Patty Murray’s Fiscal Year 2014 Budget: The Details

Earlier this week, House Budget Committee Chairman Paul Ryan kicked off the Fiscal Year (FY) 2014 budget season in Congress by releasing The Path to Prosperity: A Responsible, Balanced Budget. This budget passed the House Budget Committee and awaits action on the House floor next week. The Bipartisan Policy Center (BPC) summarized that plan and compared it to that of BPC’s Domenici Rivlin Task Force and the Simpson-Bowles Fiscal Commission.

More from BPC’s FY 2014 Budget Analysis Series

The big news of the past couple days, however, is the release and passage through committee of a Senate budget resolution, Foundation for Growth: Restoring the Promise of American Opportunity, under the leadership of Budget Committee Chairman Patty Murray (D-WA). If brought to the floor and passed, this would be the first time since 2009 that the Senate has taken such action on a budget. Chairman Murray’s submission could then, in tandem with the House-passed GOP budget, provide the impetus for regular order, wherein a conference committee would negotiate differences between the two documents and allow for expedited consideration of tax and entitlement reform through the budget reconciliation process.

Chairman Murray’s budget plan would eliminate the across-the-board sequester cuts and add additional deficit spending up front with a goal of boosting economic growth. The proposal would then roughly stabilize the ratio of debt to gross domestic product (GDP) for the duration of the ten-year window with a combination of spending reforms and revenue increases. If additional policies beyond those in this budget were not enacted, however, the debt/GDP ratio would begin to rise again in the following decade. This outcome would fall somewhat short of the goal set out by BPC and Simpson-Bowles, both of which recommended stabilizing debt as a share of the economy and then setting it on a downward path.

What follows is an objective summary and analysis of the Senate Democratic budget. As in BPC’s analysis of Chairman Ryan’s budget, we focus heavily on the ten-year budget window. Although it is critical to understand the long-term effects of major policies included in any budget, significant uncertainty in projections and lack of specificity in policies make concrete scoring beyond the first decade impossible for many of these packages.

