Natural Gas Prices and Drilling Rig Counts

Colleen Kelly contributed to this post.

Last month in a post about why natural gas prices are so low, we discussed the factors that have contributed towards the historically-low natural gas prices that have been recorded in recent months. In May, natural gas prices began to move to higher levels, and in the long-term, most energy analysts believe that natural gas prices will rise. A key driver of future natural gas prices is production, and in this post, we will examine some of the notable recent developments in drilling rig deployments.

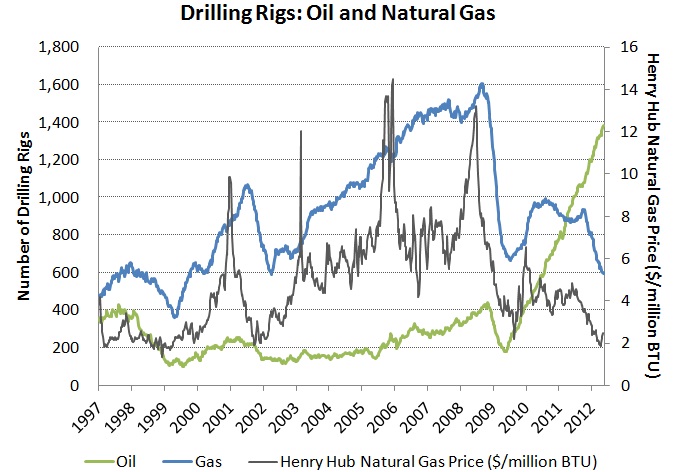

A look at the active rig count in the U.S. reveals the relationship between natural gas prices and drilling activity. The chart below shows the number of rigs actively drilling for oil and natural gas overlaid with Henry Hub natural gas prices. As natural gas prices began to rise in 2002, the number of rigs devoted to gas drilling followed suit while the growth in oil drilling remained low by comparison. Though oil prices were also increasing during this period, liquid hydrocarbon development was relatively slow compared to gas development. New domestic oil opportunities were not being discovered at the same rate that shale gas opportunities were, so producers focused heavily on gas drilling.

Sources: Rig count data from Baker Hughes, Natural Gas Price data from the Energy Information Administration

Natural gas inventories were built to higher levels as the oil industry devoted more resources to tapping into shale gas formations, motivated by the strong price signal from the mid-2000’s. However, with the onset of the recession in late 2008, the forecast for natural gas demand dropped precipitously. Natural gas prices plummeted and continued to remain stagnant during the ensuing period of slow economic growth. The large natural gas inventories built during the shale gas boom, along with the other factors detailed in this post, have kept natural gas prices at low levels. The importance of inventory levels in determining natural gas prices was demonstrated recently when prices briefly rebounded and then dropped again in response to EIA revisions of gas inventories.

Gas drilling activity has mirrored the natural gas price trend, as seen by the large drop in the gas rig count since 2008. The combination of low natural gas prices and high development costs have led to an ever decreasing number of rigs devoted to drilling for shale gas. Today, rigs devoted to natural gas drilling are at their lowest level in nearly 15 years. The slow rate of gas development will likely allow demand for natural gas to catch up with supply, which is why energy analysts predict the rise in future prices.

Interested in learning more about shale gas production? Click here to read a report from BPC’s Energy Board, Shale Gas: New Opportunities, New Challenges.

Interested in reading more about natural gas on the Bipartisan Beat Blog? Click here to read all of our natural gas-related posts.

Related Posts

- Department of Interior Releases Draft Rule for Hydraulic Fracturing on Public and Tribal Lands, May 17, 2012

- Why Are Natural Gas Prices So Low?, April 30, 2012

- EPA Finalizes New Standards for Oil and Gas Production, April 19, 2012

- The Strategic Petroleum Reserve: Political Oil and the Path Forward, April 19, 2012

- EPA’s New Regulation: Bold, Modest, or Both?, March 30, 2012

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now