Mandatory Spending and Sequestration

Shari Lin contributed to this post.

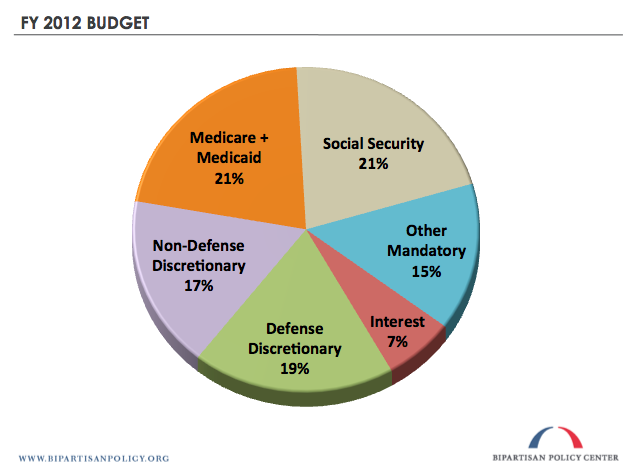

Last week, we provided a broad overview of how sequestration would apply to the major categories of federal spending in fiscal year (FY) 2013: defense discretionary, non-defense discretionary, and non-defense (or “domestic”) mandatory.* Mandatory spending is composed of programs that are funded by formulas set in law and thus do not require an annual appropriations bill to continue. This type of spending can be loosely separated into two categories: Social Security and the health care entitlements (e.g., Medicare, Medicaid and the Patient Protection and Affordable Care Act (PPACA)); and everything else, sometimes known as “other mandatory spending.” The major entitlements are familiar topics, but even policy wonks may be at a loss when the topic of other mandatory spending arises.

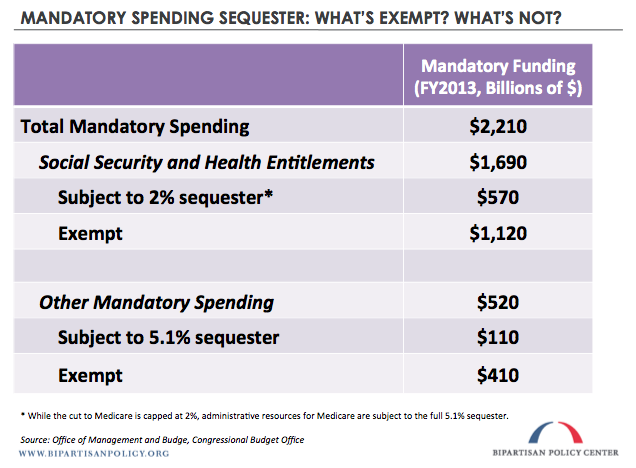

Most Mandatory Spending is Exempt

While the budget contains hundreds of mandatory programs ? many of which are subject to the sequester’s reductions ? the majority of the large ones are protected from the cuts. Social Security and Medicaid are completely exempt from sequestration, as are many programs in the other mandatory category, such as veterans’ benefits and food stamps. Mandatory spending also includes the refundable portion of certain tax credits, such as the child tax credit, the Earned Income Tax Credit, and PPACA exchange subsidies that begin in 2014. These refundable tax credits for individuals and families are also fully exempt from sequestration.

In contrast, some mandatory programs are partially-exempt. Sequestration cuts to Medicare providers and plans (including Part D prescription drug coverage and Medicare Advantage) are limited to 2 percent. Mandatory funding for the Indian Health Service (IHS) is also protected by the 2-percent limit, but most of the funding for IHS is discretionary and is not exempt from cuts.

What “Other Mandatory Spending” Is Subject to Sequestration?

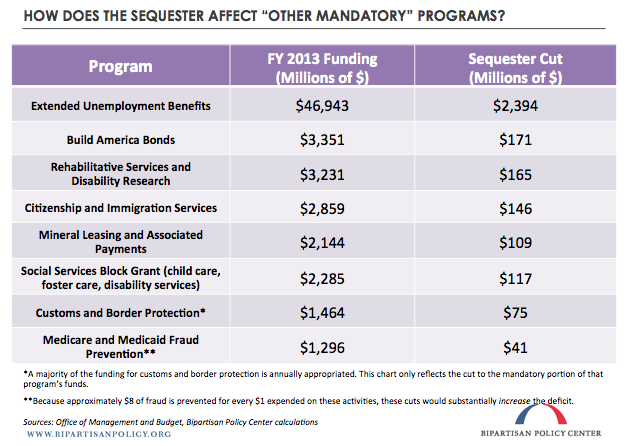

Some of the largest sequestration cuts to other mandatory spending programs are:

- Unemployment Trust Fund ($2.39 billion cut) ? Regular unemployment benefits are exempt from sequestration, but most of those payments are funded by state government unemployment programs. However, the federal government funds extended unemployment benefits for people who have been unemployed longer than 26 weeks; these extended benefits are subject to sequestration. In the wake of the economic downturn, Congress passed Emergency Unemployment Compensation (EUC), which temporarily increased the value of these extended unemployment benefits. EUC is now scheduled to continue through 2013 as a result of the American Taxpayer Relief Act of 2012 (the “fiscal cliff” legislation), and those benefits are also subject to sequestration. Because the extended benefit payments are administered by state governments, the actual timing of the cuts will vary by state, but anyone receiving benefits who has been unemployed for over 26 weeks will eventually see their benefit amount cut, in most cases by over 10 percent for the remainder of FY 2013.

