with Social Security benefits that are disproportionately high relative to what they contributed to the program. The windfall elimination provision (WEP) was enacted in 1983 in an effort to address this potential inequity. Unfortunately, the current WEP calculation is overly complex and does not actually allocate benefits fairly.

The windfall elimination provision (WEP) was enacted in 1983 in an effort to address this potential inequity. Unfortunately, the current WEP calculation is overly complex and does not actually allocate benefits fairly.

The Equal Treatment of Public Servants Act (H.R. 711), introduced by House Ways and Means Committee Chairman Kevin Brady (R-TX) and Representative Richard Neal (D-MA), would replace the WEP with a simpler and more equitable system.2 The bill is scheduled for a mark-up this week. [Update: The Ways and Means Committee announced at the mark-up that they will postpone consideration of H.R. 711 until further notice.] The Bipartisan Policy Center’s Commission on Retirement Security and Personal Savings recently recommended replacing the WEP in a similar manner as part of a comprehensive package to improve both Social Security and retirement security in general.

How exactly does the WEP work?

Social Security has a progressive design, meaning it is intended to replace a greater share of pre-retirement income for beneficiaries with lower earnings histories (measured as their average indexed monthly earnings, or AIME). Under the standard benefit formula, however, a middle- or higher-earning individual who splits their career between covered and uncovered employment could have the same proportion of their covered earnings replaced by Social Security as a lower-earning beneficiary who should be entitled to a higher replacement rate. Because many of these uncovered public-sector workers receive generous pension benefits in place of Social Security, giving them a high replacement rate through Social Security undermines the program’s intended progressivity.

The current-law WEP reduces the 90-percent replacement rate, which is applied to the first $856 of a beneficiary’s AIME, in the primary insurance amount (PIA) formula (i.e., the formula that determines what an individual’s monthly Social Security benefit is if they claim at the full retirement age). The reduction varies based on how many years an individual worked in covered employment, with a maximum reduction of 50 percentage points (such that the replacement rate below the first bend point is 40 percent) for individuals who have spent 20 or fewer years in covered employment. The total amount of the WEP reduction cannot be more than half of the pension that a worker receives from their uncovered employer, ensuring that individuals with only a few years of uncovered employment (and thus little or no pension) do not receive a significant cut.

Social Security’s companion government pension offset (GPO) serves a similar purpose, addressing spousal benefits for individuals who worked in uncovered employment and are married to a beneficiary entitled to Social Security benefits. The monthly spousal benefit for a spouse who receives pension income from uncovered employment is reduced by two-thirds of his or her monthly pension income. Typically, this eliminates any spousal benefit for individuals who worked a full career in uncovered employment.

Reforming the WEP

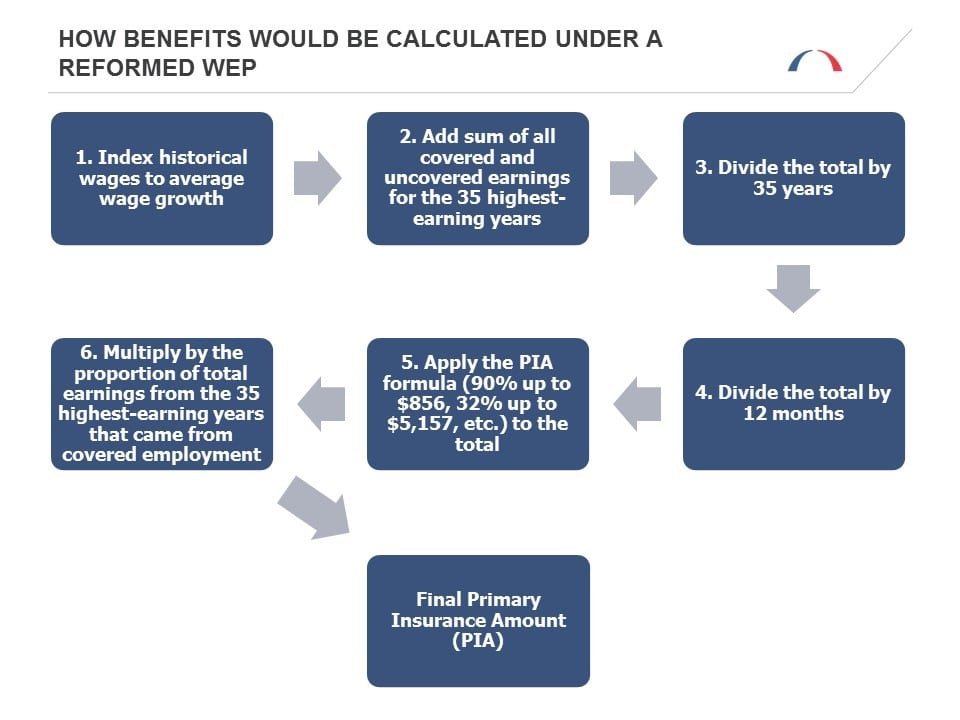

BPC’s commission recently recommended eliminating the current-law WEP (and GPO) and instead scaling Social Security benefits proportionally based on the ratio of an individual’s covered earnings to their total earnings. This proportional-adjustment method was not adopted when the WEP was enacted in 1983 because, at the time, the Social Security Administration (SSA) did not have complete data on uncovered earnings. With better SSA records on uncovered employment history, however, the proportional method is now possible. The graphic below depicts how benefits would be calculated:

