The Case for Eliminating the Preferential Treatment of Capital Gains

The following is a letter to Senator Patty Murray and Representative Jeb Hensarling, co-chairs of the Joint Select Committee on Deficit Reduction, from Debt Reduction Task Force Co-Chairs Sen. Pete Domenici and Dr. Alice Rivlin.

Thank you for affording us the opportunity to testify before the Joint Select Committee on Deficit Reduction on Tuesday, November 1, regarding the report and recommendations of the Bipartisan Policy Center’s Debt Reduction Task Force. We hope that our testimony will be helpful in your difficult but crucial work.

Due to the time restrictions at the hearing we would like to submit a complete response to the questions regarding our tax reform plan and the capital gains exclusion. We hope that this information provides helpful background for the Joint Select Committee as you continue your deliberations and would be grateful if this answer could be included as part of the official record.

[BPC’s Recommendations to the Super Committee]

As was stated in the hearing, all of the witnesses, and indeed all of the members of BPC’s Debt Reduction Task Force, concluded that both increased revenues and outlay cuts will be necessary to contain the nation’s rising public debt. Because the Task Force recognized that fact, we spent considerable time developing a fundamental tax reform package, which we believe would meet three essential criteria: increase revenue, stimulate economic growth, and distribute the additional burden according to the ability to pay. To achieve all three goals, we determined that it would be essential to eliminate the current preferential tax treatment of capital gains.

Fortunately, we have a precedent for our recommendation. The Tax Reform Act of 1986, passed by a Republican Senate and a Democratic House and signed by President Ronald Reagan, eliminated the tax preference for capital gains and reduced the top-bracket individual income tax rate to 28 percent. The Task Force proposal is quite similar.

Please allow us to discuss our proposal with respect to capital gains in the context of all three criteria.

Revenue

The evidence shows that the elimination of the capital gains exclusion in the 1986 Act did not significantly reduce sales of assets. In fact, tax revenues on capital gains increased immediately after the effective date of the 1986 Act.

The effect of the 1986 Act on the amount of capital gains realizations involves some nuance.

From the very beginning of the 1986 legislative process, it was clear that the preferential treatment of capital gains would be at least reduced. The prior law provided a 60 percent exclusion for long-term capital gains. The so-called “Treasury I” proposal from the Department to President Reagan eliminated the exclusion in exchange for inflation indexation of the cost basis of assets, which would have increased taxes significantly for comparatively large gains accrued over comparatively short times. The “Treasury II” proposal by President Reagan cut the exclusion to 50 percent. The 1985 House bill cut the exclusion to 42 percent. And then the 1986 Senate bill (which passed the Finance Committee unanimously on May 6), and the conference agreement, eliminated the exclusion entirely.