- Build America Bonds Payments ($171 million cut) ? Traditionally, the federal government has offered assistance to state and local governments by allowing them to issue bonds that pay tax-exempt interest. By creating Build America Bonds, Congress tested a system in which states and municipalities issue taxable bonds and receive a direct cash subsidy from the federal government to help reduce borrowing costs. Sequestration will reduce this cash subsidy, which means that state and local governments that issued the bonds will see their debt service costs unexpectedly increase.

- Rehabilitative Services and Disability Research ($165 million cut) ? This program, the core of the Individuals with Disabilities Education Act (IDEA), provides grants to states to help fund public education services for students with disabilities through age 21, as well as pre-school and early intervention programs for young children with disabilities.

- Citizenship and Immigration Services ($146 million cut) ? This mandatory spending is directed at activities such as reducing the backlog of immigration applications.

- Mineral Leasing and Associated Payments ($109 million cut) ? This funding, administered by the Bureau of Indian Affairs, is dedicated to helping tribes develop their energy and mineral resources.

- Social Services Block Grant ($117 million cut) ? These block grants go to states for a variety of purposes, including child care, foster care, and services for people with disabilities.

- Customs and Border Protection ($75 million cut) ? Most of the funding for Customs and Border Protection (CBP), which includes border patrol at and between ports of entry, is in the discretionary budget, but a significant portion is mandatory. Both pieces are subject to sequestration. If discretionary spending is included, the total cuts faced by CBP’s core functions amount to $512 million.

- Medicare and Medicaid Fraud Prevention ($41 million cut) ? This funding supports the government’s efforts to stop health care fraud. Last year, these enforcement efforts recovered nearly $4.2 billion in taxpayer dollars, or a return on investment of $7.90 for every $1 invested. Therefore, including the $16 million of fraud prevention in discretionary funding that will also be cut, rather than saving money, the fraud prevention sequester could actually cost the government $390 million.

Those listed above are just a small sample of the other mandatory spending programs that are subject to sequestration. Other programs affected include payments to the Transportation Trust Fund ($316 million cut),** trade adjustment allowances for displaced workers ($58 million cut), grants from the Prevention and Public Health Fund created by PPACA ($51 million cut), and compensation for victims of the September 11 terrorist attacks ($16 million cut). In some cases, a major mandatory program (such as food stamps) is exempt, but mandatory administrative costs to support the program are subject to sequestration (a $5 million cut in the case of food stamps).

Additionally, most credit programs are subject to sequestration, but the direct impact, if any, on actual federal spending is dependent on the usage of the credit. For example, the Farm Service Agency’s Commodity Credit Corporation Fund’s $6.46 billion in borrowing authority for FY 2013 is scheduled to be cut by $329 million. The reduced borrowing authority might impact the Agency’s ability to make new commodity support loans, but the need to make those loans will be dependent on commodity market prices.

Another example in this category is the Federal Deposit Insurance Corporation’s (FDIC) Orderly Liquidation Fund. This fund, created in the Dodd-Frank Act only comes into use if there is a failure of a systemically-important financial institution that could not be addressed through other means. If this authority is not invoked by the FDIC in FY 2013, then sequestration will have no practical effect.

Conclusion

If the sequester remains in effect, there will be little flexibility in the cuts to other mandatory spending, and the programs will face across-the-board cuts in each of the upcoming nine years of sequestration (through FY 2021). The recipients, whether states, localities, businesses, or individuals, will acutely feel these cutbacks in funding.

* Defense spending also contains some mandatory programs that are not annually appropriated. They make up a relatively small portion of the federal budget and nearly all of them are exempt from the sequester, so this post focuses solely on non-defense mandatory spending.

** Trust funds for transportation have historically been funded largely by user fees (such as taxes on gasoline and diesel fuel) and used to provide matching funds to states for highway and transit projects. User fees deposited into trust funds are exempt from sequestration; general fund transfers, however are subject to reductions. Because motor fuel taxes have not kept pace with the level of transportation spending that Congress has authorized, the trust funds have become more reliant on general funds. This cut will primarily reduce the funds available for the Department of Transportation to commit to future highway and transit projects (although some annually appropriated general fund monies for projects already underway may be sequestered, as well).

Related Posts

-

OMB Outlines Sequester Cuts

March 5, 2013

-

Origins of the Sequester

February 27,2013

-

The Sequester: What You Need to Know

February 22, 2013

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now