Debt, Spending, and Revenues

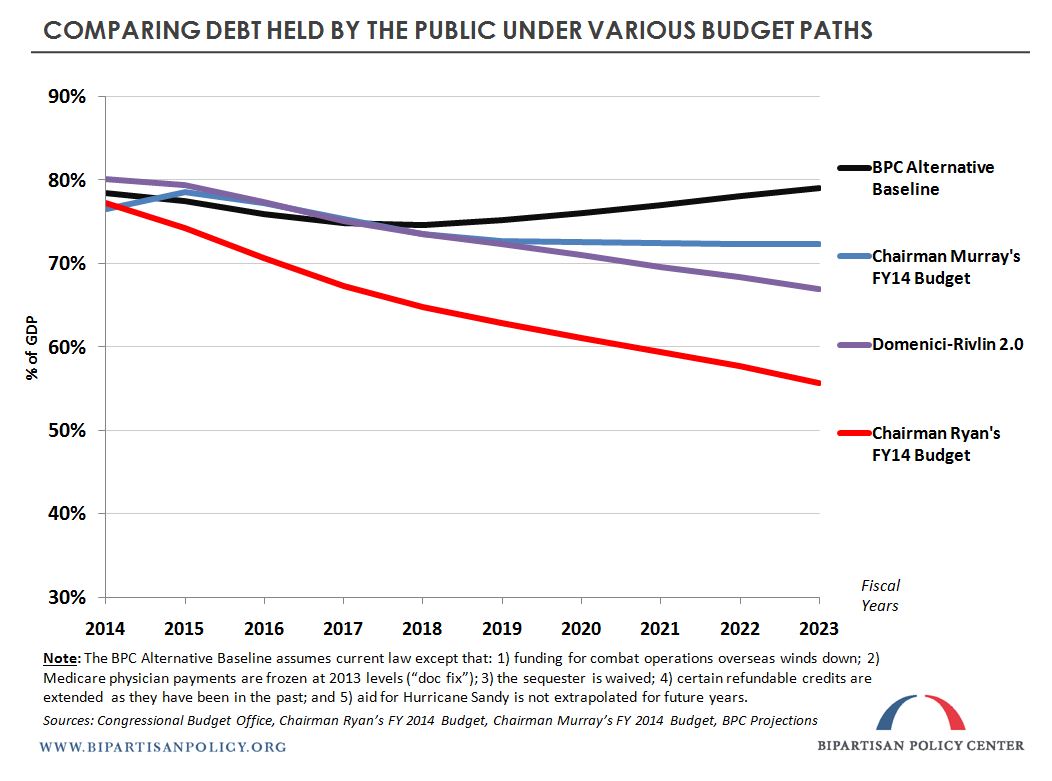

Under Chairman Murray’s budget, the debt/GDP ratio would decline to 72 percent by 2023. This is slightly above the debt levels achieved by BPC’s Domenici-Rivlin 2.0 plan and the Simpson-Bowles Commission (both of which reduce the debt to roughly 65-70 percent of GDP by 2023), and it is somewhat lower than that under the BPC Alternative Baseline* (79 percent), but significantly higher than the House GOP budget achieves (56 percent).

View larger versions of the charts below

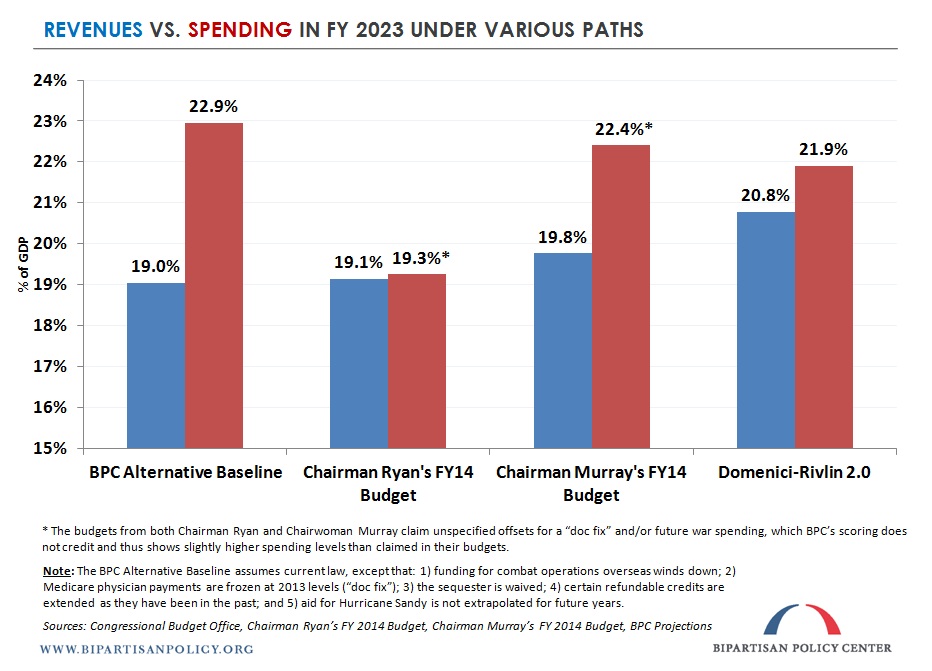

The chart below illustrates the spending and revenue levels achieved in 2023 by various budget paths, including Chairman Murray’s.

Debt Ceiling

The Senate Democratic budget would necessitate an increase of the debt ceiling by roughly $7.9 trillion through 2023. Due to the debt reduction contained in that plan, the increase would be approximately $1.9 trillion less than that required by the BPC Alternative Baseline over the same period, but greater than that of the House GOP budget, which would only require an $3.6 trillion increase.

Regardless of what budget is implemented for FY 2014, BPC has projected that the debt limit will next need to be increased as soon as August of this year.

Growth Initiatives through Deficit Spending

Prior to the implementation of policy changes enumerated below, almost all of which would have the effect of reducing future deficits from the BPC Alternative Baseline, Chairman Murray’s plan would enact approximately $100 billion of up front deficit spending. Other proposals have called for assisting the economic recovery with some immediate additional deficit spending that would be more than offset by the simultaneous enactment of deficit reduction policies phased in over time; BPC’s Domenici-Rivlin 2.0 plan is one such example, and its deficit spending is in the form of an income tax rebate.

The Senate Democratic budget would allocate this $100 billion of short-term economic growth initiatives as follows:

- $50 billion for transportation infrastructure investment;

- $20 billion for repairs and technology infrastructure investment in schools;

- $10 billion for fixing and maintaining dams and ports;

- $10 billion for a public-private infrastructure bank to leverage private investment in loans and loan guarantees; and

- $10 billion for job training programs.

