Chairman Ryan’s Budget: The Details

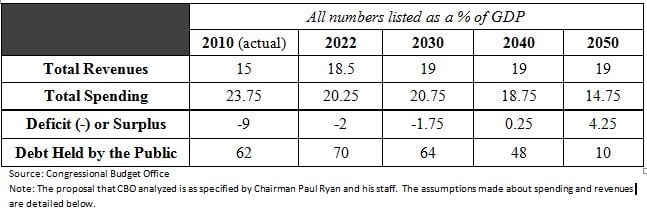

Below is our summary of Chairman Paul Ryan’s budget, which was released last week. All of the information about Chairman Ryan’s budget proposal is taken directly from either The Path to Prosperity: Restoring America’s Promise (not to be confused with the Bipartisan Policy Center’s report, Restoring America’s Future) or the Congressional Budget Office’s Long-Term Analysis of a Budget Proposal by Chairman Ryan. We hope that this comprehensive summary will be helpful and further clarify the entirety of his plan.

Medicaid Beginning in 2013, instead of the current shared-financing system between the states and federal government, the federal share of Medicaid would be allocated to the states through block grants.

- The total dollar amount of the block grants would increase annually with population growth and inflation (approximately 3.3% annually, on average). For reference, Medicaid spending is projected to average 7% annual growth for the next decade by the CBO.

- CBO Analysis: “Under the proposal, states would have additional flexibility to design and manage their programs to achieve greater efficiencies in the delivery of care. Because of the magnitude of the reduction in federal Medicaid spending under the proposal, however, states would face significant challenges in achieving sufficient cost savings through efficiencies to mitigate the loss of federal funding. To maintain current service levels in the Medicaid program, states would probably need to consider additional changes, such as reducing their spending on other programs or raising additional revenues. Alternatively, states could reduce the size of their Medicaid programs by cutting payment rates for doctors, hospitals, or nursing homes; reducing the scope of benefits covered; or limiting eligibility.”

From the CBO’s analysis of Chairman Ryan’s budget, “Starting in 2022, Medicaid block grant payments would be reduced to exclude projected spending for acute care services or Medicare premiums and cost sharing paid by Medicaid.”

- According to the CBO, this spending accounts for over two-thirds of Medicaid’s costs in 2021.

- This Medicaid spending reduction would be partially offset by Chairman Ryan’s plan to establish medical savings accounts (MSAs) for certain Medicare beneficiaries with low income (explained in greater detail below).

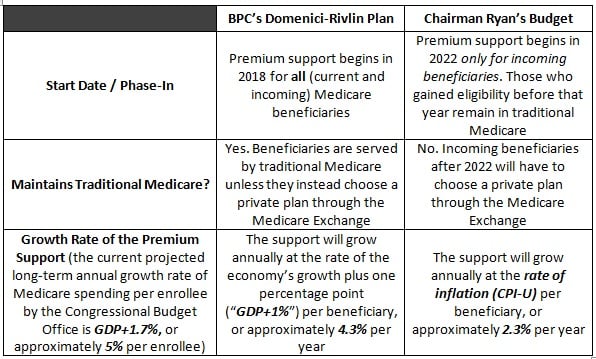

Repeal the Affordable Care Act’s (ACAs) expansion of Medicaid that would extend coverage to most nonelderly people with incomes below 138 percent of the federal poverty level. Medicare Starting in 2022, for newly eligible beneficiaries, Chairman Ryan’s budget would convert Medicare into a premium support system. Instead of automatically being enrolled in traditional fee-for-service Medicare, these new beneficiaries would be entitled to a premium support payment to help them purchase private health insurance on a newly established, regulated Medicare exchange, similar in structure to those created by the Affordable Care Act. The premium support payments given to incoming beneficiaries would increase annually with inflation, or approximately 2.3% according to the CBO. For comparison, Medicare spending per beneficiary is projected to grow annually at approximately 5%.

- CBO’s report states: “Under the proposal, most beneficiaries who receive premium support payments would pay more for their health care than if they participated in traditional Medicare [under CBO’s long-term projections]. CBO estimated that, in 2030, a typical 65-year-old would pay 68 percent of the benchmark under the proposal,” as opposed to somewhere between 25 and 30 percent under our current trajectory.

- Please see below for the differences between the Bipartisan Policy Center’s Debt Reduction Task Force (Domenici-Rivlin) premium support plan and the one offered by Chairman Ryan:

- Chairman Ryan’s premium support proposal would also means-test support payments for people in the top 8% of the annual income distribution.

