Entitlement and Tax Reform: The Two Must-Haves

Apostolos Pittas contributed to this post.

The co-chairs of the Bipartisan Policy Center’s Debt Reduction Task Force ? Senator Pete Domenici and Dr. Alice Rivlin ? testified together last week before the Joint Select Committee on Deficit Reduction to warn about the perils of failure and advise on the path to success.

All four echoed a similar message: 1) don’t settle for $1.5 trillion and 2) any plan that actually stabilizes the debt must tackle health care costs and reform the tax code to raise new revenue. Senator Domenici, in his testimony, put it best:

“Let me be blunt here: Any plan that does not fundamentally restructure Medicare and the other health entitlements will fail to adequately address the debt crisis we face. Both sides ? those who are against any fundamental health entitlement reform and those who oppose any revenue increases ? will be equally complicit in bringing this nation closer to the fiscal brink.”

The best way to restructure Medicare is to adopt the Domenici-Rivlin Protect Medicare Act, which relies on competitive bidding to provide beneficiaries with the option of staying in traditional Medicare or enrolling in competing private health care plans on well-regulated exchanges. Such a system will provide major incentives to increase the efficiency and effectiveness of health care delivery to seniors ? without abolishing current Medicare, or forcing any beneficiary to move to a different system.

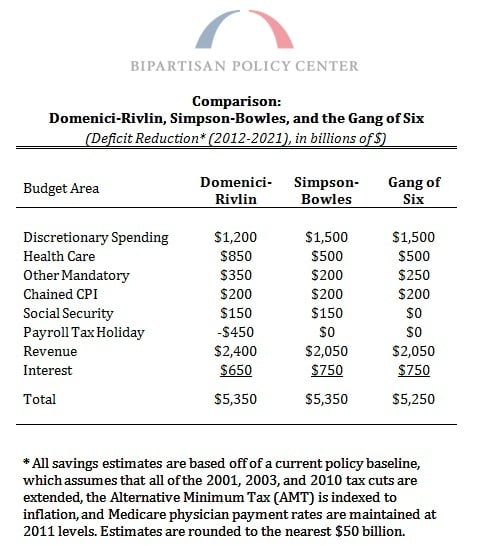

When combined with various short-term proposals to control Medicare costs, this framework will save $850 billion over the next decade for that program alone. Along with the discretionary caps established by the Budget Control Act, reforms to other entitlements, and savings on interest, deficit reduction on the spending side of the ledger can come close to $3 trillion.

In order to stabilize the fiscal outlook, however, the budget also will require new revenues. Our debt already is too high to address through spending cuts and entitlement reform alone, and the pending retirement of the baby boomers will make the fiscal challenge even tougher. But, a fundamental reform of our arcane tax code can create a simpler, more progressive, pro-growth system with only two brackets of 15 and 28 percent ? with the top individual rate being the same as that on corporations. This type of reform will increase work incentives by lowering marginal tax rates, make the U.S. more competitive, and raise the requisite revenue to help stabilize America’s debt ? the Bipartisan Policy Center’s Debt Reduction Task Force has shown how.

As can be seen in the table above, members of the Domenici-Rivlin Task Force, Simpson-Bowles Commission, and the Gang of Six all agreed to roughly $2 trillion of increased revenue as the amount that is needed to truly control the rising debt. All three major bipartisan plans curb spending significantly across the federal budget ? including entitlements ? and then raise the necessary revenue for the government to pay its bills.

We hope that the super committee will set a path for structural entitlement reform and sufficient revenues to stabilize our debt ? ultimately, in our view, those are the two metrics on which its success will be judged.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now