Medicare

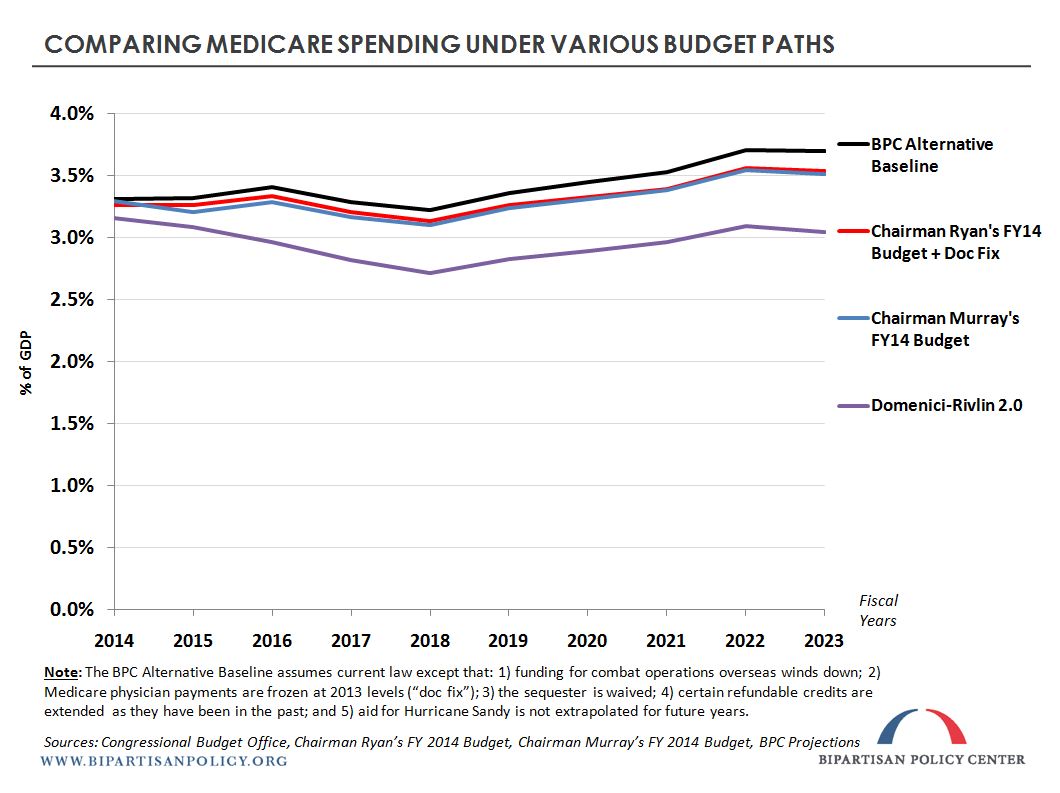

Chairman Murray proposes approximately $265 billion in spending cuts to Medicare, but offers very few details about how those reductions would be made. The budget does indicate, however, that they would not be focused on beneficiaries and offers suggestions of policy approaches that could reduce the cost of delivering care. Policies that are mentioned as possibilities include a broader expansion of bundled payments (consolidating many smaller payments into one shared payment to a group of providers for each episode of care, which could result in greater coordination and efficiency), value-based purchasing (in which reimbursement to hospitals is modified based on quality measures), and readmissions adjustments (the reduction of provider payments when patients they served are admitted to a hospital shortly after being discharged). The plan also suggests that efforts to reduce waste and fraud could contribute to these savings, but does not offer a specific approach.

The Senate Democratic budget proposes to spend roughly the same amount on Medicare as the House GOP budget within the ten-year window, but lacks a major reform in the long run that could bend the cost curve in the following decades. Chairman Ryan’s budget would transition the program to a premium support system beginning in 2023, which is projected to substantially reduce the growth in Medicare costs to the federal government in later years.

Like Chairman Ryan, Chairman Murray includes in her budget a permanent fix to the formula that governs Medicare payments to physicians (the “Doc Fix”), avoiding a 25-percent cut in payment rates scheduled for 2014. This plan would also reverse the scheduled Medicare sequestration cuts, which are set to reduce all payments to providers and plans (including Medicare Advantage and Part D prescription drug plans) by 2 percent for each of the next nine years (beginning in the current fiscal year). Both of these policies are included in the BPC Alternative Baseline, meaning that they do not have any impact on spending, deficit, or debt projections from that benchmark.

