The House Republican Debt Limit Proposal, Explained

Updated January 24, 2013

UPDATE: Obama signs debt-ceiling bill

UPDATE: H.R. 325, The Debt Limit, and Extraordinary Measures: A Technical Note

UPDATE: Senate votes to temporarily suspend federal debt limit

Last week, at the House Republican retreat in Williamsburg, VA, members of the leadership team announced that they were considering a short-term increase in the debt limit that would allow Congress to address several other budget-related deadlines first. These include the automatic across-the-board sequestration cuts set to take effect March 1, the March 27 expiration of the continuing resolution to finance the federal government for the current fiscal year, and the April 15 deadline for a congressional budget resolution for the next fiscal year.

Today, the House of Representatives approved a bill (H.R. 325) that seeks to implement the short-term debt limit increase while forcing the Senate to pass a budget resolution this year, which that chamber has not done since 2009.

Key Takeaways: The House Republican Debt Limit Proposal (H.R. 325)

The Bipartisan Policy Center (BPC) notes that the debt limit provisions are novel, contain substantial complexity, and may have implications that we have not foreseen. The following is BPC’s initial interpretation.

- Upon enactment of this bill, the debt limit would be temporarily suspended.

- Treasury debt issuance operations would immediately return to normal and Extraordinary Measures currently in use would begin to be unwound.

- On May 19, 2013, the debt limit would then be automatically increased by the amount of debt above the current statutory limit “necessary to fund commitment[s] incurred by the Federal Government that required payment before May 19, 2013,” minus the amount of outstanding Extraordinary Measures in use on the date of enactment. BPC projects that under the most likely interpretation, if the legislation is enacted by the end of January, Extraordinary Measures beginning around May 19 would provide Treasury with sufficient funds to meet all federal financial obligations through at least the end of July.

- If enactment of this legislation is delayed into February, however, Extraordinary Measures would likely last for a shorter period of time after May 19. In other words, using past practice as guidance, the sooner this bill passes, the later the next X Date ? the first day on which the federal government has insufficient funds to meet all of its obligations ? would arrive.*

- Again assuming that the legislation is enacted by the end of January, BPC estimates that the dollar amount of the scheduled debt limit increase on May 19 would be approximately $450 billion.

- Pay for members of Congress would be temporarily withheld if a budget resolution is not passed by their chamber on or before April 15. Questions are being raised regarding the constitutionality of this provision.

Fiscal Timeline Under Passage of H.R. 325

Scroll over each entry below for more details

Assumed before Feb 12013

-

House GOP Debt Limit Bill, H.R. 325, Signed Into Law

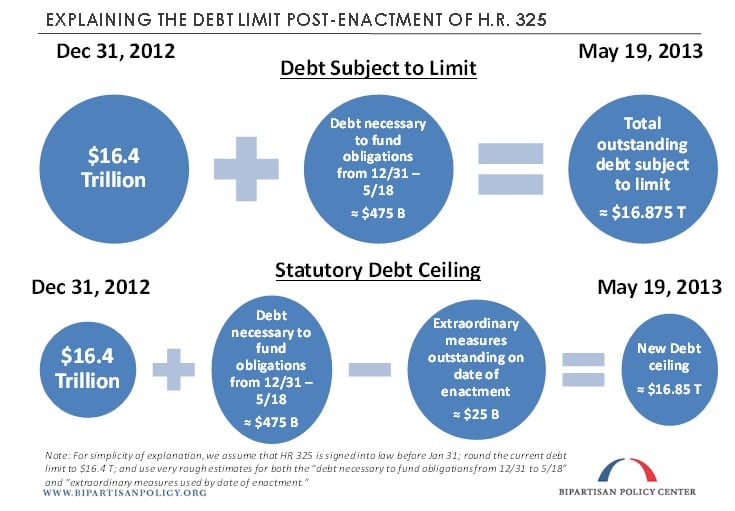

One provision of the bill would temporarily suspend the statutory debt limit through May 18, 2013. On May 19, the debt limit would then be automatically increased by the amount of debt above the current statutory limit “necessary to fund commitment[s] incurred by the Federal Government that required payment before May 19, 2013,” minus the amount of outstanding Extraordinary Measures in use on the date of enactment. BPC estimates that this amount will total approximately $450 billion.

-

Treasury Begins to Unwind Extraordinary Measures

Treasury would begin to unwind the Extraordinary Measures it started using on December 31, 2012, including making legally-required reimbursements to funds (such as the Thrift Savings Plan G-Fund) for the suspended investments and the interest that would otherwise have been earned.