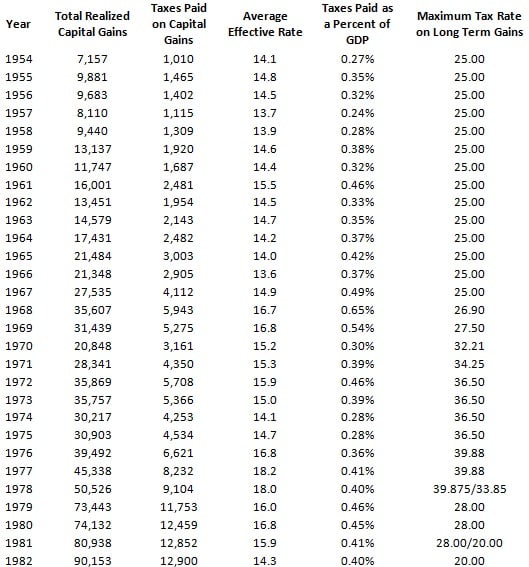

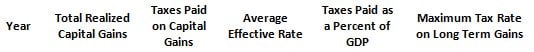

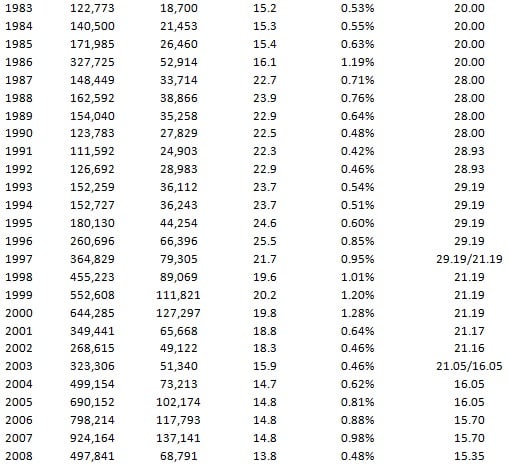

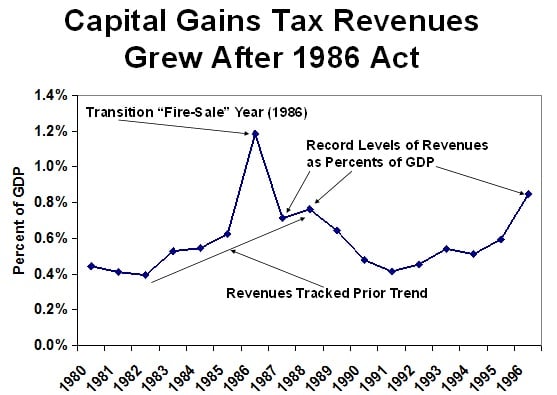

Throughout this process, the designers of the 1986 Act, including Senate Finance Committee Chairman Bob Packwood and House Ways & Means Committee Chairman Dan Rostenkowski, recognized that the significant reduction in the capital gains preference could raise questions of fair transition. Accordingly, they wrote the law with a prospective effective date (January 1, 1987), so that taxpayers who had contemplated selling an asset using the prior law preference could do so. This created a “fire sale” opportunity for realization of gains at what was in effect a temporarily low rate. Realizations in 1986 were expected to increase substantially, and they did. Revenues from capital gains realized in 1986 were fully double the level of 1985 ? the largest increase on record by a factor of two. But that was fully expected and intended to be a one-time phenomenon, as should be obvious from the attached chart.

The open question was what would happen to capital gains tax revenues in 1987, given that many of the gains that were realized in 1986 likely were accelerated from 1987 (and later years) to take advantage of the “fire sale” on the expiring exclusion. Surprising to some, tax receipts on capital gains were higher in 1987 than they were in 1985, the last “normal” year ? i.e., without the influence of the transition to taxation of gains as ordinary income ? under the prior law. This was true both in dollars and ? even more significantly ? as a percentage of GDP. In fact, in 1987, tax revenues from capital gains hit the largest percentage in recorded history, discounting the “fire sale” year of 1986 ? and then were superseded immediately by a new record tax revenue year in 1988. This result was remarkable, especially in light of the likely acceleration of the realization of significant amounts of gains from 1987 and 1988 forward to 1986 because of the temporary tax advantage to do so.

Subsequent years confirmed that the 1986 Act was conducive to revenue growth from realizations of capital gains. The treatment of capital gains remained essentially unchanged through 1996. Between 1987 and 1996, after a decline because of the 1990-1991 recession, tax revenues from capital gains increased as a share of the GDP, and doubled in dollar terms. The 1996 ratio displaced that of 1988 as the highest “normal” year on record, not that far below the 1986 “fire sale” year. And overall tax revenue was growing with the economy, combining with spending restraint to narrow the previously troublesome budget deficit from the then-record level of $290 billion (4.7 percent of GDP) in 1992 to only $107 billion (1.4 percent of GDP) in 1996. In that period, federal revenues had increased from 17.5 percent to 18.8 percent of GDP, while outlays had declined from 22.1 to 20.2 percent of GDP, contributing to the reduction in the deficit.

We believe that the simple amount of tax revenue on capital gains realizations actually understates the federal government’s revenue gain from 1986-style tax reform. Under BPC’s proposal, the top-bracket tax rates for ordinary income, capital gains, and corporate income all will be equal. There will no longer be a reward for legal manipulation to re-characterize ordinary income as capital gain, capital loss as ordinary loss, or an individual business as a corporate business (or vice versa). The manipulation between capital and ordinary gain or loss has been widely cited as by far the greatest source of actual day-to-day tax complexity. Such manipulation also, obviously, reduces tax revenue. Even economic growth can suffer, as labor and investment capital are moved from their best uses in the free marketplace to their best uses on the tax form. True tax reform, such as the Task Force proposal, would increase revenues in part merely by ending such manipulation. The portion of the 1986 Act that ended such manipulation increased total revenues, but decreased measured revenue from the taxation of capital gains. This fact makes the rise in capital gains revenues from the 1986 experience even more striking: the revenues rose more than enough to fully offset the measured negative effect of cracking down on manipulation.

Economic Growth

Experience has demonstrated that the 1986 Act was conducive not only to revenue growth, but also to economic growth. By 1996, under essentially the same capital gains tax treatment as in the 1986 Act, the economy had recovered from the 1990-1991 recession, economic growth was robust, and a full-fledged investment boom was underway. Business investment in equipment, which had fallen to 6.9 percent of the GDP in the 1990-1991 recession, was up to 8.3 percent in 1996. Real GDP grew by an average of 3.3 percent over 1992-1996, and 3.7 percent in 1996.

This result follows from basic economics. Economists know that the income tax on capital gains is a very small part of the cost of capital. Far greater is the cost of funds ? the interest rate itself. The main mission of the Joint Select Committee ? deficit reduction ? is far more important for capital investment than anything that might be done to protect the tax preference for capital gains.