The Affordable Care Act and Other Health Spending

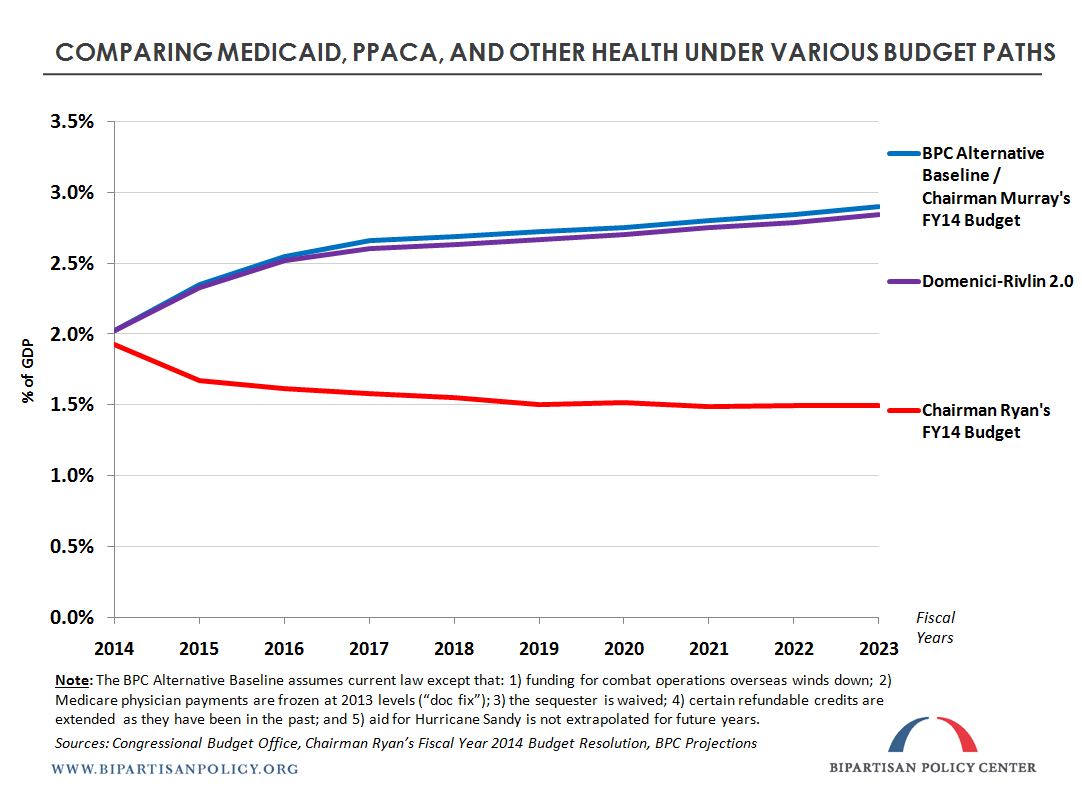

There is a stark difference between the proposed spending levels for non-Medicare health programs in the House GOP and Senate Democratic budgets. Chairman Murray’s budget retains all elements of the Patient Protection and Affordable Care Act (PPACA) that are scheduled to take effect. In contrast, Chairman Ryan’s budget repeals all of the coverage expansions, other spending increases and tax provisions affiliated with that legislation, while only retaining the reductions to Medicare spending contained in the law.

Additionally, the House GOP budget includes block grants for both Medicaid and the Children’s Health Insurance Program that would give the states more flexibility to administer the programs, but significantly reduce federal funding for them. The Senate Democratic budget, by comparison, makes only very modest (and unspecified) reductions ? in the range of $10 billion over the decade ? to non-Medicare health programs.

For this category, which includes Medicaid, the Children’s Health Insurance Program, exchange subsidies, as well as annually appropriated discretionary spending for agencies such as the National Institutes of Health and the Food and Drug Administration, Chairman Murray proposes to spend roughly $2.5 trillion more than Chairman Ryan over the ten years.

Social Security

The Senate Democratic budget does not make specific proposals to improve the solvency of Social Security. Chairman Ryan’s budget does not either, but calls for a bipartisan process, whereby both the president and congressional leaders would be required to propose plans to restore 75-year sustainable solvency to the program. Both Domenici-Rivlin 2.0 and Simpson-Bowles recommended packages with benefit reforms and revenue increases that achieved this goal.