Mar 12013

-

Imposition of Sequester Cuts ($85 billion)

The Budget Control Act of 2011 formed a congressional “super committee” that was instructed to agree on at least $1.2 trillion of deficit reduction. Additionally, as a failsafe, it included automatic cuts to defense and non-defense spending that would be implemented if the super committee did not meet its target. Now that such an outcome has materialized, the across-the-board cuts are scheduled to go into effect absent congressional legislation that waives or postpones them. BPC will be updating its analysis of the sequester cuts shortly in light of the American Taxpayer Relief Act of 2012 and new emergency aid passed in response to Hurricane Sandy.

Mar 272013

-

Expiration of Fiscal Year 2013 continuing resolution

Because no individual appropriations bills were enacted for Fiscal Year (FY) 2013, which began on October 1, 2012, all federally appropriated programs are funded through March 27th with a continuing resolution at the same level of funding, pro-rated, as in FY 2012 ? $1.047 trillion.

-

Expiration of Temporary Assistance for Needy Families (TANF)

TANF is a block grant program that funds a wide range of benefits and services for low-income families with children. When Congress passed the continuing resolution in October, it included a six-month extension of the TANF program, which was set to expire. For grants to the states under TANF to continue beyond March, Congress would either need to pass another short-term extension or a long-term reauthorization.

Apr 152013

-

Each Chamber of Congress Must Pass a Budget for Its Members to Be Paid on Time

Under H.R. 325, each chamber of Congress must pass a budget resolution by April 15; otherwise, the pay for members of a chamber that has failed to approve a budget will be suspended and placed in escrow. If the deadline for passage of a budget is missed, member pay would be reinstated either when a budget is passed or the end of the 113th Congress (i.e., the end of 2014), whichever occurs first. The constitutionality of this provision is unclear.

May 192013

-

Statutory Debt Ceiling Increased from $16.394 Trillion by Approximately $450 Billion

On May 19, the debt limit would be automatically increased by the amount of debt above the current statutory limit “necessary to fund commitment[s] incurred by the Federal Government that required payment before May 19, 2013,” minus the amount of outstanding Extraordinary Measures in use on the date of enactment of H.R. 325.

-

Treasury Begins Using Extraordinary Measures (close to $200 billion available)

In order to continue paying bills on time, Treasury would begin disinvesting certain funds, such as the Thrift Savings Plan G-Fund, and could declare a Debt Issuance Suspension Period (DISP). Because the increase in the statutory debt limit on May 19 will not be sufficient to cover all outstanding debt subject to limit on that date (roughly by the amount of the outstanding Extraordinary Measures in use on the date of enactment of H.R. 325), Treasury will have to immediately use a small chunk of Extraordinary Measures in order to remain under the debt limit. Therefore, Treasury effectively would have access to a somewhat smaller amount of Extraordinary Measures than it otherwise would.

Jun 302013

-

Additional Extraordinary Measures Become Available

On June 30, 2013, Treasury will have the option to suspend reinvestment of maturing securities in the Civil Service Retirement and Disability Fund (CSRDF) and the Postal Service Retiree Health Benefits Fund, and to suspend the semiannual interest payment to these funds. Using these Extraordinary Measures would generate additional borrowing authority to assist the federal government in paying its obligations.

No earlier than Aug 2013

-

X Date ? “Extraordinary Measures” Exhausted

Once the debt limit is reached, the U.S. can no longer borrow money to meet its financial obligations. If Congress does not promptly approve an increase in the debt ceiling, the Treasury Department can take “extraordinary measures” to raise cash to avoid default for a limited time. These measures include borrowing from other government accounts, such as funds related to currency exchange and federal employee retirement. The borrowed amounts must be repaid (in full and with foregone interest) once the debt limit is increased. If these measures are exhausted without Congress acting to increase the debt limit, the U.S. government will be unable to meet all of its financial obligations, which include Social Security benefit payments, the salaries of our men and women in the armed forces, and interest payments on the national debt.

