Debt Limit Update: X Date Most Likely in 4Q of 2015

The statutory debt limit is scheduled to be reinstated on March 16, 2015. On that date, the Treasury Department will begin use of extraordinary measures to ensure that the government is able to continue to meet its financial obligations in full and on time.

Today, the Congressional Budget Office (CBO) revised its projection, now estimating that, in the absence of another increase to or suspension of the debt limit, the government will probably run out of cash in October or November. CBO had previously written that the government could run out of cash as early as September.

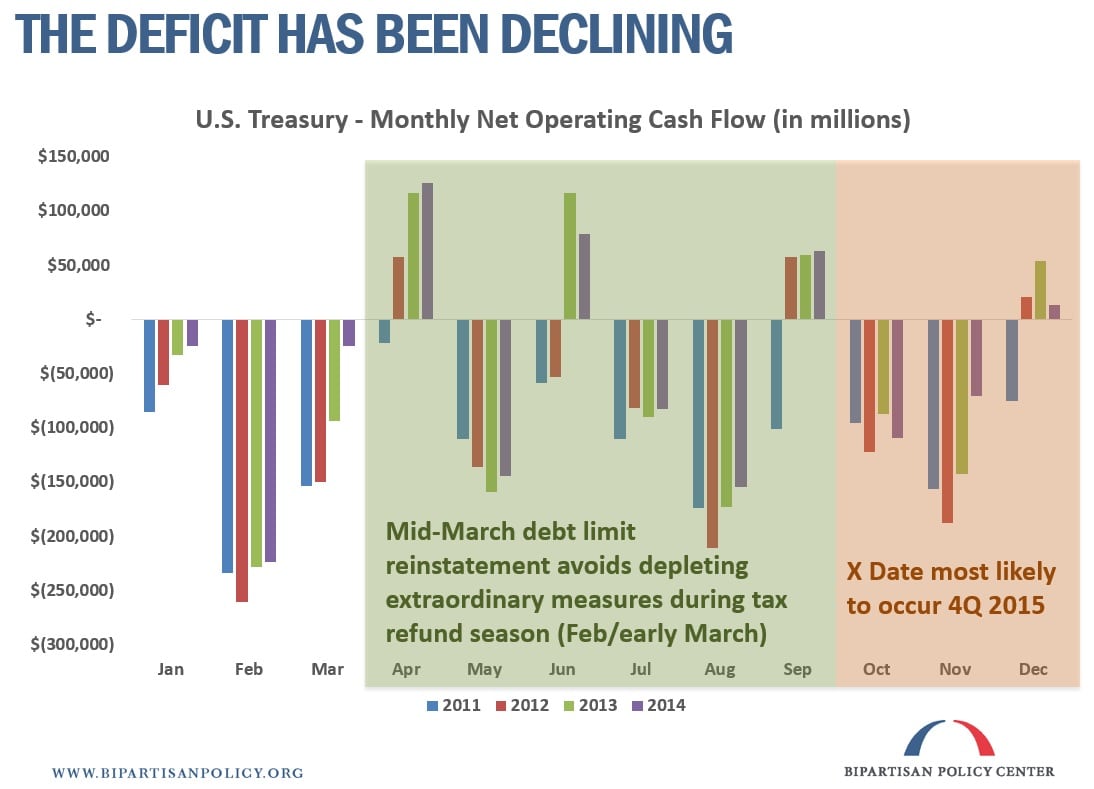

Over the past several years, the Bipartisan Policy Center (BPC) has developed its own debt limit projection model. BPC estimates that extraordinary measures and cash-on-hand will allow the U.S. government to continue meeting its financial obligations until sometime in the fourth quarter of 2015 (between October 1 and December 31). If policymakers do not act, the nation will reach the X Date, or the point at which Treasury lacks additional borrowing authority and does not have sufficient cash-on-hand to make all payments in full and on time. Extraordinary measures will likely last several months, much longer than the previous debt limit event in early 2014.

What is driving this change?

- More extraordinary measures are available this time (around $350 billion, compared to about $200 billion in 2014) ? the Federal Employee Retirement System’s G-Fund is larger and the Civil Service Retirement and Disability Fund has more principal and interest due to be rolled over and credited, respectively;