Beginning in 2022, the federal government would establish a medical savings account (MSA) for certain beneficiaries with low income. The amount of the federal contribution would grow annually with inflation, or approximately 2.3%, on average. Again, for comparison, Medicare spending per beneficiary is projected to grow annually at approximately 5%.

- Medicare beneficiaries with income below the federal poverty level, in 2022, would initially receive a federal contribution of $7,800.

- Beneficiaries with income between 100 percent and 150 percent of the federal poverty level would initially receive a federal contribution of $5,850.

Beginning in 2022, the Chairman’s plan will increase the eligibility age for Medicare by two months per year until it reaches 67 in 2033. According to the CBO, “On the basis of the specification provided by Chairman Ryan’s staff, CBO’s analysis included no change in the sustainable growth rate mechanism for payments to physicians under Medicare.” [emphasis added]

- In other words, the CBO was instructed by the Chairman not to include a “doc fix” in the scoring of his plan, meaning that in order to prevent cuts in provider payment rates, unspecified offsets would have to be found.

Affordable Care Act Chairman Ryan’s budget repeals:

- The individual mandate;

- The establishment of health insurance exchanges and subsides for certain individuals and families who purchase coverage through them;

- The expansion of Medicaid coverage to include most nonelderly people with income below 138 percent of poverty;

- The Community Living Assistance Service and Supports (CLASS) act;

- The Independent Payment Advisory Board (IPAB);

- The provisions that closed the “doughnut hole” in Medicare Part D;

- The penalties on certain employers if any of their workers obtain subsidized coverage through the exchanges; and

- The tax credits for small employers that offer health insurance.

But, his proposal maintains the various cuts to Medicare enacted in the ACA. Chairman Ryan’s treatment of the so-called “Cadillac Tax” on high-cost employer-provided health plans is unclear. Other Health Tort Reform ? Caps noneconomic and punitive damages. Social Security Chairman Ryan does not make specific proposals for Social Security, but calls for a bipartisan process whereby both the President and congressional leaders would have to submit plans to restore the program to balance. Taxes While he does not include a detailed proposal, Chairman Ryan indicates that he wants to achieve revenue-neutral tax reform (from a current policy baseline) that lowers the top individual and corporate rates to 25% while broadening the base through the elimination or reform of most deductions and credits. Other Spending For the CBO scoring, Chairman Ryan simply specifies a path for the combination of spending on other mandatory programs (e.g., federal civilian and military retirement, most veteran’s programs, agriculture support, food stamps, unemployment compensation, and Supplemental Security Income) and total discretionary spending.

- In 2010, this spending was equivalent to 12% of GDP.

- According to specifications given to the CBO by Chairman Ryan’s staff, this spending would decline to 6% of GDP in 2022, to 4.25% by 2040, and to 3.5% by 2050

- For comparison, the CBO notes that “spending in this category has exceeded 8 percent of GDP in every year since World War II.”

Although Chairman Ryan’s Path to Prosperity does not specify a comprehensive list of spending cuts that would achieve these targets, he does lay out some policies.

- Defense Spending: Over the next ten years, Ryan utilizes the $78 billion dollars in defense savings identified by Secretary Robert Gates, which serve to hold defense spending to growth at inflation for the next five years. Chairman Ryan also assumes the same wind down of overseas operations as President Obama. Over the long run, based on the assumptions that Chairman Ryan’s staff gave to the CBO, defense spending would decrease to approximately 1.5% of GDP by 2050.

- For comparison, defense spending in 2011 is 4.7% of GDP, and has not been below 3% of GDP since before World War II.

Non-security discretionary spending is reduced to below 2008 levels for Fiscal Year 2012, then frozen for five years, then held to growth at inflation indefinitely. Some specific proposals include:

- Decrease funding for job-training programs and low-income housing assistance; and

- Cut the federal workforce by 10 percent over the next three years and freeze federal employee pay for the next five years.

Other Mandatory Programs:

- Decrease funding for food stamps and Pell grants;

- Require federal civilian employees to contribute significantly more money toward their retirement plans;

- Reform farm programs; and

- Wind down Fannie Mae and Freddie Mac, eventually fully privatizing them.

Miscellaneous Chairman Ryan proposes to repeal Dodd-Frank financial regulation.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now