$(document).ready(function() {

$('div.fiscal-data-wrap').each( function() {

$left = $(this).find('.fiscal-data-left');

$right = $(this).find('.fiscal-data-right');

if ($left.height()

$left.css ('height', $right.height());

else if ($right.height()

$right.css ('height', $left.height());

// check which background gradient to use for date on the left

if ($left.height() > 70) {

if ($(this).parents('.red-zone-right').length > 0) {

$left.css ('background', 'transparent url("http://www.bipartisanpolicy.org/sites/default/files/images/bgr-red-zone-left-long.png") repeat-x left bottom');

}

else $left.css ('background', 'transparent url("http://www.bipartisanpolicy.org/sites/default/files/images/bgr-fiscal-year-date-long.png") repeat-x left top');

}

var right_height = $right.height();

var right_list = $right.find('ul');

var right_list_height = right_list.height();

right_list.css ('margin-top', (right_height-right_list_height)/2);

});

$(".fiscal-data-right li a").each(function () {

var $this = $(this),

$overlay = $this.siblings('.right-overlay'); // Overlay is a span inside of the a tag.

if ($overlay.length > 0) {

var $thisHeight = $this.outerHeight();

var $linkPosition = $this.position().top;

// find what to highlight - the whole row (if 1 item) or just this list item

var num_items = $(this).parent('li').siblings().length + 1;

var events = {

on: function () {

// find if the overlay bubble needs to be showing below or above the link it's accompanying

// depending on how close the link is to the bottom of the page

//$overlayHeight = 110; // height of the overlay image

$overlayHeight = $overlay.height();

//var scrollBottom = (-1) * ($(document).height() - $(window).height() - $(window).scrollTop());

//alert ($overlayHeight );

//alert (window.innerHeight + $(window).scrollTop() - $thisHeight - $overlayHeight);

$.browser.chrome = /chrome/.test(navigator.userAgent.toLowerCase());

if($.browser.chrome || $.browser.safari) {

$overlay.css ('top', $linkPosition + $thisHeight + 17 + 'px');

}

else if ($.browser.msie) { $overlay.css ('top', $linkPosition + $thisHeight + 40 + 'px'); }

else $overlay.css ('top', $linkPosition + $thisHeight + 'px');

if ($linkPosition + $thisHeight + $overlayHeight > window.innerHeight + $(window).scrollTop() - $thisHeight - $overlayHeight -40) {

$overlay.addClass ('flipped');

$overlay.css ('top', $linkPosition - $overlayHeight - 10 + 'px');

if($.browser.msie) { $overlay.css ('top', $linkPosition - $overlayHeight + 40 + 'px'); }

}

// show overlay

$overlay.stop(true, false).fadeIn("fast");

$overlay.show();

$overlay.css ('display', 'block');

if (num_items == 1) {

if ($this.parents('.red-zone-right').length > 0) {

$this.parents('.fiscal-data').addClass ('red-zone-hover');

//$this.parents('.fiscal-data').css ('background', 'url("http://www.bipartisanpolicy.org/sites/default/files/images/background-red-zone-left-flip.png") left bottom');

}

else {}

$this.parents('.fiscal-data').addClass ('hover');

//$this.parents('.fiscal-data').css ('background', 'url("http://www.bipartisanpolicy.org/sites/default/files/images/background-fiscal-year-date-flip.png") left top');

}

else if (num_items > 1) {

if ($this.parents('.red-zone-right').length > 0) {

$this.parent('li').addClass ('red-zone-hover');

//$this.parent('li').css('background', 'url("http://www.bipartisanpolicy.org/sites/default/files/images/background-red-zone-left-flip.png") left top');

$this.css ('border-color', '#840010');

}

else {

$this.parent('li').addClass ('hover');

//$this.parent('li').css('background', 'url("http://www.bipartisanpolicy.org/sites/default/files/images/background-fiscal-year-date-flip.png") left top');

$this.css ('border-color', '#0E56A0');

}

$this.parents('.fiscal-data-right').find('li:last-child').children('a').css('border-bottom', '0');

$this.parents('.fiscal-data-right').find('li:first-child').children('a').css('border-top', '0');

}

},

off: function () {

$overlay.stop(true, false).fadeOut("fast");

$overlay.hide();

$overlay.removeClass ('flipped');

/*$.browser.chrome = /chrome/.test(navigator.userAgent.toLowerCase());

if($.browser.chrome) {

$overlay.css ('top', $thisHeight + $linkPosition + 17 + 'px');

}

else $overlay.css ('top', $thisHeight + $linkPosition + 'px');*/

if (num_items == 1) {

$this.parents('.fiscal-data').removeClass('red-zone-hover');

$this.parents('.fiscal-data').removeClass('hover');

//$this.parents('.fiscal-data').css ('background', 'url("http://www.bipartisanpolicy.org/sites/default/files/images/background-fiscal-year-item.png") left bottom');