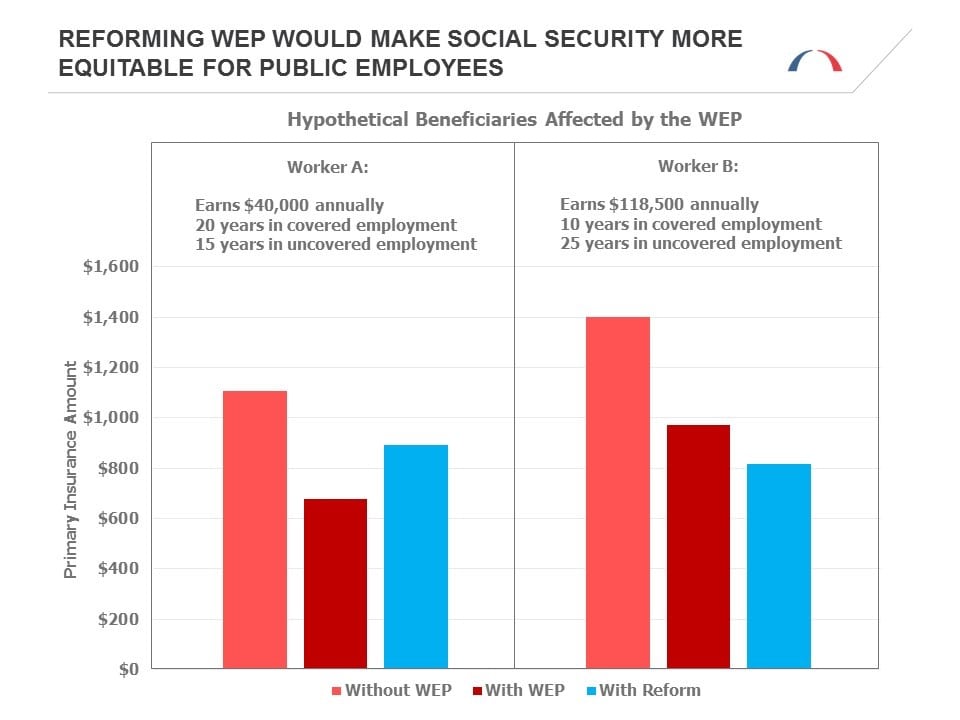

Consider how this reform would impact two hypothetical individuals who each spent a portion of their career in uncovered employment. Worker A earns a steady (wage-indexed) annual salary of $40,000 over 35 years, 15 of which are at an uncovered public-sector job and 20 of which are at a covered job in the private sector. Meanwhile, Worker B earns above Social Security’s taxable maximum (currently, $118,500) for 25 years at an uncovered public-sector job before moving to the private sector for 10 years. Under the current WEP, Worker A would have a benefit that is just 61 percent of what an individual with an identical AIME would receive without the WEP, while Worker B would get 69 percent of a non-WEP-adjusted benefit, despite Worker B having higher income.

Under the commission’s proposal, however, Worker A would receive 81 percent of a non-WEP-adjusted benefit while Worker B would receive 58 percent of a non-WEP-adjusted benefit, reflecting the fact that Worker A spent significantly longer in covered employment and was a lower earner. Most importantly, the replacement rate received by each of these workers is identical to what would be received by an individual with comparable earnings over a full career in covered employment. For this reason, the reformed WEP produces a more-equitable outcome.

Furthermore, this reform would increase transparency and be easier for affected workers to understand. Individuals impacted by the WEP are often unaware of the reduction until after they claim Social Security, which gives them no time to plan. Under the proposed reform, a more-accurate estimate of benefits would be available for workers on their Social Security statements when they are making important decisions about retirement and benefit claiming.

A Good Starting Point

Rectifying Social Security’s treatment of uncovered workers is far from the only improvement needed for the program, which faces significant financial challenges and demands other changes to modernize it for a 21st century workforce. That’s why BPC’s commission included WEP and GPO reform as part of a comprehensive plan to improve both Social Security and retirement security overall. Notably, the commission’s package of recommendations included additional safety net provisions to protect lower earners (including some vulnerable beneficiaries who might actually see small reductions under a reformed WEP). Nonetheless, change must start somewhere and leveraging this bipartisan momentum to enact legislation in a frequently contentious area would be a good first step towards addressing these broader issues.

1 Federal employees hired prior to the end of 1983 were also not covered under Social Security. All federal employees hired after 1983 are automatically covered by Social Security, and employees hired before that date were allowed to opt in starting that year as well.

2 The president’s latest budget included a similar WEP replacement proposal, though his (like BPC’s recommendation) would reform the GPO as well.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give NowRelated Articles

Join Our Mailing List

BPC drives principled and politically viable policy solutions through the power of rigorous analysis, painstaking negotiation, and aggressive advocacy.