Capital gains tax preferences are also much more a bonus for the already-wealthy portfolio investor than an incentive for the budding entrepreneur. The capital gains tax preference is irrelevant for the many entrepreneurs who hope to build and run successful businesses and earn salaries from them. Even for such entrepreneurs who look forward eventually to selling their businesses upon retirement, the capital gains tax is years away, and its impact on their ultimate outcomes will be overwhelmed by the degree of their success in running their businesses.

The much greater part of capital gains realized by individuals is on sales of corporate stock by portfolio investors, rather than sales of businesses owned by entrepreneurs. In the latest (2007) data released by the Internal Revenue Service, tax-favored long-term capital gain or loss transactions on corporate stock accounted for 53 percent of all transactions, and 26 percent of all net capital gain. In stark contrast, capital gain or loss transactions on partnership, S corporation and estate or trust interests accounted for only 2 percent of all transactions, and less than 6 percent of all net capital gain ? only about one-fifth the amount of sales of shares of established corporations. Net ordinary income from businesses and professions was nearly seven times the amount of capital gains from sales of businesses ? and that does not include any of the entrepreneurial income that is reported as simple salary income. And of course, a tax preference afforded to all capital gains steers scarce resources also to all other kinds of investments ? including precious metals, collectibles, U.S. government bonds, and so on ? instead of to the rewards to true entrepreneurs, much of which flow in the form of ordinary income.

As noted earlier, a lower tax rate for capital gains directs more capital into investments that are more likely to throw off income as capital gains, at the expense of some other uses that might actually have higher rates of return. Capital gains treatment historically has been one of the key ingredients in the classic tax shelter, which wastes society’s scarce resources on investments that generate tax losses to offset other income, rather than profits earned in the free marketplace. And misleadingly, because the eventual cash receipts from liquidating tax shelters are reported as realized capital gains, this sheer economic waste makes the tax receipts from capital gains look larger.

The Task Force proposal includes a substantial reduction in the corporate income tax rate, to 28 percent. That makes the corporate rate approximately equal to the average across all developed nations. Because firms usually want to locate in the markets in which they sell, and because the United States is the largest market in the world, this competitive corporate tax rate should encourage the location of more production activity in the United States, with resulting benefits for employment. And the reduction of the tax rate for corporate-source income will provide a benefit to owners of corporate stock who would lose the capital gains preference.

In sum, we believe that the Task Force tax proposal would on net be more conducive to economic growth than the current system, while also reducing the deficit directly.

Fairness

The capital gains preference is a key reason why many people of extraordinary wealth can pay lower tax rates on their income, at the margin, than people of far more modest means who simply work for a living.

Because capital gains are such an important source of income for those at the top of the income scale, this tax preference has great leverage over the distributional results that are used to judge the progressivity and fairness of the tax system. More than three quarters (78.5 percent) of all tax returns with adjusted gross income (AGI) of over $1 million report tax-preferred long-term capital gains income, and on average those capital gains equal almost two fifths (39.0 percent) of the amount of their AGI. (Of returns with over $10 million of income, 92.8 percent have tax-preferred gains, equal to 52.1 percent of their AGI.) In stark contrast, of the income group ($30,000 to $40,000) of the median taxpayer, only 5.2 percent have any tax-preferred capital gains, constituting only 0.9 percent of their total income. Accordingly, if there is a capital gains preference in an alternative tax system as part of budget deficit reduction, the larger that preference, the higher must be the tax rate on ordinary income. In other words, we cannot have lower capital gains tax rates for free; they must be offset by higher tax rates on ordinary income. But increasing the capital gains preference and increasing the tax rate on ordinary income explicitly transfers income from people who work ? including many job-creating entrepreneurs ? to people who already have accumulated wealth. That such an outcome should be perceived as fair is far from clear, not to mention the economically distorting effects of the higher ordinary-income tax rate.

Conclusion

?In an uncertain world with complex issues at play, the tax reform proposal of BPC’s Debt Reduction Task Force provides the best balance that we have found among the nation’s revenue needs, the imperative of economic growth, and society’s need for a foundation of fairness of contribution according to ability to pay.

The objection that we hear most often to the elimination of any tax preference, with the capital gains preference perhaps the most prominently cited, is that it will inhibit economic growth. We refer those who bear that concern to a column by Martin S. Feldstein in The Wall Street Journal of October 24, 2011, in which he estimates significant increases in taxable income as the result of the enactment of the Tax Reform Act of 1986. The Tax Reform Act of 1986, as you know, eliminated the tax preference for capital gains. We can only conclude that there is perhaps a broader than realized consensus among economists ? not to mention the endorsement of President Ronald Reagan ? that the capital gains preference is not essential for economic growth, and does not increase tax revenues.

Again, thank you for the opportunity to testify. We hope that you find this expanded response helpful to you.

Related Posts

- Putting America Back to Work, November 15, 2011

- Mayor Bloomberg’s Address on Deficit Reduction, November 10, 2011

- Entitlement and Tax Reform: The Two Must-Haves, November 7, 2011

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now