}

else if (num_items > 1) {

$this.parent('li').removeClass('red-zone-hover');

$this.parent('li').removeClass('hover');

//$this.parent('li').css('background','none');

$this.css ('border-top', '1px solid #fff');

$this.css ('border-bottom', '1px solid #ddd');

$this.parents('.fiscal-data-right').find('li:last-child').children('a').css('border-bottom', '0');

$this.parents('.fiscal-data-right').find('li:first-child').children('a').css('border-top', '0');

}

}

};

$this.on("mouseenter", events.on);

$this.on("mouseleave", events.off);

} // end found overlay

else {

// if no over lay - don't do anything with the link. No hover, no roll-over, no bubble

$this.css ('cursor', 'default');

$this.hover ( function() {

$(this).css('color', '#0E56A0'); // default color

});

}

});

$(".fiscal-data-right li a").click (function (e) {

e.preventDefault();

});

// fix the position of the vertical text in the "red zone" dependent on the right info's height

$('.fiscal-cliff-red-zone .red-zone-vertical-text').css('top', $('.fiscal-cliff-red-zone').height()/2-115);

$(".fiscal-cliff-embed").click(function (e) {

e.preventDefault();

var pos = $(this).position().top;

var left = $(this).position().left;

$overlay = $('.embed-overlay');

if ($(this).attr('id') == 'fiscal-cliff-embed-bottom') {

pos = pos - $overlay.height() - 23;

}

else if ($(this).attr('id') == 'fiscal-cliff-embed-top') {

pos = pos + 32;

}

if ($overlay && !$overlay.is(':visible')) {

$overlay.css ('top', pos);

$overlay.show();

$overlay.css ('left', left-$overlay.outerWidth()+ $(this).width());

$('p.code_to_copy').text("");

SelectText('code_to_copy');

}

else if ($overlay && $overlay.is(':visible')) $overlay.hide();

});

$(".embed-overlay p.close-embed-overlay a").click(function (e) {

e.preventDefault();

var $overlay = $('.embed-overlay');

if ($overlay && $overlay.is(':visible')) $overlay.hide();

});

// selects the entire text in the element sent in as a parameter

function SelectText(element) {

var text = document.getElementById(element);

if ($.browser.msie) {

var range = document.body.createTextRange();

range.moveToElementText(text);

range.select();

} else if ($.browser.mozilla || $.browser.opera) {

var selection = window.getSelection();

var range = document.createRange();

range.selectNodeContents(text);

selection.removeAllRanges();

selection.addRange(range);

} else if ($.browser.safari || $.browser.chrome) {

var selection = window.getSelection();

selection.setBaseAndExtent(text, 0, text, 1);

}

}

$('.code_to_copy').click(function () {

SelectText('code_to_copy');

});

$('.fiscal-cliff-month-bar').each ( function () {

var parent_width = $(this).parents('.fiscal-cliff-monthly-list').width();

var heading_width = $(this).siblings('span.fiscal-cliff-month').outerWidth();

$(this).css('width', parent_width - heading_width);

});

});

All estimates assume BPC’s most likely interpretation of H.R. 325 and that the bill is passed before February 1.

What follows is a more detailed explanation of this new approach, along with some questions that remain.

A New Approach to the Debt Limit

With respect to recent history, the House bill is a somewhat new approach to the debt limit. In the past, Congress has almost always increased the limit by a specific dollar amount.** H.R. 325 would instead select a specific date (in this case, May 19, 2013) and increase the debt limit by the amount needed to finance federal obligations up to that point (minus the outstanding Extraordinary Measures in use on the date of enactment).

Under the conventional approach of raising the debt limit by an exact amount, the time between enactment of a debt limit increase and when the debt limit would be reached again was mostly dependent on two variables: the dollar amount of the increase and the future operating cash flow (the difference between revenues collected and expenditures made) of the federal government.***

Under the approach in H.R. 325, however, the date at which the debt limit will next be reached is known in advance, but the dollar amount of the increase is unknown and would be based on projections of federal operating cash flow and changes in intragovernmental debt.

How It Would Work

The House GOP approach would be implemented by suspending the debt limit upon enactment of H.R. 325 and through May 18, 2013. In other words, after enactment, Treasury would be able to return to issuing debt using normal operations to finance the government. This bill would be just like other debt limit increases in that respect. Treasury would immediately begin unwinding the Extraordinary Measures that it started using on December 31, 2012, including making legally-required reimbursements to funds for suspended investments (such as the Thrift Savings Plan G-Fund) and for the interest that would otherwise have been earned.****

On May 19, absent further action by policymakers, the debt limit would come back into force, and rather than “snapping back” to the existing $16.394 trillion ceiling, the limit would be at a new, higher level. What that level would be and what would occur at that point in time (absent a further increase in the debt limit before then) are two important questions.

