Buying Time or Speeding Up?: Iran's Mixed Signals

With international negotiations on its nuclear program scheduled for February 26 in Kazakhstan, Iran has made some interesting ? and seemingly incongruous ? announcements in recent days. First, on February 12, Iran confirmed that it has once again drawn from its stockpile of 20% enriched uranium in order to produce reactor fuel. Then, on February 13, it announced that it had begun the work of installing next generation centrifuges at its Natanz Fuel Enrichment Plant (FEP). The first of these actions effectively slows down Iran’s approach to nuclear weapons capability, the latter hastens it.

First, it is important to point out that these Iranian statements have yet to be verified by international inspectors. We do not yet know how much, if any, 20% enriched uranium Iran has recently been removed for processing into fuel. Second, there has been no independent verification that the advanced centrifuges are being installed, let alone whether they are operational, or whether they represent a technological improvement above the previous generation. The next report of the International Atomic Energy Agency (IAEA), expected later this month, should begin to answer some of these questions. (The last IAEA report came out in November 2012. See BPC’s analysis of the finding here.)

However, these announcements appear to be sending a mixed message.

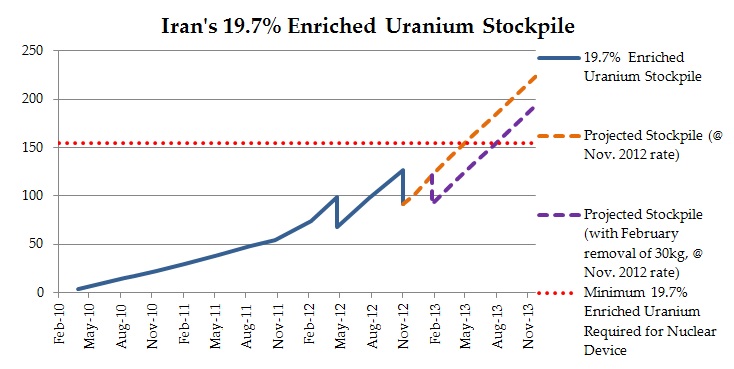

On the one hand, the removal of 20% enriched uranium pushes back the date at which Iran will cross the threshold of nuclear weapons capability. This would suggest that Iran is trying to apply the brakes to its nuclear program. Indeed, this would be the third time in the last year that Iran has drawn down its stockpile of 20% enriched uranium. Last May, and then again in November, the IAEA reported that Iran had removed 20% enriched uranium, 30 and 36 kilograms respectively, to be turned into fuel for its Tehran Research Reactor. Without these past removals, Iran’s stockpile of 20% enriched uranium would have surpassed the critical threshold of 155 kilograms ? the minimum amount of 20% enriched uranium needed to produce, with further enrichment, enough fissile material for a nuclear device ? last November.

But with the removal of 66 kilograms of 20% enriched uranium in 2012, Iran pushed the date for crossing that threshold into mid-2013. By removing yet more 20% enriched uranium, Iran delays that moment even further. If we assume that they have once again removed roughly 30 kilograms and that their rate of producing 20% enriched uranium has remained constant since November, Iran’s stockpile would surpass 155 kilograms by September 2013, effectively buying three months.

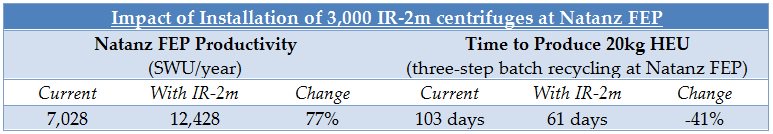

This attempt to put the brakes on its nuclear program appears to contradict a concurrent development: the installation of next generation centrifuges at the Natanz FEP. The centrifuge model currently deployed at Iran’s enrichment facilities, the IR-1, based on a Pakistani design sold to Tehran by A.Q. Khan, has underperformed. Iran has steadily increased the productivity of its centrifuges (measured per machine in Separative Work Units per year [SWU/yr]) from 0.08 when Iran first began enriching in 2007 to 0.76 – 0.9 SWU/yr more recently. But that still falls far short of the 2.5 SWU/yr that these centrifuges are designed to produce. The IR-2m centrifuges that Iran claims to be installing have a nominal productivity of 5 SWU/yr. Even if Iran is unable to unlock the full potential of these centrifuges, it is still reasonable to assume they will be able to enrich uranium twice as fast as the IR-1.

It is widely expected that were Iran to make a sprint for a weapon, it would feed its existing stock of 20% and, if necessary, 3.5% enriched uranium into the centrifuges at the Natanz Fuel Enrichment Plant to produce HEU. If we assume that the IR-2m will achieve twice the productivity of the IR-1 (1.8 SWU/yr) and that Iran installs 3,000 of these machines at Natanz, as the IAEA expects, in addition to more than 9,000 centrifuges already operational there, the facility’s productivity will increase by more than 75%. This would translate into a 40% reduction in the amount of time Iran needs to produce the minimum amount of HEU for a nuclear weapon (for more on timing assessments see here).

Interpreting the significance of these seemingly contradictory actions will be key for policymakers, especially as they head into the February 26 negotiations in Kazakhstan. But until we have an answer as to why Iran is speeding up its enrichment program at the same time stalling for time, the United States and its partners should continue to make clear, in both word and deed, that they will use all means in their power to prevent a nuclear Iran.

Share

Read Next

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Give Now