Taxes

Like the House GOP budget, Chairman Murray outlines tax reform parameters that could be used by the tax-writing committee through the reconciliation process later this year, thus avoiding a filibuster on the Senate floor. Chairman Murray’s budget requires that such reconciliation legislation be reported no later than October 1, 2013.

Both the House GOP and Senate proposals call for eliminating or curtailing tax expenditures ? a concept referred to as “broadening the base” ? but neither specifies the precise credits, deductions, or exemptions that would be eliminated or curtailed. Also, both support a reform of the corporate income tax.

The similarities between the two frameworks, however, part ways beyond that point. Chairman Murray proposes to raise $975 billion over the coming decade off of the BPC Alternative Baseline, whereas Chairman Ryan would only raise $52 billion.** The Senate Democratic budget emphasizes that none of these revenues would be raised by increasing the tax burden on the “middle class” or low-income Americans ? all new revenues would have to come from the “wealthiest Americans and big corporations.” BPC’s Domenici-Rivlin 2.0 and the Simpson-Bowles Commission proposed raising approximately $1-1.5 trillion of additional revenues from the current BPC Alternative Baseline through tax reform, but both plans emphasized that all but the most-vulnerable taxpayers must contribute in a progressive manner to this effort to reduce the debt.

Both of these plans also stressed that as revenues are increased, marginal tax rates should be reduced in order to enhance long-term economic growth. The Senate Democratic budget allows for the possibility of lowering marginal individual income tax rates, but does not set any specific targets.

Finally, Chairman Murray’s outline for tax reform would include a permanent extension of low-income tax credits that were legislated in 2009, extended in ATRA, and are now scheduled to expire after 2017, such as the American Opportunity Tax Credit (for higher education), and the enhancements to the Earned Income Tax Credit and Child Tax Credit.

Discretionary Spending

The Senate Democratic budget proposes to entirely overturn the nine years of sequestration that began to go into effect on March 1, 2013, stemming from the Budget Control Act of 2011 (BCA). This policy would lift the across-the-board reductions that are currently being implemented for FY 2013 as a result of that law and would also restore the limits on discretionary spending to their levels under the latest BCA caps (pre-sequester), as slightly amended by the American Taxpayer Relief Act of 2012 (the “fiscal cliff” deal).

After rescinding sequestration, Chairman Murray’s budget would make modest reductions to both defense and non-defense discretionary spending ? these changes are detailed below.