The reinstated debt limit on May 19 would be increased from the previous limit to cover new debt issued to meet commitments that were due before May 19, net of any outstanding Extraordinary Measures on the date of H.R. 325’s enactment. For example, if Treasury issues $475 billion in additional debt to cover payments due before May 19 and there are $25 billion in outstanding Extraordinary Measures in use on the date of the legislation’s enactment, then the debt ceiling would increase by $450 billion on May 19. This means that on May 19, the total debt subject to limit that the U.S. has accrued would be scheduled to exceed the newly-imposed debt ceiling level.

At that time, based on an initial review of the bill, BPC’s interpretation is that Treasury would be able to issue a new Debt Issuance Suspension Period (DISP) and once again begin using Extraordinary Measures. Because of the mismatch cited above, Treasury will immediately either need to use some Extraordinary Measures to stay under the new limit or use cash on hand to redeem some outstanding debt.

The longer it takes to enact the bill in the coming days, the more Extraordinary Measures will be netted from the debt limit increase on May 19. As a result, the speed at which this bill is enacted would affect the X Date; an earlier signing would make the new X Date relatively later, and a later signing would make the new X Date relatively earlier.

If H.R. 325 is enacted before the end of January, BPC projects that these measures would provide Treasury with sufficient funds to meet all federal financial obligations through at least the end of July. BPC also estimates that the magnitude of this debt limit increase would be approximately $450 billion.

Finally, the proposed legislation includes an important qualification: The debt limit increase will only cover the issuance of debt “necessary to fund a commitment incurred by the Federal Government that required payment before May 19, 2013.” This effectively prevents Treasury from issuing large amounts of debt to the public in the days before May 19 to stockpile cash to pay bills that are due after May 19.

About That Budget Resolution

H.R. 325 also includes a provision designed to spur the Senate to pass a budget resolution this year. The bill would withhold congressional pay for the members of a respective chamber of Congress that fails to pass a budget resolution ? a plan for spending and revenues for the coming fiscal year ? by April 15. Under the Congressional Budget and Impoundment Control Act of 1974, failure to adopt a conference agreement on a budget resolution by April 15 generates procedural speed bumps in the Congress, but those consequences have been regularly waived in years when such agreements have not been reached. This new legislation does not require that the House and Senate agree on a conference agreement on a concurrent resolution, but merely that each chamber pass its own.

Potential Constitutional Issue

A major potential issue with the incentive described above is that the Twenty-Seventh Amendment to the Constitution limits the ability of Congress to make changes to member compensation for the current term. Since ratification, changes (including pay cuts) have only gone into effect after the next session of Congress had begun. The drafters of H.R. 325, however, tried to address this issue by including a provision (Section 2. Holding Salaries of Members of Congress in Escrow Upon Failure to Agree to Budget Resolution) proposing to hold members’ pay in escrow for a period of time (beginning April 15), and then paying those funds out on the date that a budget resolution is passed or the last day of the 113th Congress (at the end of 2014), whichever comes first.

No one on BPC’s economic policy team is a legal scholar, but whether this approach is actually constitutional may be open to question, and if it were actually to go into effect, members of Congress could potentially sue to have it overturned . Furthermore, there is no severability clause included in the legislation.

* Some are interpreting the debt limit provision in H.R. 325 to mean that the debt ceiling would increase on May 19 by the full amount necessary to cover all outstanding debt subject to limit at that point in time. This is a plausible reading and, assuming that the bill is passed quickly, differs only modestly from BPC’s current analysis, which is effectively that those Extraordinary Measures outstanding on the date of H.R. 325’s enactment will not be available again after May 19. At this point, however, no one can be certain about what the final interpretation of the statute will be.

** During a debt limit event in 1996, Congress temporarily exempted from the limit any debt issued in order to pay Social Security benefits.

*** The timing of reaching the debt limit is also dependent on changes in intragovernmental holdings of debt, which include securities in the Social Security and Medicare trust funds and are covered by the statutory debt limit.

**** For more information, see the Government Accountability Office’s report from last year: Analysis of 2011-2012 Actions Taken and Effect of Delayed Increase on Borrowing Costs.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now