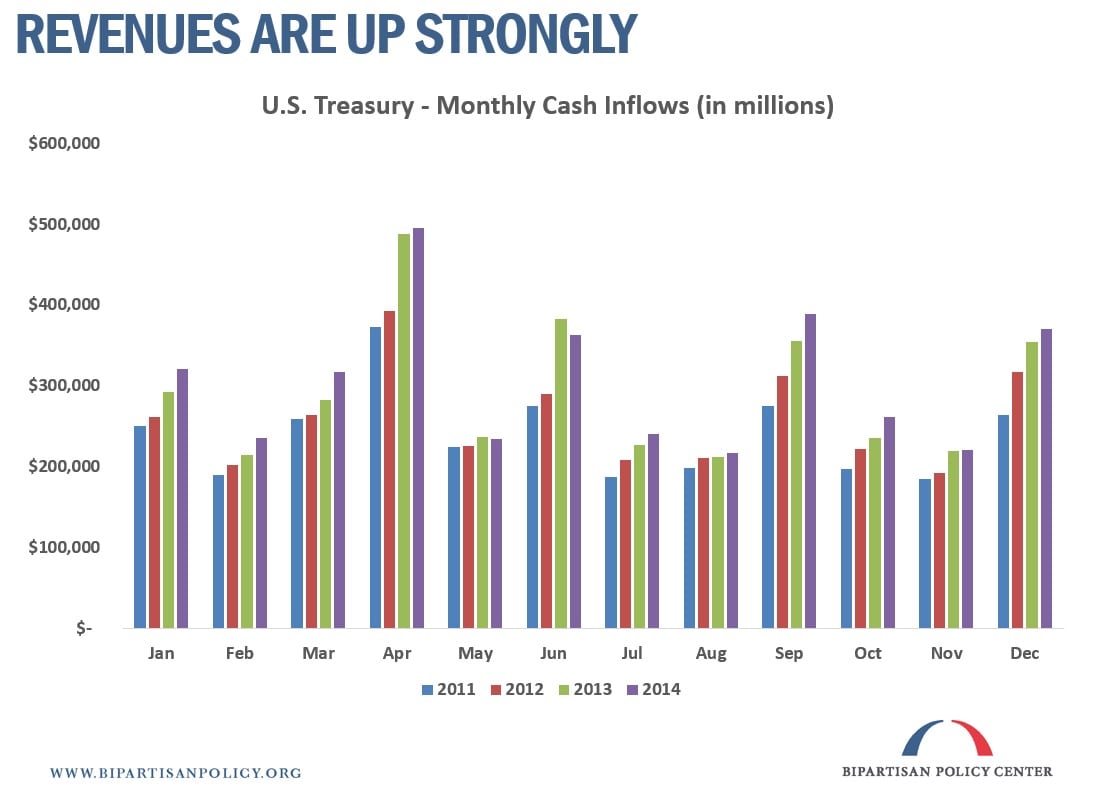

- In the past year, deficits have decreased by 16 percent. Revenues have increased by 4.5 percent while expenditures have remained roughly flat; and…

- Most tax refunds have already been paid. The debt limit is being reinstated after the main tax refund season (February and early March), and some upcoming months are projected to have surpluses.

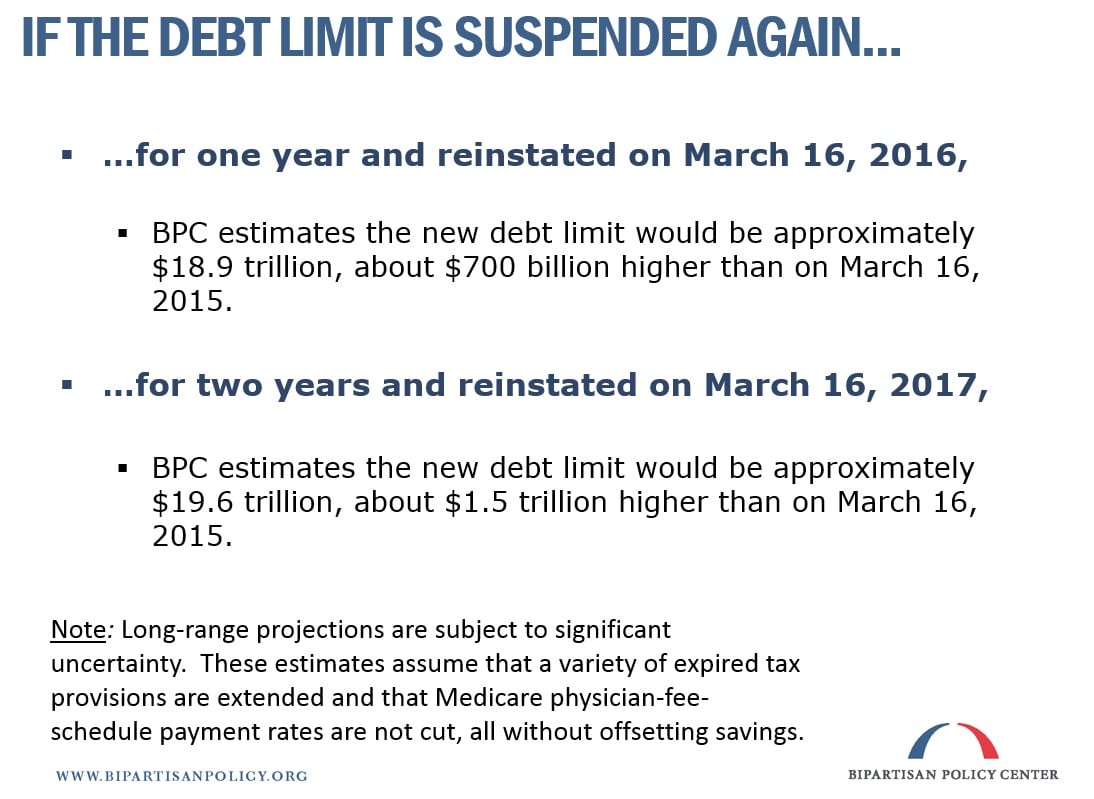

BPC estimates that another one-year debt-limit suspension would result in an effective debt-limit increase of roughly $700 billion; a two-year suspension would effectively be a roughly $1.5 trillion increase.

Government cash flows are volatile and projections are not certain, especially when there are many months of potential economic or policy deviations. BPC will continue to update its analysis periodically to incorporate the latest financial information and policy developments.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give NowRelated Articles

Join Our Mailing List

BPC drives principled and politically viable policy solutions through the power of rigorous analysis, painstaking negotiation, and aggressive advocacy.