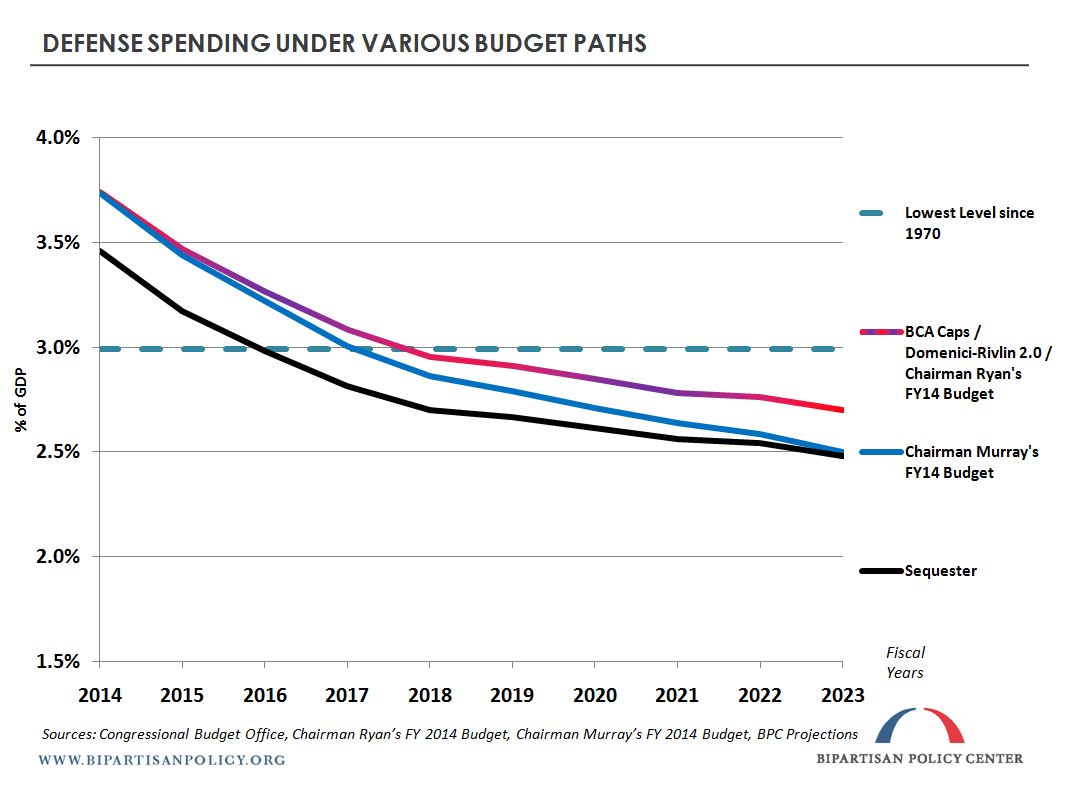

Defense Discretionary: The Senate Democratic budget would fund the base defense budget at $552 billion in FY 2014, which is the adjusted BCA cap level and identical to the level proposed in Chairman Ryan’s budget. Beginning in FY 2015, Chairman Murray would phase in approximately $240 billion of reductions off of the BCA caps during the remainder of the ten-year budget window ? additional cuts that are roughly consistent with the spending path laid out by Simpson-Bowles. The House GOP budget, in contrast, would keep base defense spending at the BCA caps, which is consistent with the policy recommended in BPC’s Domenici-Rivlin 2.0.

Regarding funding for Overseas Contingency Operations (OCO) ? i.e., “war spending” ? Chairman Murray’s budget authorizes substantially less per year than what is proposed in the President’s Budget. Because there is no policy in the budget that would reduce this funding below what is currently forecast ? and in order to maintain scoring consistency ? BPC does not credit these reductions in its estimates of the Senate Democratic budget.

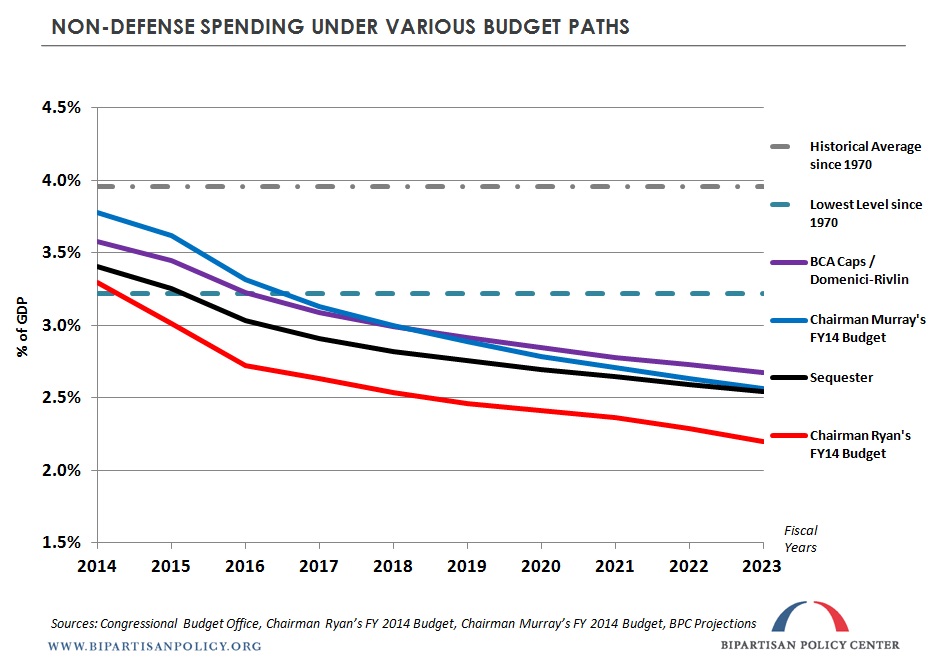

Non-Defense Discretionary: Chairman Murray’s budget calls for approximately $140 billion of reductions below the adjusted non-defense BCA caps. While the budget proposes to increase funding for many non-defense discretionary (NDD) activities (see below), there are no specific policies recommended that would offset these bump-ups and allow NDD to remain within the caps.

Over the decade, the Senate Democratic budget would fund NDD programs at levels somewhat below those recommended by BPC’s Domenici-Rivlin 2.0 and roughly consistent with Simpson-Bowles. The House GOP budget cuts substantially further, proposing to authorize roughly $900 billion less to NDD spending over the decade than Chairman Murray’s plan.

View larger versions of the charts above

Other Mandatory Programs

All nine years of sequester cuts to other mandatory spending (which includes all mandatory spending other than the major entitlements, such as Medicare, Medicaid, and Social Security) would be waived under the Senate Democratic budget. Chairman Ryan’s plan, in contrast, would allow these cuts to take effect.

After restoring the sequester reductions, Chairman Murray’s budget would reduce other mandatory spending by $76 billion over the ten-year budget window. The specific policies that add to the $76 billion are not fully delineated, but would include:

- Reforms and cuts to agriculture programs that sum to $23 billion over ten years. The specifics are left to Senate Agriculture Committee, which is encouraged to write a five-year Farm Bill. The Senate Democratic and House GOP budgets both propose to achieve significant savings from reductions in farm programs ? in particular, Chairman Ryan’s budget calls for $31 billion.

- Establishing risk-based premiums for companies’ under-funded pension plans through the Pension Benefit Guaranty Corporation (PBGC). While the precise proposal and corresponding savings are unclear, a similar reform was included in BPC’s Domenici-Rivlin 2.0.

For comparison, the House GOP budget proposes $962 billion in cuts to this section of the budget.

Additionally, the Senate Democratic budget proposes to implement a tax-credit bond program, which would be similar in structure to the Build America Bonds program that was enacted as part of the 2009 stimulus and recently expired. These bonds would authorize states or local governments to issue bonds to investors, who would then receive federal tax credits for (instead of interest on) their holdings. The ten-year cost of this program is unspecified.

Miscellaneous

- The Senate Democratic plan proposes to reform the management of government properties to dispose of unneeded ones, to reduce improper payments made across the government, and also to have Senate committees review the recommendations of the Government Accountability Office for achieving efficiencies and reducing duplication within the federal budget. Furthermore, like Chairman Ryan’s budget, Chairman Murray urges the authorizing committees to review programs within their jurisdiction in order to eliminate overlapping efforts.

- Within the adjusted non-defense discretionary budget caps that are established by Chairman Murray’s budget, the document proposes to increase funding for: the provision of public preschool programs; the expansion of PPACA’s Maternal, Infant, and Early Childhood Home Visiting Program, which directly provides voluntary parent education and family support services to parents with young children; the operation, maintenance, and construction activities of the Bureau of Reclamation and the Army Corps of Engineers, including the construction of deeper harbors and measures that ensure that the Harbor Maintenance Trust Fund will fully expend the collections that are deposited into it annually; vital water programs, such as the Rural Water Supply Program; NASA; the Food and Drug Administration; the Commodities Futures Trading Commission, which assists in regulating the derivatives market; an electronic claims processing system for veterans with disabilities; wild land firefighting and watershed recovery programs; Violence Against Women Act programs that fund the prosecution of domestic violence on American Indian reservations; energy research and development for programs at the national labs and Advanced Research Projects Agency ? Energy (ARPA-E); the Low-Income Home Energy Assistance Program; and energy efficiency programs, such as the Weatherization Assistance Program and the State Energy Program.***

- The reauthorization of conservation measures, such as the Federal Land Transaction Facilitation Act, is encouraged by the Senate Democratic budget.

- Although not a change to current law, the Senate Democratic budget states that it would maintain the scheduled inflation adjustment to the maximum Pell grant award. Chairman Ryan’s budget proposes to freeze the maximum level, which would save monies from the program.

Note: This post has been updated to more clearly describe the details of Chairman Murray’s budget and how it compares to other budget paths.

* The BPC Alternative Baseline assumes current law, except that:

- funding for combat operations overseas winds down;

- Medicare physician payments are frozen at 2013 levels (the “doc fix”);

- the sequester is waived;

- certain refundable tax credits are extended as they have been in the past; and

- aid for Hurricane Sandy is not extrapolated for future years.

** The Senate Democratic budget would raise $923 billion off of a current law baseline, which assumes the expiration of certain low-income tax credits at the end of 2017. Utilizing this current law baseline, the House GOP budget proposes a revenue-neutral tax reform.

*** Some of these increases may be part of the $100 billion in up-front growth, in which case such spending would not have to fit under the adjusted discretionary caps, but Chairman Murray’s budget does not make this distinction for specific items on this list.

| Murray Budget Charts.pdf | 589 KB |

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now